MARKETCYCLE’s

.

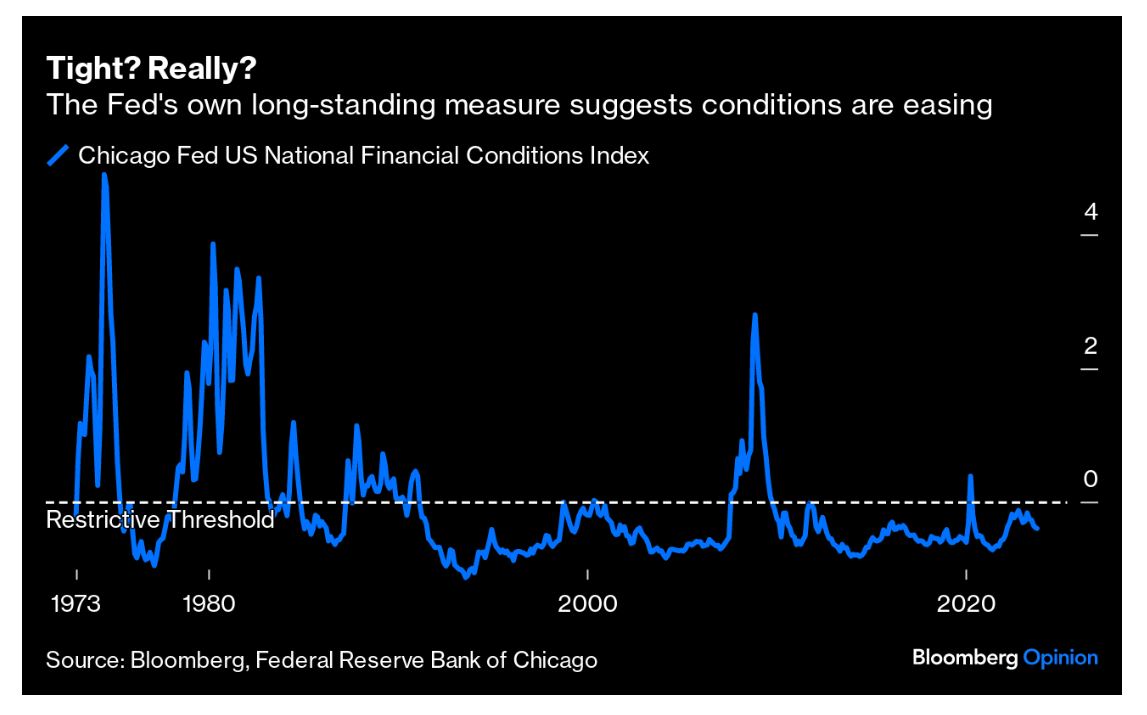

The U.S. Federal Reserve publicizes its intentions via a “DOT PLOT” which is a chart that shows when and where they expect interest rates to be in the future. It is how they communicate with investors and the government. Their most recent “June 12th” Dot Plot suggests 1-2 interest rate cuts of 0.25% each for the remainder of 2024… and 4 rate cuts of 0.25% each in 2025… and 4 rate cuts of 0.25% each in 2026.

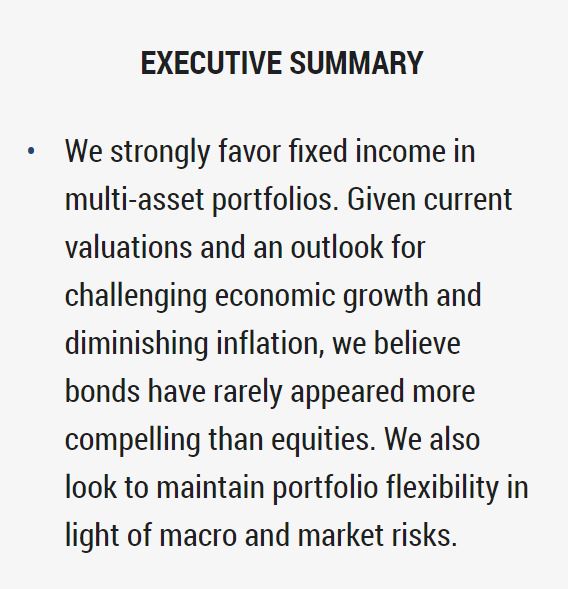

The first interest rate cut might come in mid-September with the stock market reacting BEFORE the cut arrives. Regardless and if nothing changes in their Dot Plot, then this would be a total of 9-10 individual interest rate cuts of 0.25% each over the coming 2.5 years… very stimulative for both the bond market and the broad stock market.

