MARKETCYCLE WEALTH MANAGEMENT

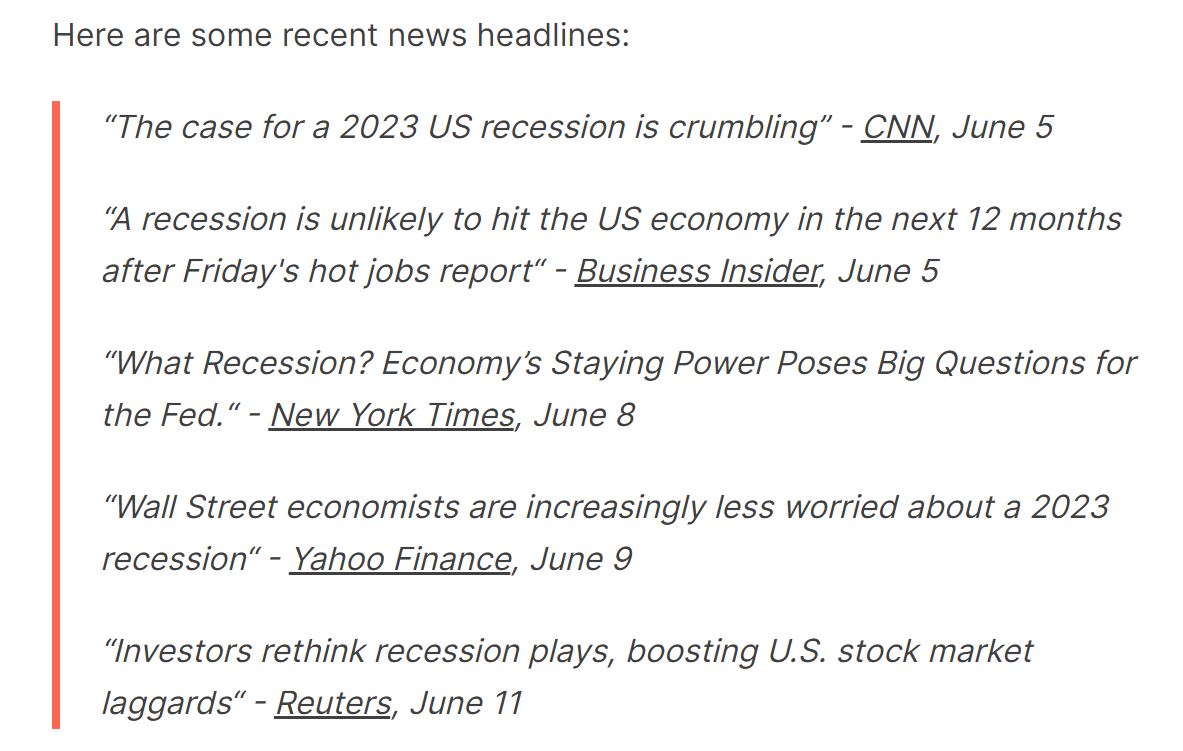

MarketCycle’s 2023 end-of-year target is 4800 and as far as I know, we were the first to suggest this; we made this call back when most investors were still hiding in cash. Now some of the big institutions are predicting an even higher level than 4800 by year’s end.

