MARKETCYCLE WEALTH MANAGEMENT

Estate planning is the process of arranging for the management and distribution of everything that one owns or controls both during and after their lifetime. This includes such things as cryptocurrencies, art, cars, homes, investment accounts and owned businesses, as well as guardian directions for underage children (and possibly even pets). It also includes one’s liabilities such as mortgages, loans, credit card debt, etc. Without pre-planning for this, one’s estate can get caught up in legal entanglements that can drag on through the courts for years. For clients that might be reading, the below pertains to the United States, but it isn’t that much different globally.

Here is a simplified version of ESTATE PLANNING…

TERMS:

- Grantor… person that creates a Trust

- Testator… person that creates a Will

- Executor… executes the estate plan and protects the estate… they usually require a percentage of the estate as compensation (such as 5% or 10%)

- Trustee… holds the assets after your death

- Person with Power-or-Attorney… your stand-in, can be temporary, limited in scope and/or time, or it can be permanent (durable)

- Probate… court supervised process that distributes the estate (for the ultra-wealthy, trusts can bypass costly probate)

.

WILL: A “will” is your voice after you die. Without a will the state controls your assets and they will distribute using a one-size-fits-all approach. A will includes all assets such as jewelry, cars, artwork, cryptocurrency, investment accounts, etc. All investment accounts can be held in “Joint Tenancy” with one’s spouse so that probate is side-stepped. (This is easy to do at Interactive Brokers, even on already established accounts. Unmarried partners should be listed as a “beneficiary” on all investment accounts.) Every person reading this article MUST have a will, without exception. Contact an attorney, or use one from online if your estate is small. All wills should include two witnesses and should be notarized.

.

TRUST: A “trust” is a contract that can protect high worth estates from the government and state. Most states do not have an estate tax (you should do an Internet search for your state). I live in Virginia and there is no state estate tax here. Estates worth less than $23.4-million for married couples and $11.7-million for individuals ARE NOT SUBJECT TO FEDERAL ESTATE TAX, so there is no need to set up a trust for estates below this cut-off. If the estate that you are to pass on to your heirs is below these $-limits then there are few benefits to setting up a trust, and you may have to pay higher taxes annually on anything that generates income within the trust (such as investment accounts or rental properties). Some rare trusts are set up in a manner that causes inherited investment accounts to be taxed at higher rates (the “step-up-value” does not work in these rare trusts), so your attorney needs to be made aware of this. So, a trust offers almost no benefit for almost all people. Federal tax rates on money that exceeds the above tax-free price cut-offs (of $23.4-million or $11.7-million) are taxed at between 10% and 40%, depending on exactly how rich you are. .

TRUST TYPES (your assets must be renamed and “transferred” into the trust, a complex and time consuming process):

- Living Trust Revocable… flexible, for both assets and health directives including life sustaining measures, but it may not help with taxes after your passing… and sometimes a revocable trust can be set up to instantly become “irrevocable” after your passing (fairly costly to maintain)

- Living Trust Irrevocable… once set up, it cannot be altered… it is for both assets and all health directives and it offers substantial protection from estate taxation after one’s death… it is much like turning all of your assets into one giant life insurance policy

- Spendthrift Trust… protects one from creditors

- Testamentary Trust… established through one’s standard will and this is a good option for most people that desire a trust

- Charitable Trust… set up to benefit charities after your death

SUMMARY: All people need a will. Most people benefit from health/death directives in their will. Generally, only the super rich will benefit from setting up a trust and trusts are difficult and costly to set up and maintain.

.

.

.