If the Fed actually follows this path, it would likely cause a roughly 50% gain in extended-duration Treasury bonds (the 30 year T-bond) over the same time frame even if there is no weakening of the U.S. economy. If the economy weakens, then these particular bonds could generate profits of perhaps 65% over the next 2.5 years. Of course, the 30-year Treasury bond will also pay 10% in tax free interest over the next 2.5 years, so this has to be added to potential gains.

MarketCycle’s client accounts hold tax free 30 year Treasury bonds and 20-25 year (highest quality) U.S. corporate bonds… and our IRA & Roth & SEP-IRA retirement accounts hold similar bonds, but in a form that pays roughly 18% ‘tax free’ via a BuyWrite strategy (plus 25% of the client’s retirement account portfolio pays roughly 60% ‘tax free’ interest via low-risk ODTE stock options).

Below is the most recent Federal Reserve DOT PLOT that was released on June 12th and it suggests continued fuel for the stock and bond bull markets during the next three+ years:

.

MarketCycle’s CURRENT THOUGHTS:

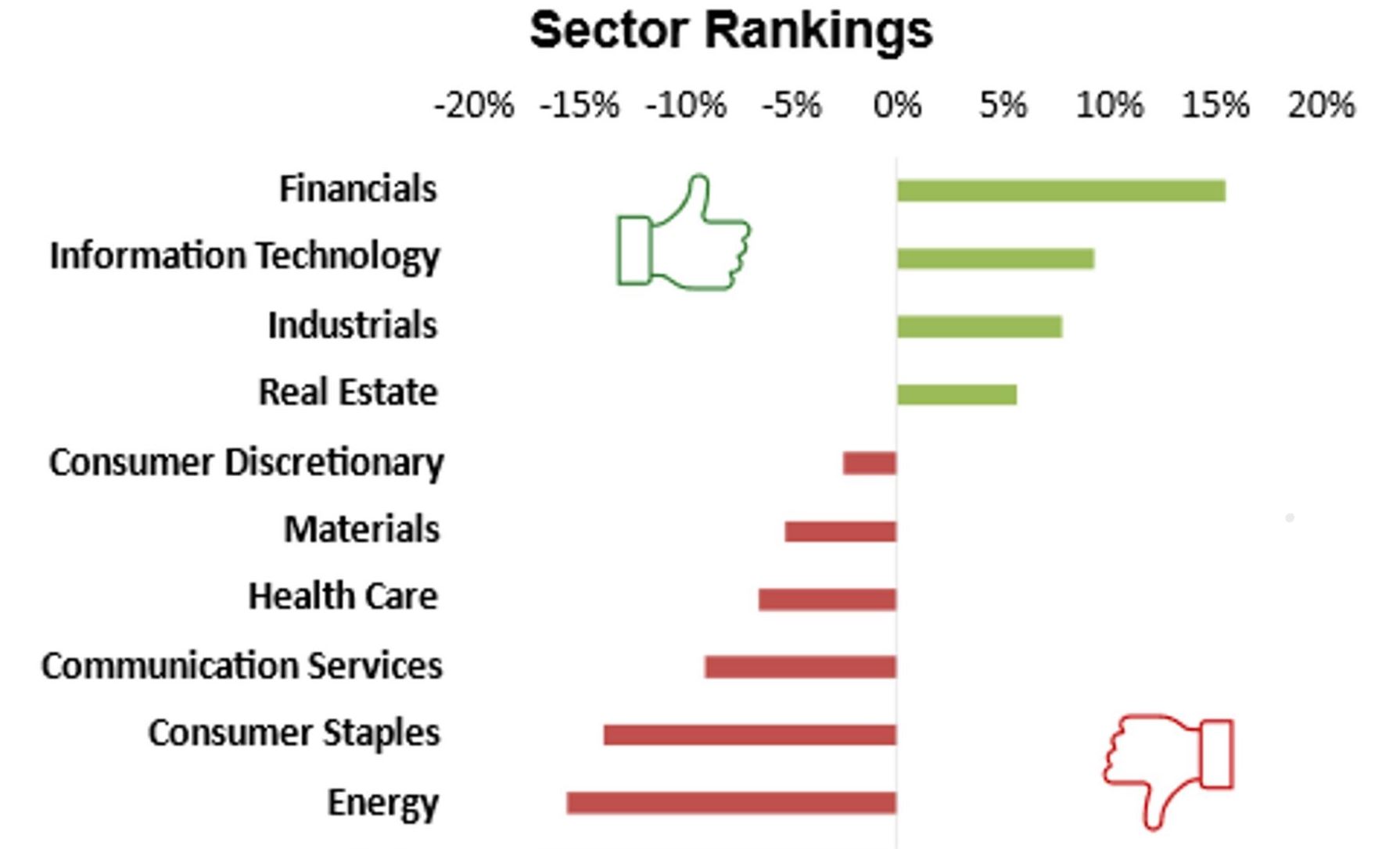

