MarketCycle Wealth Management

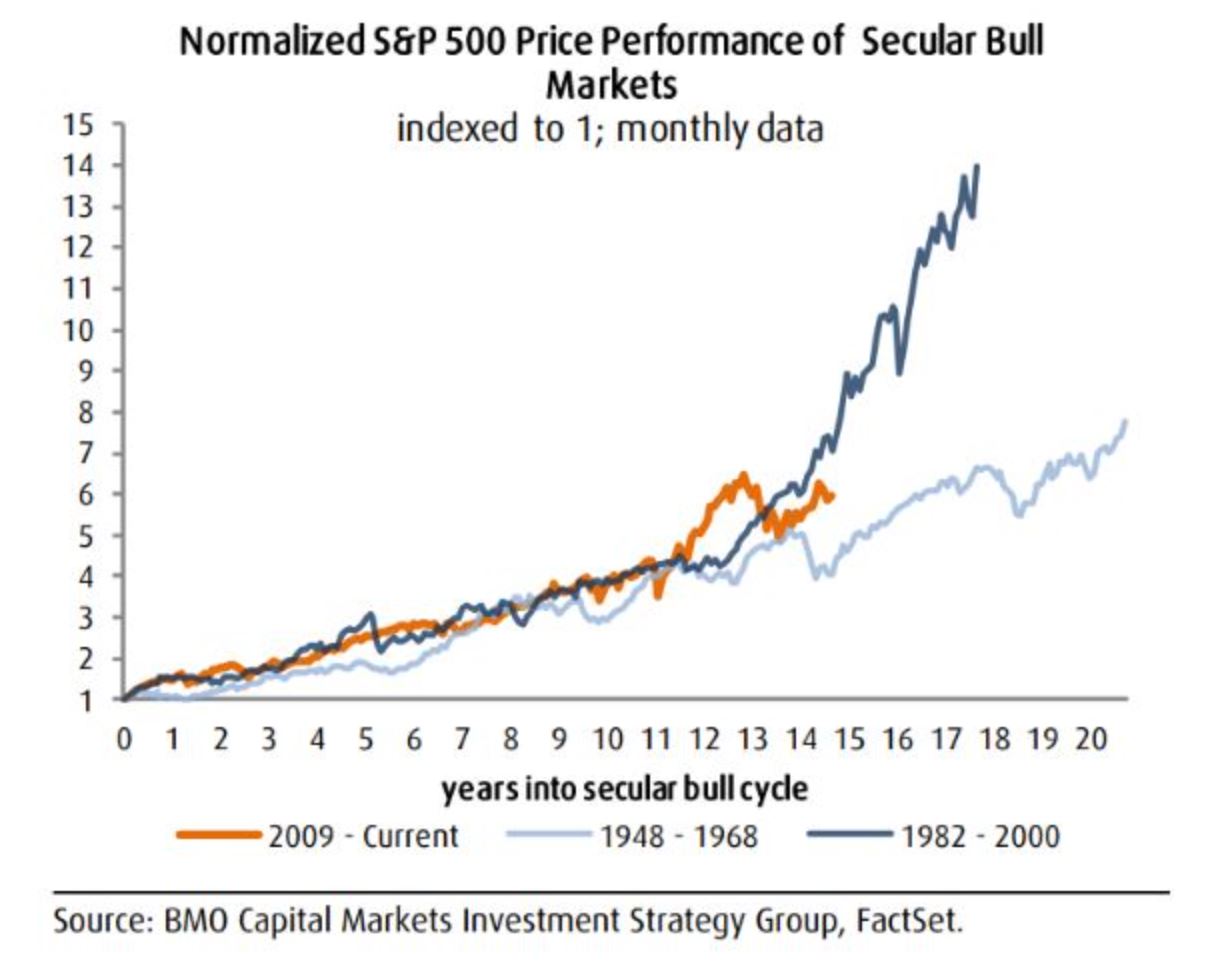

STOCKS: The stock market has been marching sideways for two years now and this is not convenient and not wanted, but we get what we get. The good news is that the longer the sideways period, the stronger and longer is the coming bull.