And just a bit about the markets and investing:

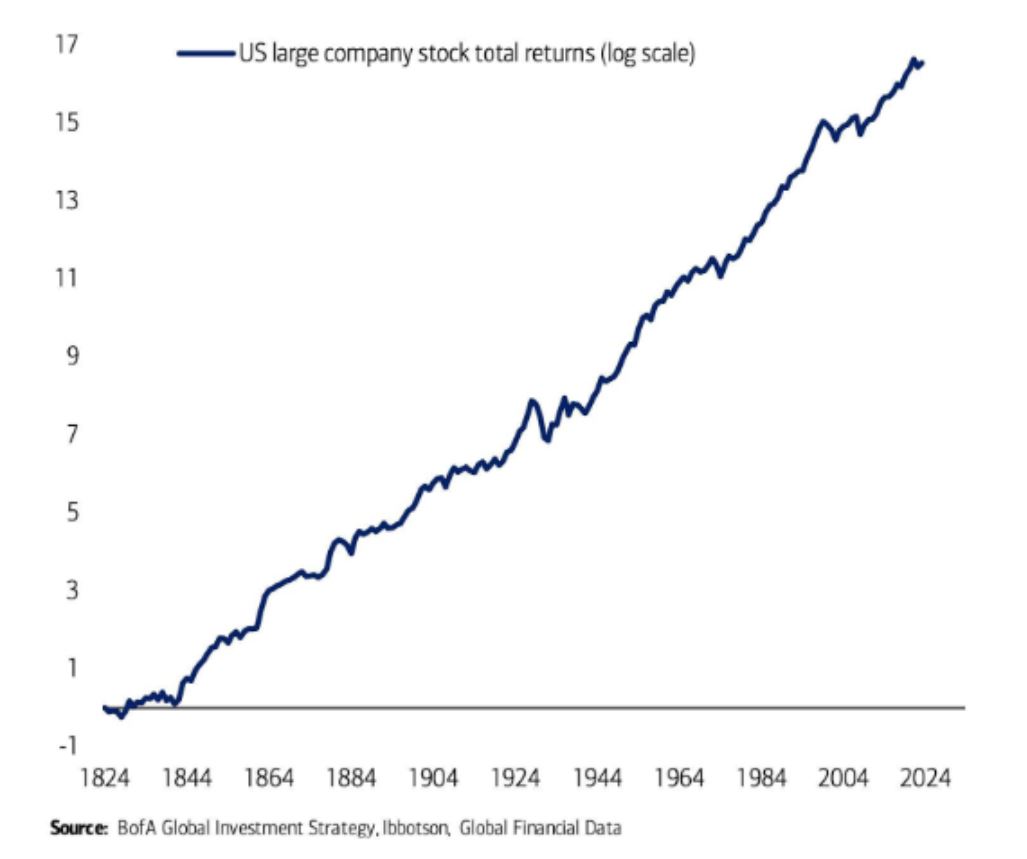

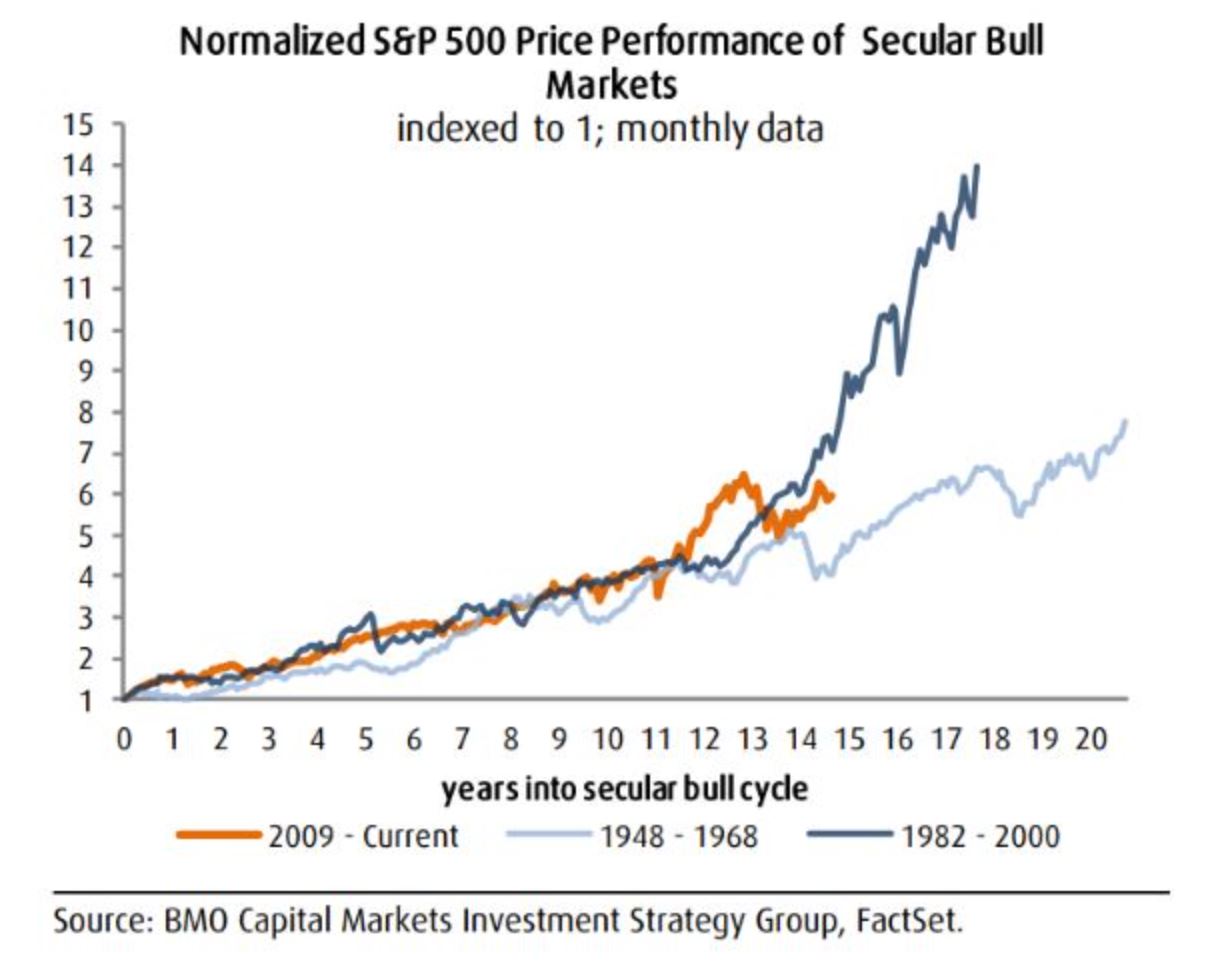

High for the year: A year ago MarketCycle gave its target high for the year 2024 of S&P-500 @ 5200, which at the time was the highest prediction on Wall Street, and we further stated that the S&P-500 might go even higher and that we would have to raise the target as 2024 progressed. Well, we were correct and we are obviously going to have to raise it since the S&P-500 is currently just OVER the 5200 target and it is only early June. But to raise it to what?????? Last year we were perfect in our prediction for the high for 2023; we hit it exactly on the mark. This year, to reach the top of the trend channel would be an impossible feat, so I really do not know where the market will end the year, other than to say: “HIGHER!”