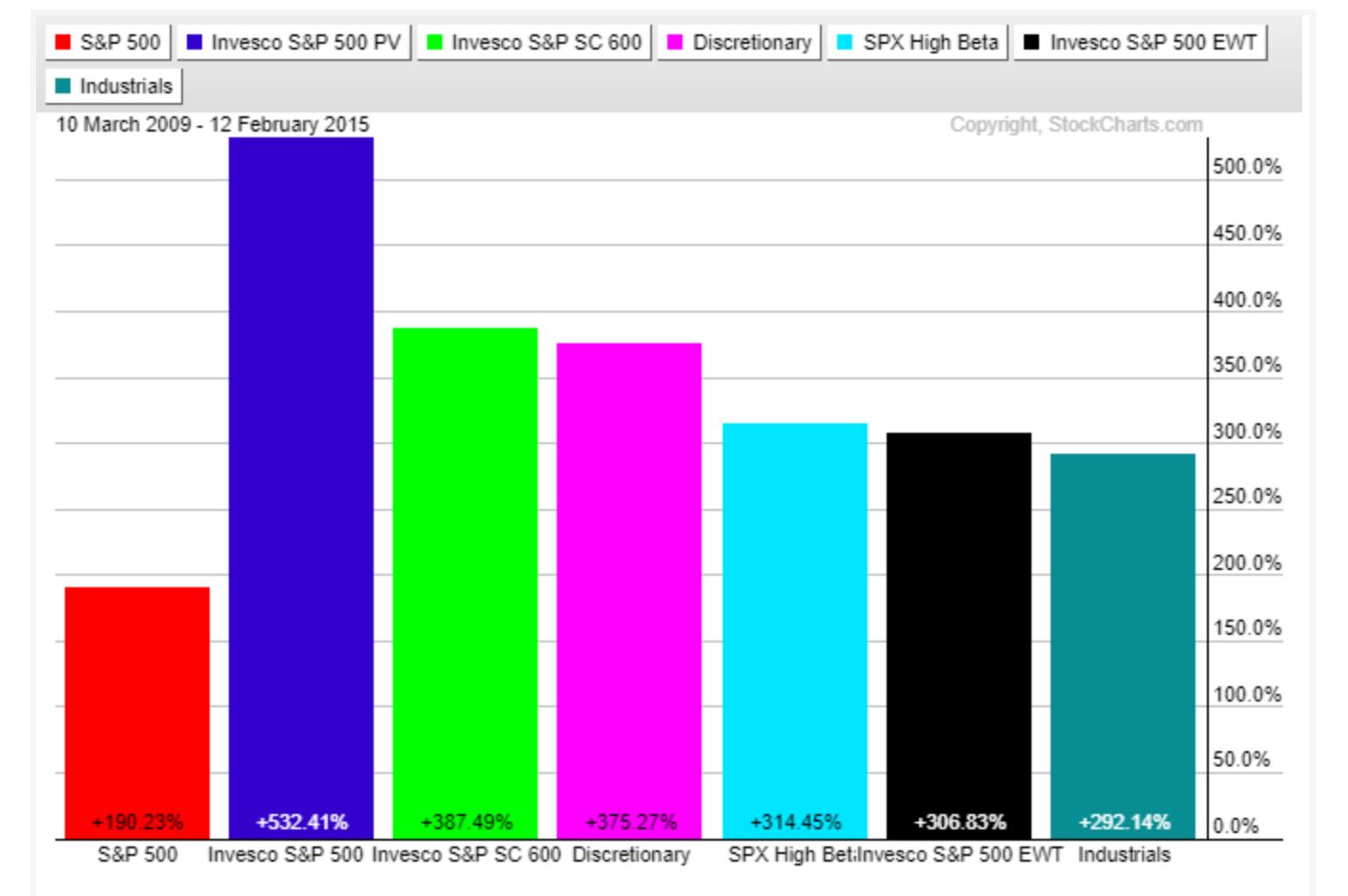

We pre-positioned into early-stage assets, those portfolio positions that normally outperform during the first few years of all new cyclical stock bull markets (like the one that we recently entered). We bought at fire-sale bargain prices and we were willing to wait for them to take off, which they finally started to do in June of 2023. This first chart shows how these assets did after the prior bear market bottom (the Financial Crash of 2008) from March of 2009 to early 2015. They excelled. The 1st red bar shows the S&P-500 and the 6 other bars show our early-stage holdings. Percentage gains are shown at the far right and at the bottom of each bar:

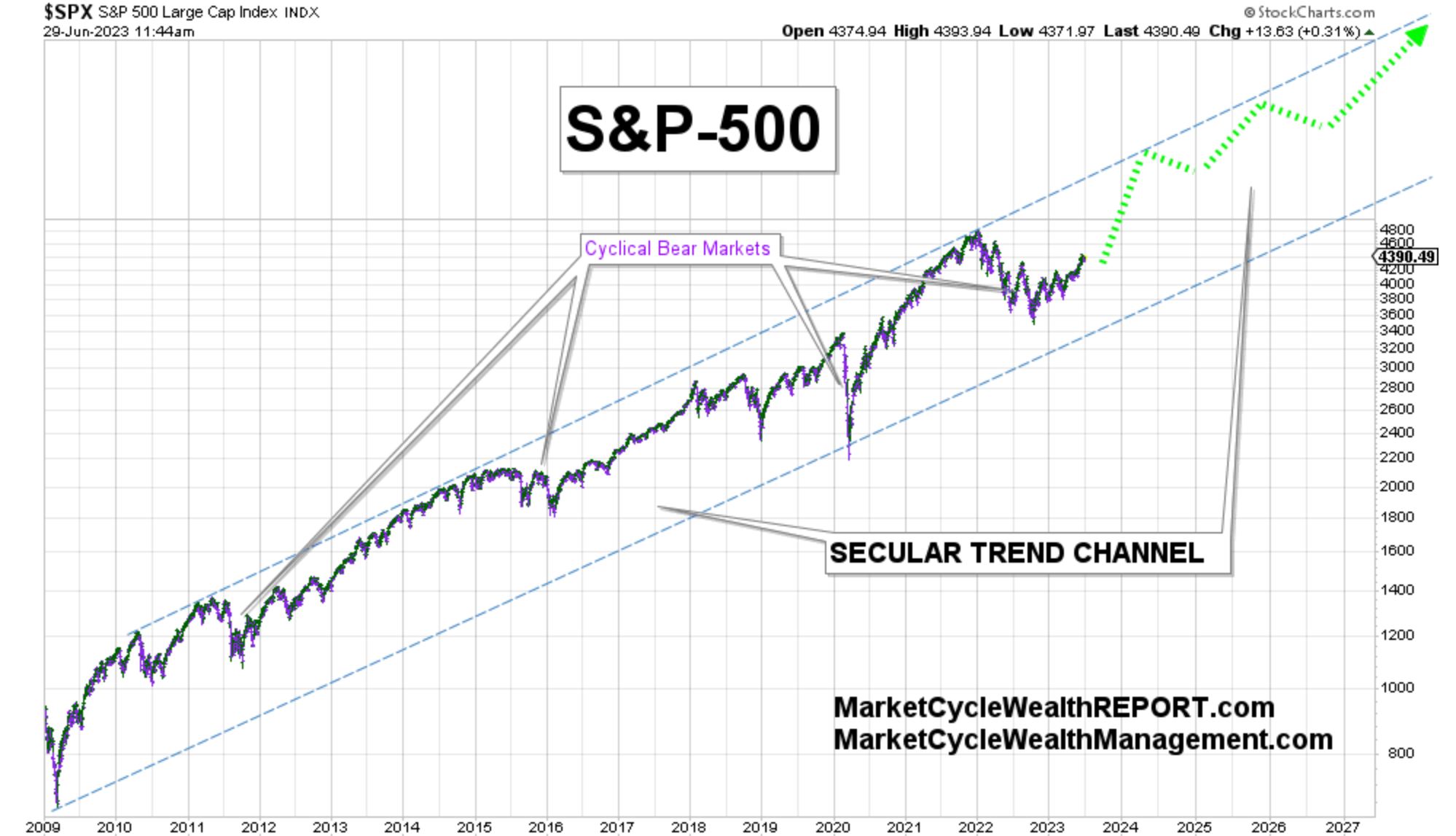

Near-term S&P-500 trend channel with a likely end-of-year target of 4800, which takes us at or into record territory. (MarketCycle’s most recent client Update said that the market was about to temporarily pull back, which it did the very next day.):

