MarketCycle Wealth Management

MarketCycle Wealth Management normally publishes a large summary of institutional and hedge fund and analyst predictions at the beginning of each year. The majority of institutional financial centers and hedge funds are STILL bearish, if you can imagine that! And there is STILL record cash sitting on the sidelines ($6,000,000,000,000) that normally is invested. By contrast, if my predictions about the current bull market are correct, by 2029 there will be $0 on the sidelines instead of $6-trillion and people will eventually be taking out second mortgages on their homes, just like they did in 1999, so that they can invest the money in what may be the greatest stock bull market of our lifetimes.

[Please note that there is a new PRINT function at the bottom of this posting on the website. If prompted to “add to chrome extensions,” please do so, it is safe.

Every year MarketCycle gives a fairly decent chunk of its advisory management fees to a charity. Last year’s donation went to a charity that builds public playgrounds for under-privileged children. This year’s charity will be seen as you scroll below.]

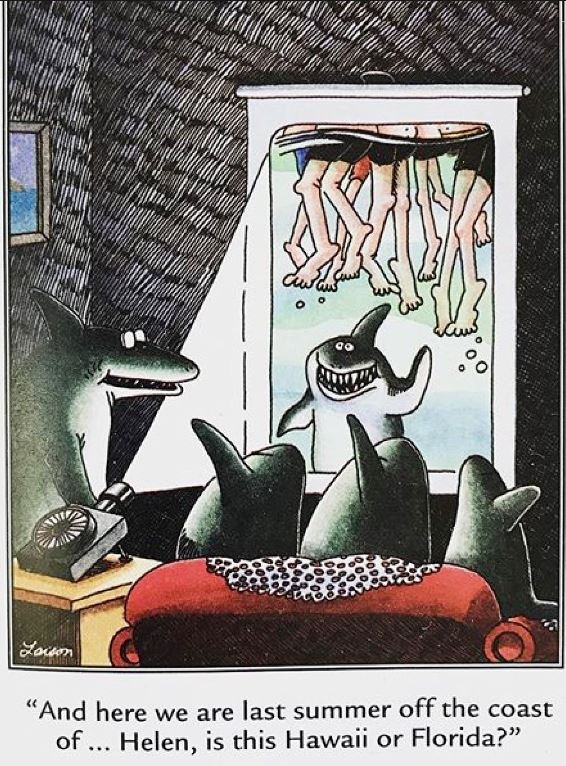

Because the big players are literally always wrong in their predictions, and I do mean ALWAYS wrong, I’ve decided to not waste my time this year by me spending countless hours in writing a summary of their incorrect predictions. Even a consensus of their opinions is less than useless. Their end-of-year calls are useless. So instead, I’m only going to present MarketCycle’s predictions for 2024.

Remember that these are MarketCycle’s opinions and they are not etched in stone… as conditions change, MarketCycle reserves the right to change too. Our opinions actually begin afresh each evening when we re-do our extensive “daily review” (reviewing hundreds of constantly-updated charts and reviewing all ecomomic data and important analyst opinions). And we do “super reviews” each Saturday and “super-duper reviews” at each month’s end.

.

MarketCycle’s PREDICTIONS for 2024:

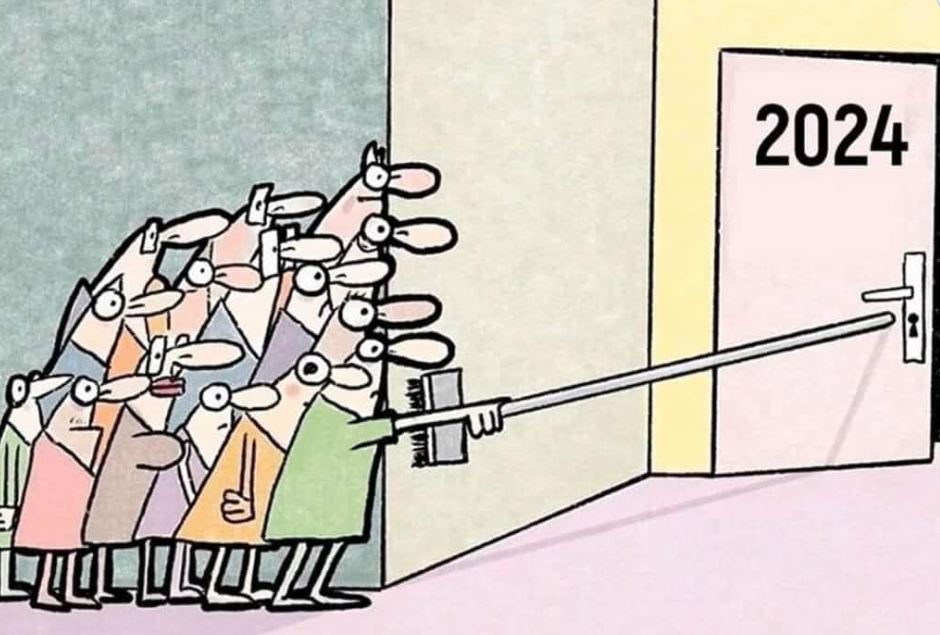

- What has happened over the past two years? Many investors still do not understand. With investing, you don’t get what you want, you generally can only extract (and exploit) what the market offers. 2022 offered a losing global bear market year; these happen roughly once every 5-10 years. The good news is that 2022 is behind us and the next bear market is years away. Out of sympathy, 2023 was quite difficult and volatile and sideways moving; a few dozen large-cap technology stocks really outperformed, at least until August of 2023, while almost 60,000 stocks underperformed and most entire asset classes performed poorly. Although the S&P-500 and the Nasdaq-100 moved higher off of the 2022 bear market low, we also experienced a sort of “rolling recession” during the first 10 months of 2023.

- Today, while a chunk of large-cap stocks are re-approaching their late-December 2021 highs (from two years ago), the majority of stocks are still fairly far away from their old 2021 highs… the Pandemic really screwed things up. Small-cap stocks are still sitting where they were THREE YEARS AGO. But right now, like the Phoenix, broad-based strength is clearly rising out of the ashes.

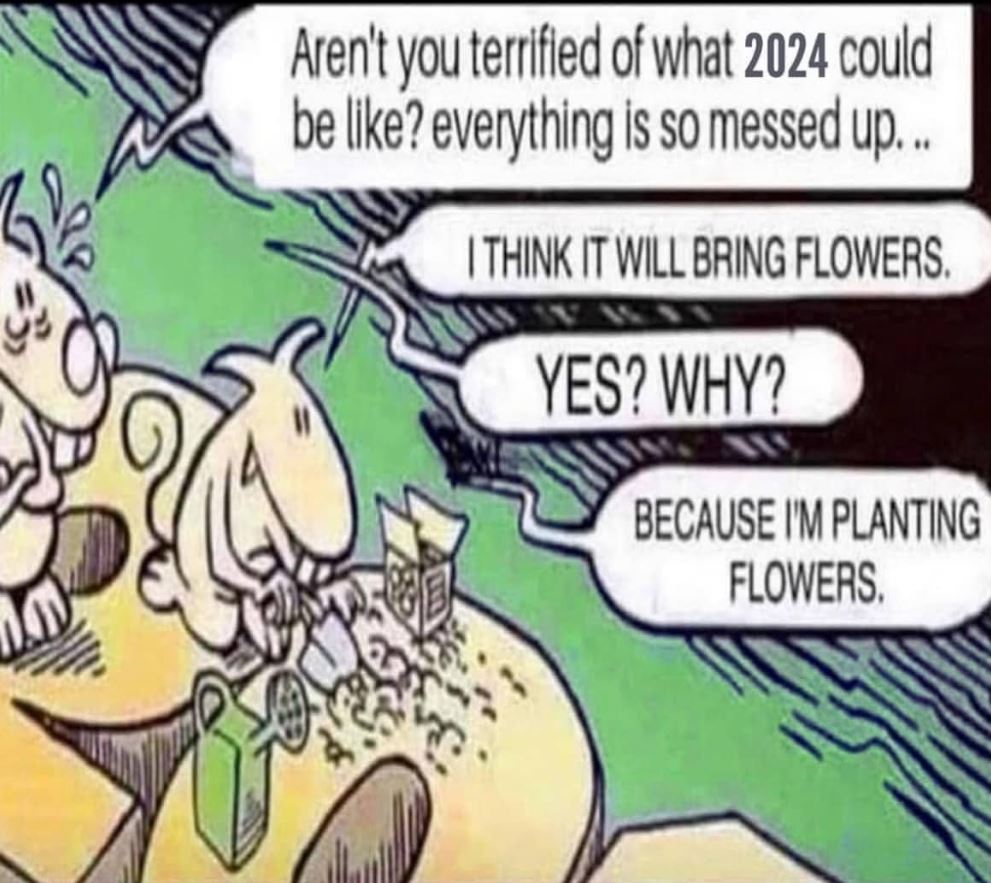

- 2024 is likely to be a very good year with smart asset pickers outperforming by perhaps a wide margin… and by 2029, I expect the stock market to be SKY HIGH. Right now and for the next 5 years, investors need to do three things: get over their fears, take a longer term view and invest rather than spend.