- It is important to see where we are in the traditional “market cycle” and to then determine what’s different about the market cycle this time. It appears that “momentum investing” is making a very early appearance in this relatively young stock bull market. Momentum investing is the buying of strong stocks (in any corporation size from small-cap to large-cap) rather than buying cheap & undervalued stocks. When it becomes evident to investors that the Fed will finally be lowering interest rates, then we might get VERY broad stock participation. This means that, while early stage assets such as REITs will likely perform well, momentum stocks may actually outperform the rest of the market. So, perhaps one should hold a barbell approach of both early stage undervalued stocks as well as holding the strongest momentum stocks.

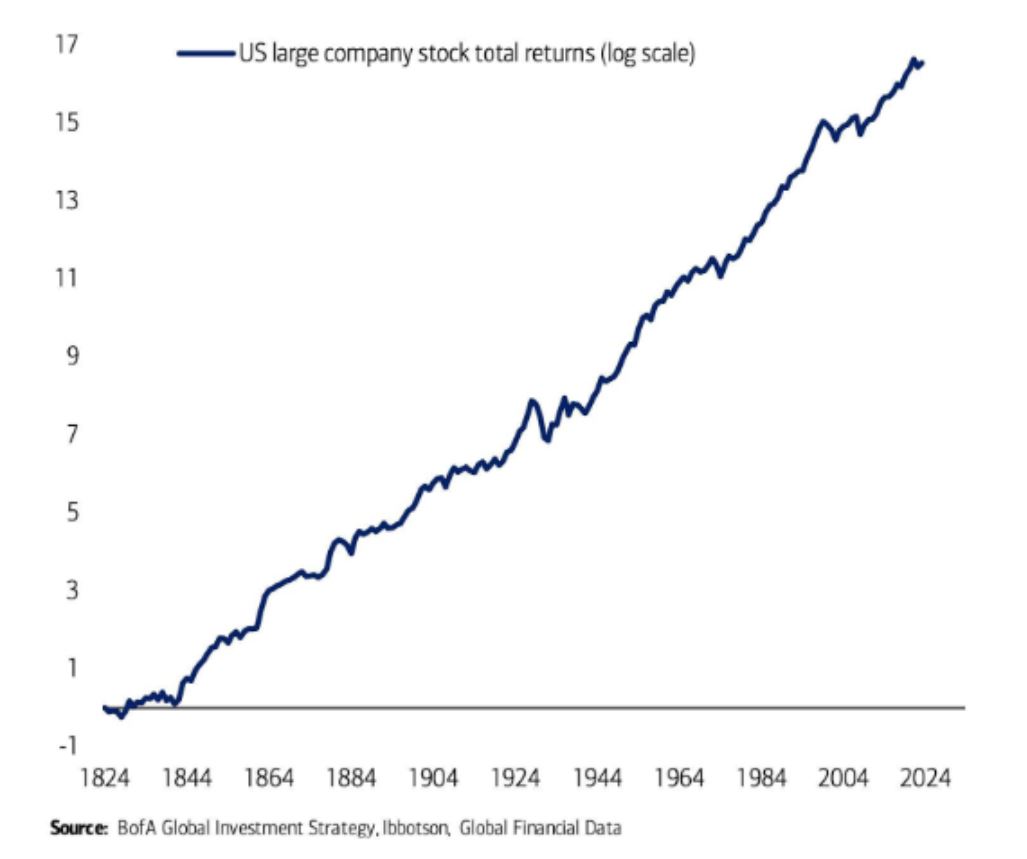

- As we’ve been saying for years now, 2024-2029 may resemble a merged combination of the incredibly bullish 5 year periods of 1924-1929 and 1994-1999. Both prior instances offered incredibly profitable, speculative and parabolic stock markets… and the coming 5 years may offer the same. If I’m correct in my current thinking, the next 5 years might prove to be the most profitable bull market in history with the S&P-500 surpassing 13,000. And at the end? The next bear market will offer the opportunity for us to generate extremely rapid & low risk profits, just as I pulled off in the similar big bear markets of 2000 & 2008.