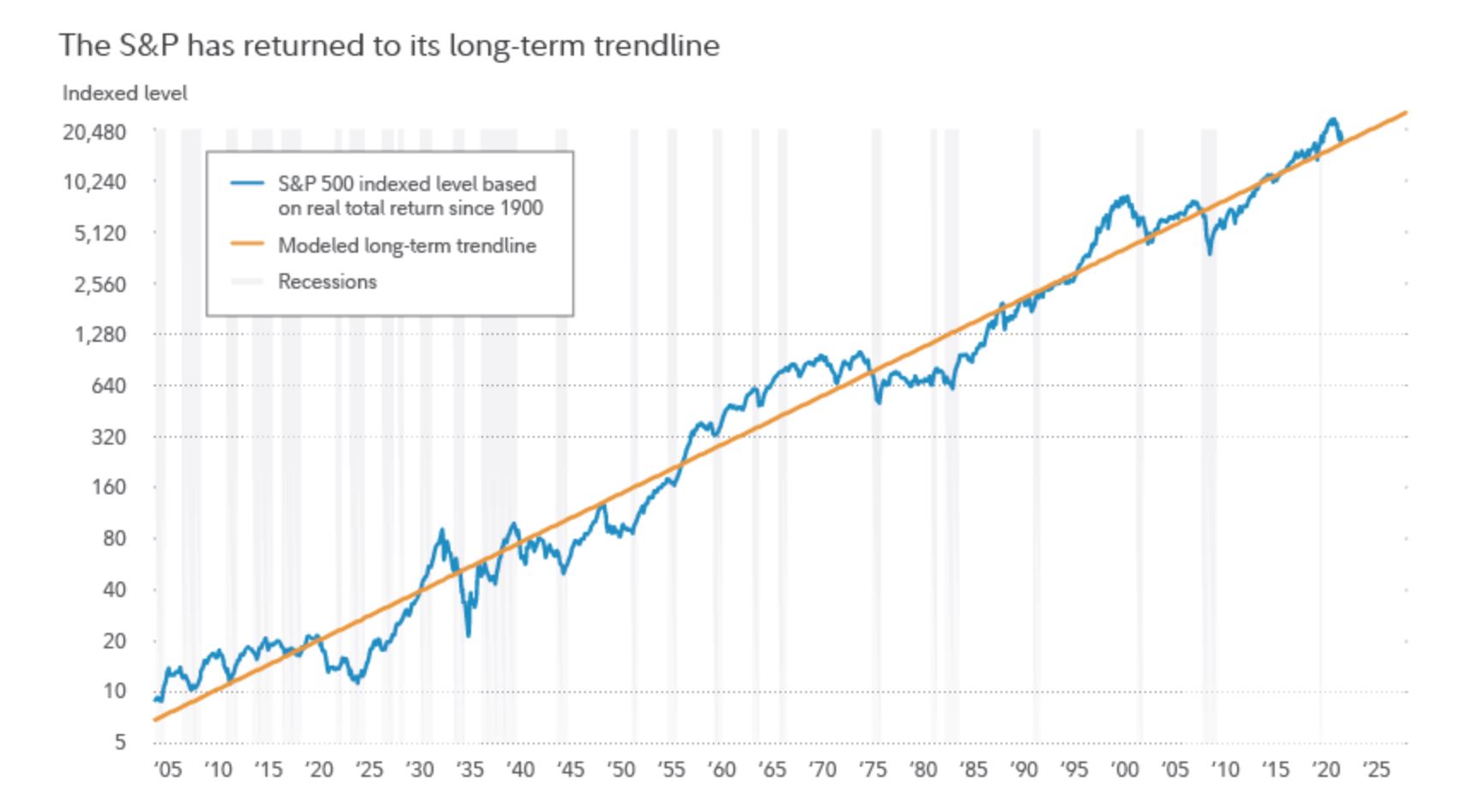

Longer-term SECULAR view of the S&P-500 with our 2029 target of 10,000 (or likely even higher):