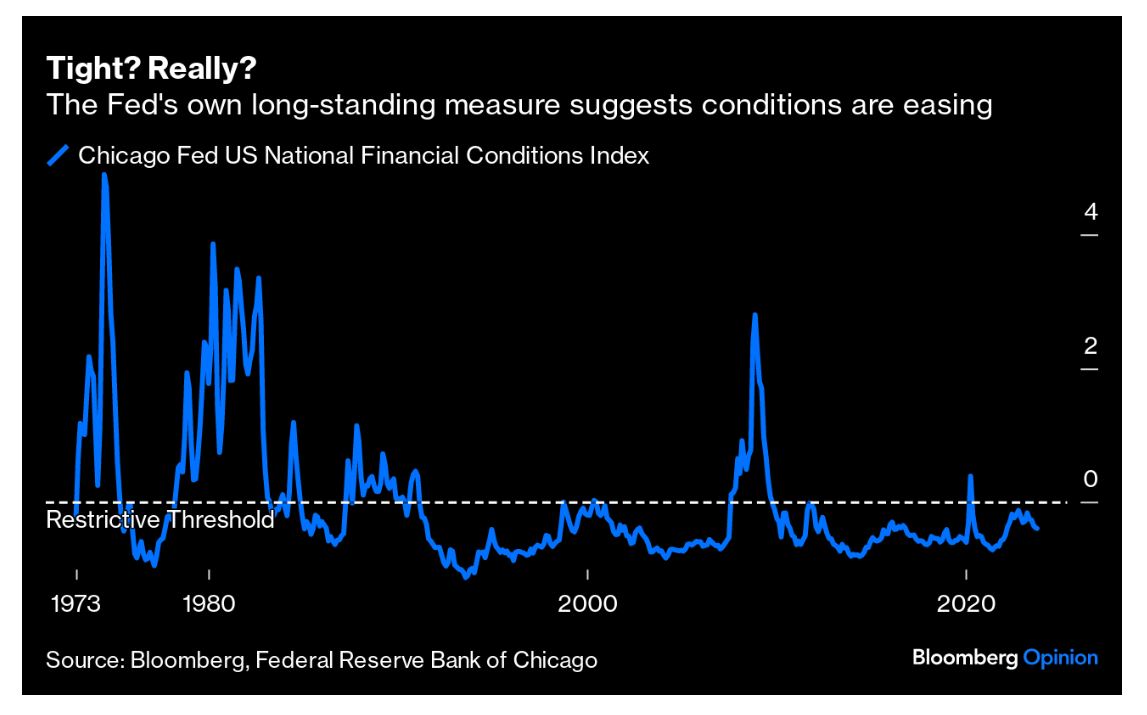

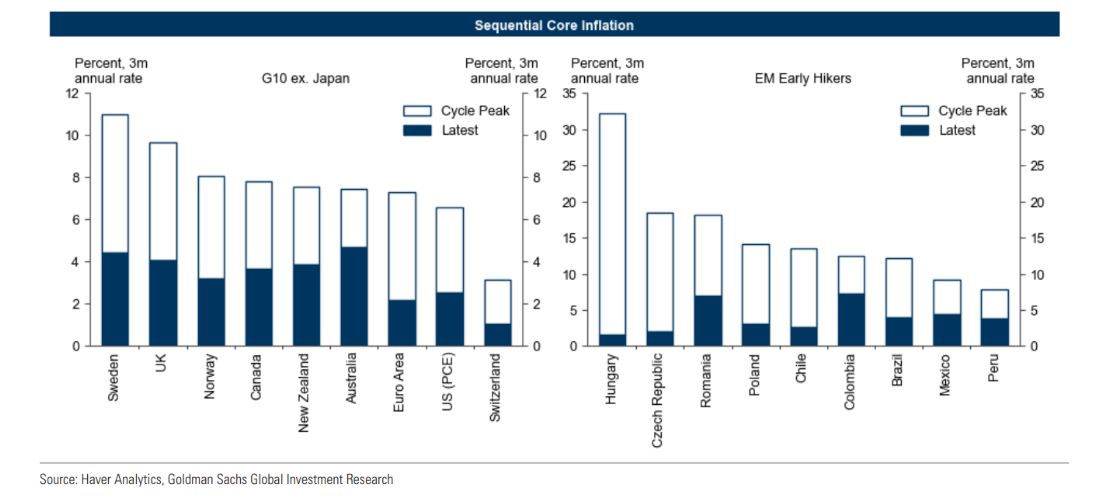

Rate cuts: At the same time (during the middle of last year) that we called for 5200 in 2024, MarketCycle also stated that there would be 3 rate cuts in 2024 (when everyone else was still saying zero rate cuts). When 2024 arrived we lowered it to 2-3 rate cuts (and everyone else raised their prediction to seven rate cuts in 2024). We are now saying 1 rate cut in 2024 (and everyone else is a mixed bag of predictions). So, who knows since none of us can control the Fed. It is likely that the Fed wants to cut rates at least once in 2024 because Donald Trump is calling for himself to be the ONLY person in control of all interest rate decisions (yes, this is true) and, for obvious reasons, it seems like the Fed might cut at least once in the late summer or early Fall in order to strengthen Biden’s election chances. Even just one rate cut by the Fed would be REALLY supportive of equities, especially early cycle equities. But the only thing that “has to be true” is that the Federal Reserve absolutely will eventually lower rates. Yes they will, there is no new paradigm.