.

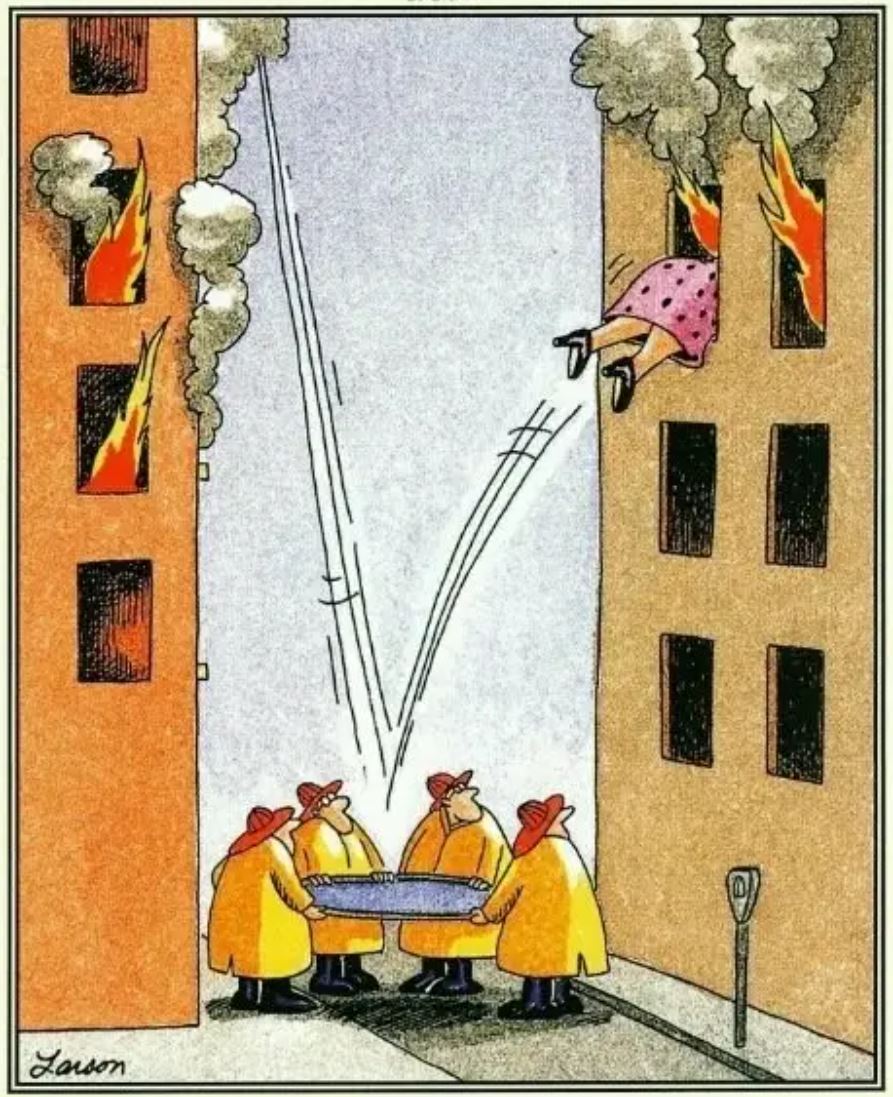

I came across this old photo of me, taken when I was just starting to see patients in an earlier career incarnation. Doug Flutie’s father took this photo of me. Doug, the famous professional quarterback, used to throw footballs to me (actually, sort of at me) in the hallway of our local gym… like trying to catch a missile.

.

CLIENT INFORMATION: Quarterly paper statements will arrive at your home by mid-July. If you have moved, you must notify Interactive Brokers of the address change and this might require sending in paper proof of your new address, like a utility bill. The SEC requires a proper physical address. Interactive Brokers can be reached via: 1-312-542-6901

Our portfolios keep moving higher.

.

Thanks for reading!

MarketCycle manages investment accounts and we earn our keep. There is a contact tab on the top banner of our website. I always reply on the same day and usually within one hour.

Our paid member REPORT site can also be reached via the link on this website.

.

..