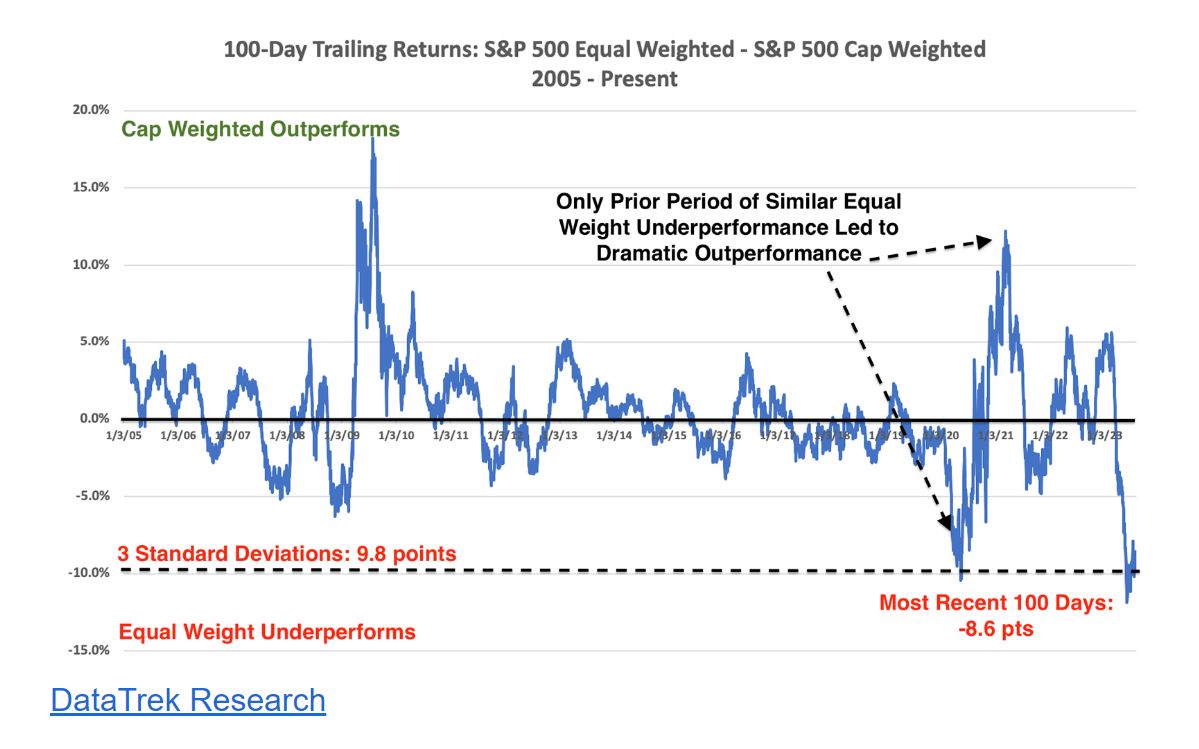

Going forward, small-cap and mid-cap stocks may beat the S&P-500:

And small-cap (small company) stocks in particular may soundly beat the S&P-500. We have to remember that not very long ago Apple, Amazon, Facebook, Google, Netflix, Microsoft, Nvidia, Tesla, etc were all SMALL companies. (The “LINK” just below is disabled):

But “seasonality” suggests possible weakness during August and September (when vacations are more important than investing) but then the market re-gains strength from October into early 2024:

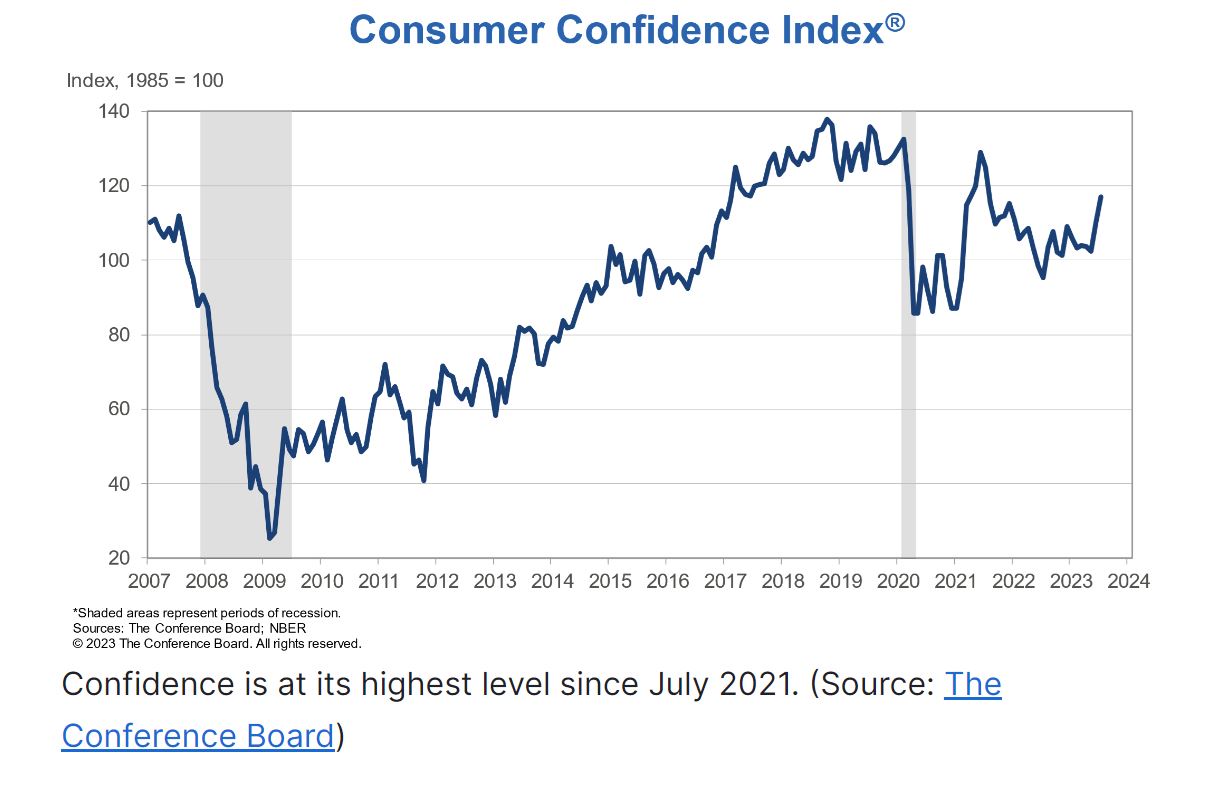

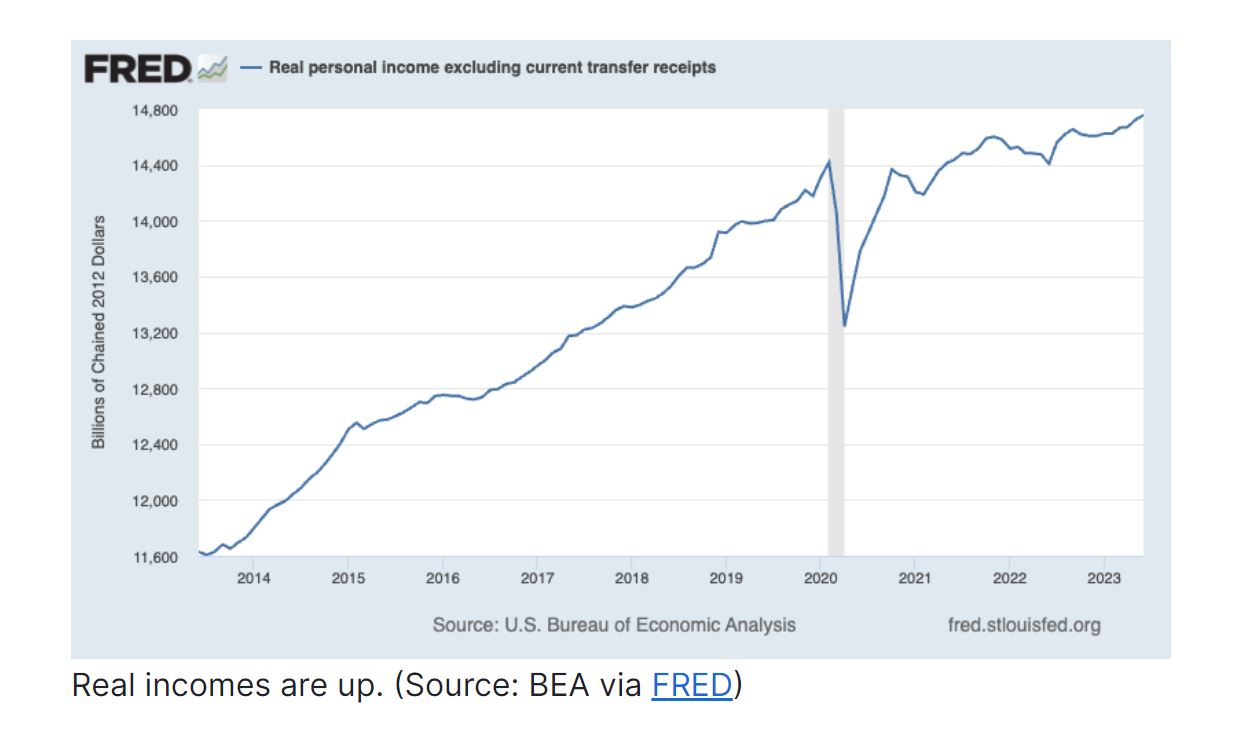

Consumer spending makes up 70% of the U.S. economy. Consumer confidence is strong (chart via the NBER):

And consumer sentiment is likewise strong (chart via the Federal Reserve):