- There is likely to be no “typical” recession in 2024 although unemployment may reach 4.4%, which is still extremely good & strong.

- There may be some temporary & passing weakness (>-5%?) sometime during the first quarter of 2024… a sort of “growth scare.” Dips can be used to add to positions. During any pullback, our gold, our bonds and our extremely high level of interest payments will likely come to the rescue. (Clients will see interest & dividend payments entering into their accounts during the first two weeks of January and this captured money will be reinvested.)

- In 2024, the stocks and other assets that outperform will be those that benefit from falling interest rates (note, the U.S. still leads in relative strength): various assets that generate fixed-income such as REITs and financial preferreds, quality small-caps, home builder stocks, innovative technology, value stocks, biotech and early-cyclical sectors. [NOTE: MarketCycle’s current 17 asset portfolio holdings were selected using MarketCycle’s highly-tested & new & innovative & advanced (& proprietary) asset selection system, which was recently implemented during the Fall of 2023. We hold 17 different assets because, frankly, there is a lot to chose from right now.]

- For the 2024 high, we predict a record S&P-500 market high of 5200-5400 (so, 400-600 points higher and roughly a 12% gain for large-cap U.S. stocks). Wall Street predictions run from 3300 to 5400 for the S&P-500 with most analysts predicting 4833 as the 2024 end-of-year price.

- I expect small-cap stocks to gain as much as 40% in 2024.

- MarketCycle correctly called the S&P-500 @ 4800 as the high for 2023. We hit 4794 intraday on 12/28/23, a whisper away from 4800. This was literally the most accurate call on Wall Street for the year’s high, but since I’m a hermit and nobody knows who I am, MarketCycle gets no credit. lol

- Extended-duration Treasury-bonds will likely perform as well as do stocks (maybe even better) and unlike 2022 & 2023, they will offer the additional benefit of some market protection during any routine market pullbacks. If stocks temporarily pull back, bonds will likely become super strong.

- Bitcoin will continue to zig-zag higher. Crypto proxy stocks may perform well; the ARKK ETF holds a number of these stocks.

- Gold will perform well and will also offer market protection to portfolios. Starting some time around 2029, gold becomes more important than bitcoin.

- Artificial intelligence (and innovative technology in general) will lead the stock market to great heights during the coming five years, until the next major bear market.

- China will dramatically lag the United States in economic strength. The same thing is currently happening to China that happened to Japan 50 years ago… it is internally imploding.

- I expect India to remain the strongest emerging market country.

- As globilization implodes, manufacturing should continue to move back to the United States (and Mexico as a proxy). This move is surprisingly strong and rapid. Europe may move its Asian manufacturing plants back towards Eastern Europe.

- The USDollar is still in a confirmed BULLISH (10 year long) trend channel, but I expect the USD to gyrate sideways and slightly down in 2024 & 2025 as it slowly moves back toward the bottom resistance line of this long-term trend channel.

- Inflation will continue to fall during 2024 & 2025 and eventually find its new resting spot @ 3% (rather than 2%). Even if it first falls to 2%, it will then likely climb a bit higher to 3%.

- As inflation drops, commodity prices will generally drop in unison. This is very stimulative for the economy. This will also benefit other developed markets (as in Europe and Japan), but not emerging markets.

- Mortgages will likely drop to 6% in 2024 and then to 4% in 2025. Home prices will likely remain strong, but price gains will very definitely lag gains in the stock market.

- There will be several Fed rate cuts during 2024. As inflation falls, if the Fed does not lower rates, then they are effectively tightening because of the growing spread between the lower inflation rate and higher interest rates. The Federal Reserve will be forced to cut interest rates a number of times or they will strangle the economy, and they already understand this.

- MarketCycle remains BULLISH for 2024. Market internals show nothing but strength in the intermediate-term. Our secular indicators show rapidly building long-term strength. The ROARING 20’s (just like the 1920’s roaring stock market) will repeat all over again! “We’re firing on all cylinders.”

.

.

CHARITY DONATION FOR 2023 goes to The Nature Conservancy, which buys ecologically and environmentally sensitive privately owned (global) land from owners that want to protect the important parcel… a no lose donation where everyone and every thing wins and that all can get behind. This donation is extracted out of our management fees… so a big thank you goes out to MarketCycle’s wonderful clients.

.

.

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating your investment account through rough seas. The entire process is easy.

Our REPORT site can be reached via the connecting link on this website.

Please FORWARD this FREE BLOG to your friends!!!!! MarketCycle does not advertise and we depend on (your) word of mouth for referrals.

.

.