.

“The uncertainty about where neutral is today creates a challenge for Federal Reserve interest rate policy makers.”

Neel Kashkari, Minneapolis Federal Reserve President, June 3rd, 2024

MarketCycle’s interpretation of the Fed’s comment: The Federal Reserve doesn’t know what to do and they tell us so every day because they can’t seem to just stop talking.

.

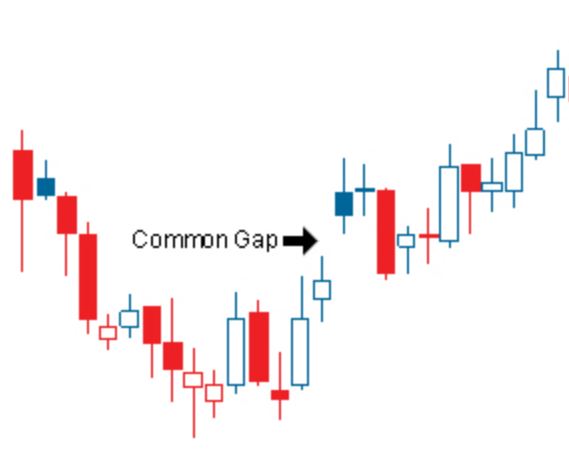

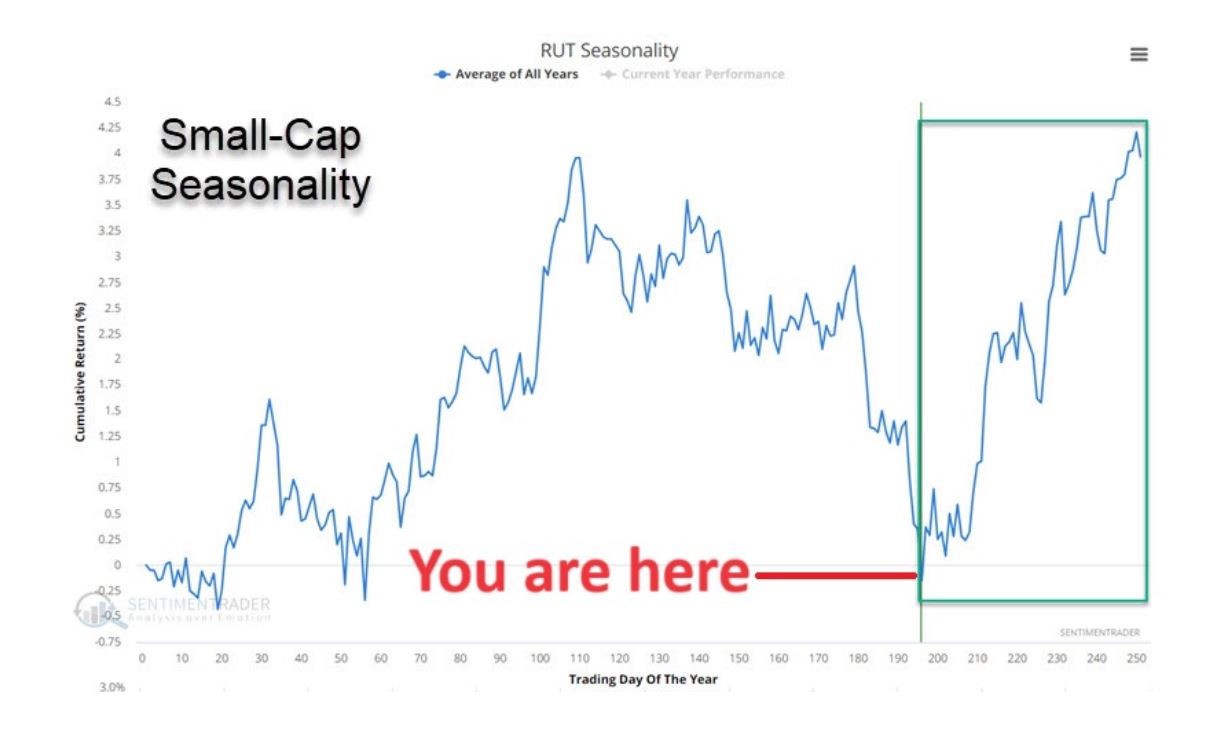

I receive a number of comments about small-cap stocks… basically people telling me that I am wrong and that small-cap stocks are never going to rise. But these stocks have been forming a (sideways launching pad) base over the past 1.5 years and they are anxious to rocket higher. When they do, and they will, they should outpace the rest of the market by a wide margin… they could make as much as 70% in the first 12 months of their initial move. MarketCycle’s chosen small-cap ETF has already been beating the S&P-500 stock index over these past 1.5 years and it is the only one to do so. (Chart courtesy of Topdown Charts and the message is to buy small-cap stocks.)

.

The same thing applies to extended-duration quality U.S. bonds (IE, the 20-30 year Treasury bond). They are like a cat that is coiled and ready to pounce. When U.S. bonds take off, and they will, the move is going to be long and strong and they will rapidly make up for lost time.

To get in at the start of a big bullish move, even if a bit early, you have to see a no-lose situation with limited downside… and then buy & patiently wait… and you have to do so before the crowd sees the potential opportunity.

.