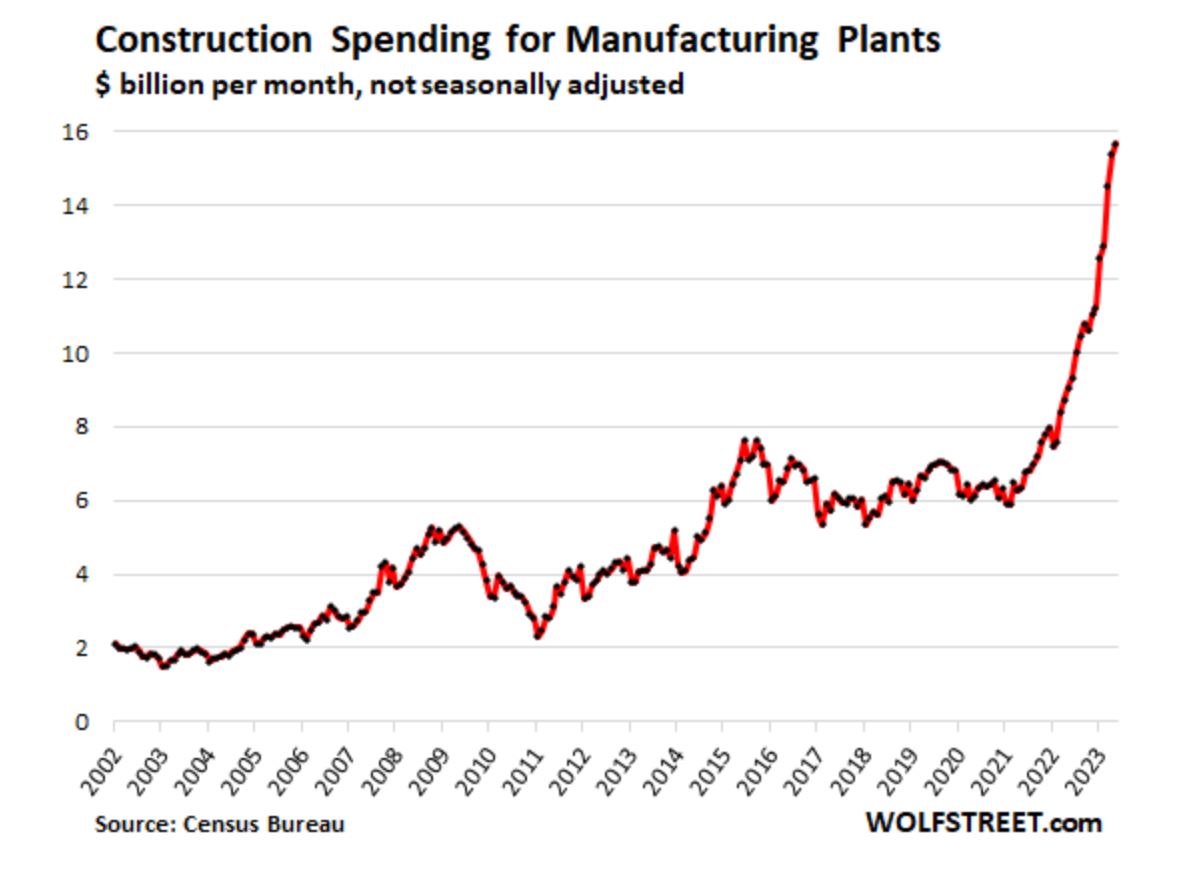

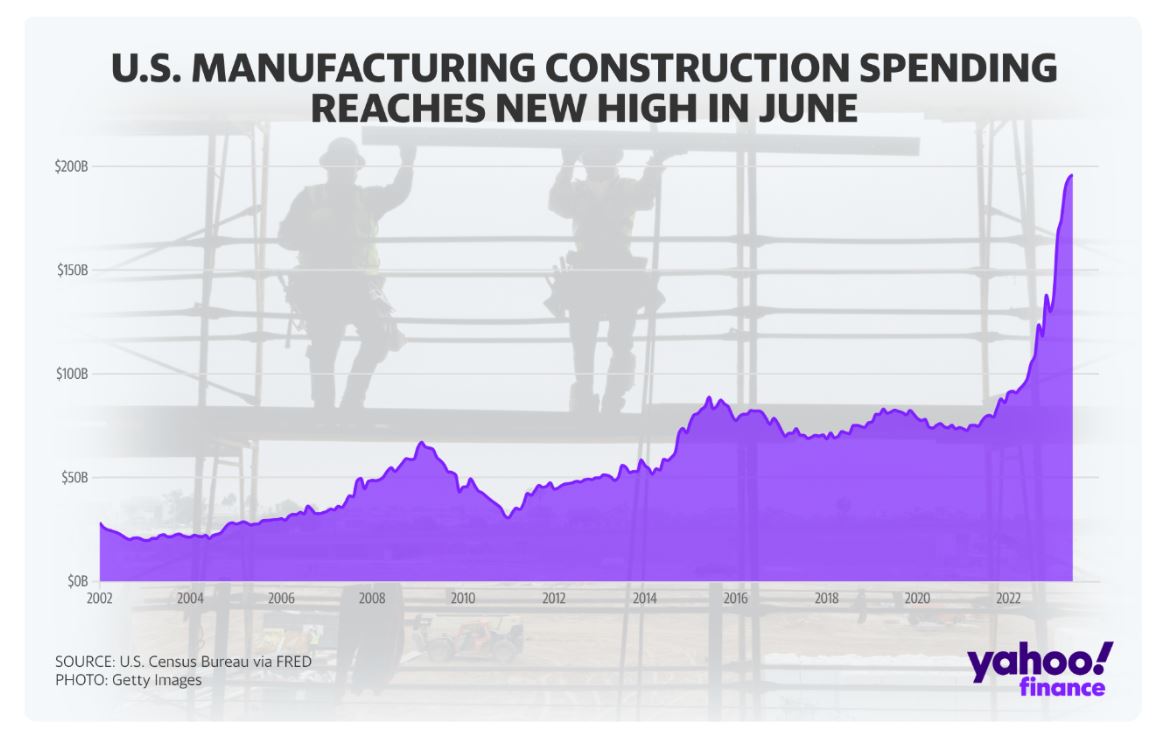

The other 30% of the U.S. economy is manufacturing. Importantly, manufacturing is rapidly coming back to the United States, suggesting that the U.S. will continue to lead in strength relative to all other global regions (the U.S. will likely lead for another 6 years):

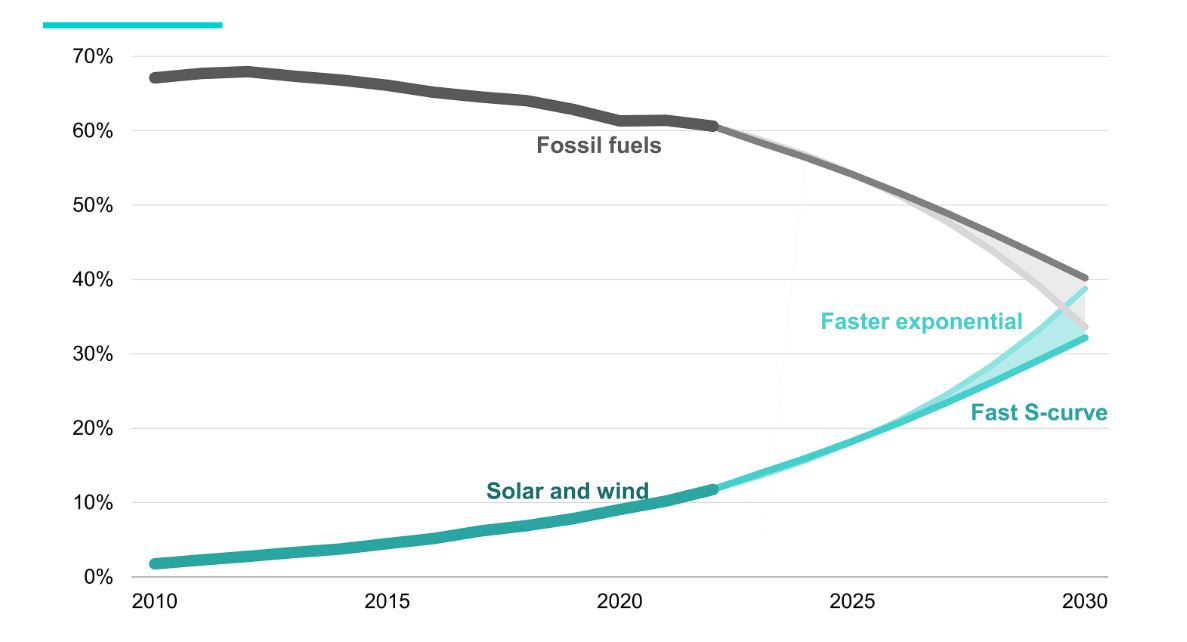

And finally, it is not just artificial intelligence that will lead this final multi-year bull market run, but also global clean energy:

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. The process is easy. There is a contact tab at the top of our website.

Our paid members REPORT site can be reached via the connecting link on this website.

MARKET CYCLE — TREND FOLLOWING — RELATIVE STRENGTH — DUAL MOMENTUM — HEDGE FUND