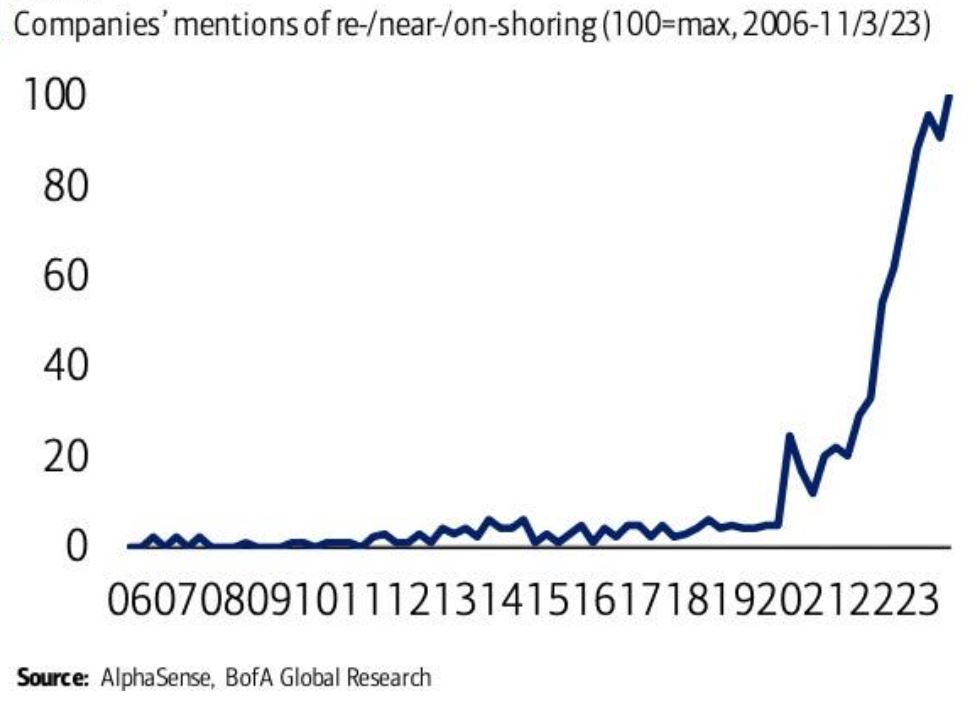

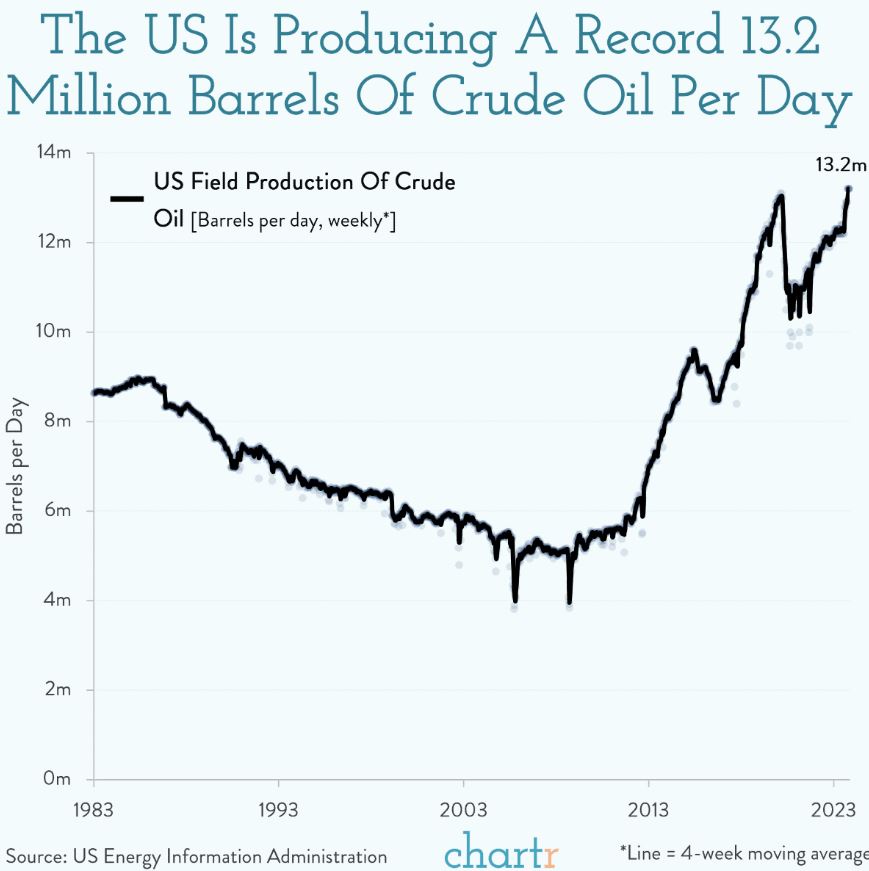

As I keep saying, the United States is the strongest card in the deck and it will continue to be so for the next 5-ish years. There has been a major change in manufacturing moving back to the United States, as shown below. (Chart courtesy of Bank of America.)

.

And to back that up, construction spending for factories in the United States has gone parabolic, as shown below. This is SUPER bullish for U.S. equities. (Chart courtesy of Wolf Street Analysis.)

.

I stopped doing my ANNUAL “beginning of the year summary” of the economic and market predictions of the bigger institutions and analysis companies because THESE KEY PLAYERS ARE ALWAYS, ALWAYS WRONG. I’d say that 95% of all predictions from these big institutional level investors are wrong each and every year, so what’s the point of even listening to their predictions and opinions.

So, the below chart really caught my eye (from the Swiss Finance Institute). It implies that the more famous the investment professional is, the LESS MONEY THEY MAKE for their clients. Most famous investors are well known because of their one big trade from many years ago. Roughly 5% of investment professionals consistently know what they are doing and none of them are famous and they may be extremely difficult to find. They most likely are not on that podcast that we all listen to each week. Fancy that. They may also be a “slow motion, learn as you go, but do not repeat mistakes” type of Market Wizard.

.

And finally, can anybody guess why almost exactly 50% of Americans wrongly believe:

- That the economy is (recession) shrinking when, in fact, Gross Domestic Product (GDP) is steadily growing

- That unemployment is at a 50 year high when, in fact, unemployment is near a 50 year low

- That the stock market is down for 2024 when, in fact, it is up roughly 12% over the past 5 months

Facts?

.

.

Thank you for reading!

MarketCycle Wealth Management manages your wealth, particularly of investment accounts. High quality at a fair cost. We earn our keep. There is a contact tab at the top of the web site. Most new investors seem to start with a smaller account and then fairly rapidly add their entire liquid net worth as they watch the process unfold.

Our paid member REPORT site can be reached via a link on this website.

.

.