I believe that this two year base gives us the impetus for a multi-year explosive move higher. I believe that we (orange line) next track the path of the 1990’s higher (dark blue line).

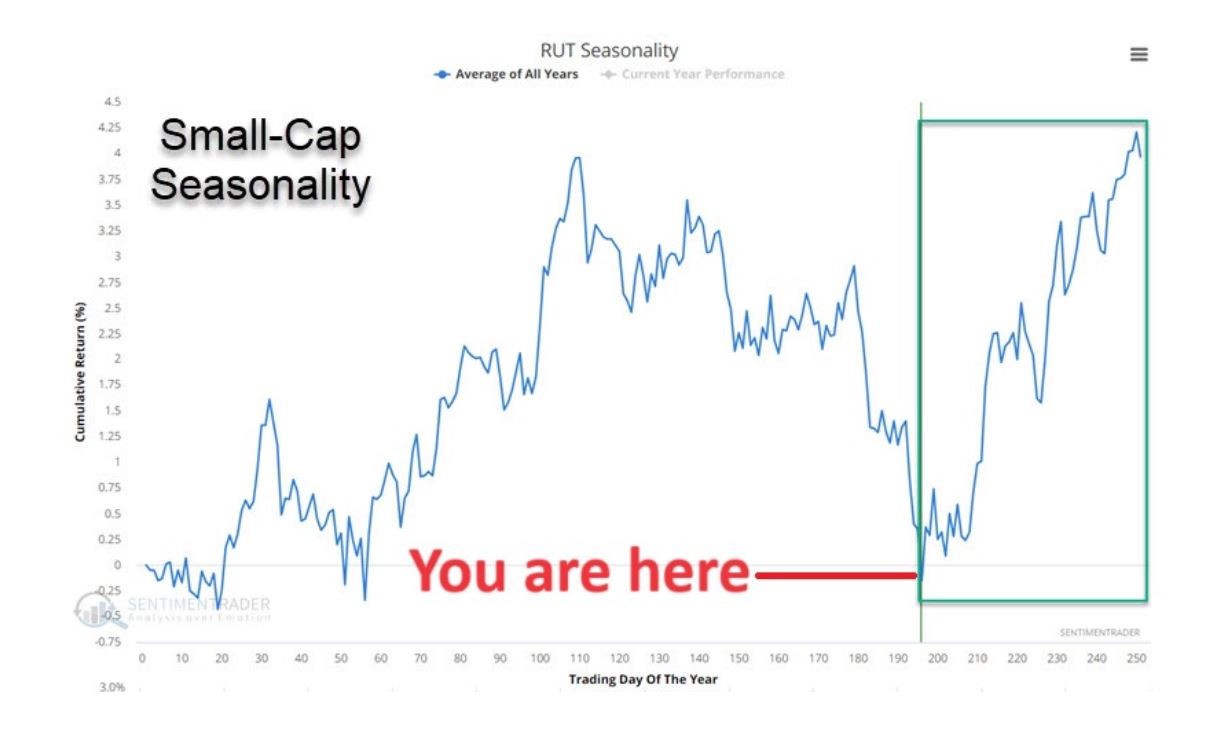

This move higher will initially incorporate (cash-cow) smallcap stocks, which are incredibly oversold.

Right now, we look to be finishing the third leg down on a chart pattern that is usually ultimately bullish. The market would tend to bounce up off of the red lines.

It is important that 4148 holds on the S&P-500 or the market is going lower… and protection would then need to be placed on portfolios.

BONDS: MarketCycle’s system of indicators shows that bonds appear to be attempting a bottom on Bond-VIX capitulation and incredibly strong volume and momentum divergence (this is only a small portion of what we look at for bonds).. and the higher “gaps” on this chart must be back-filled.

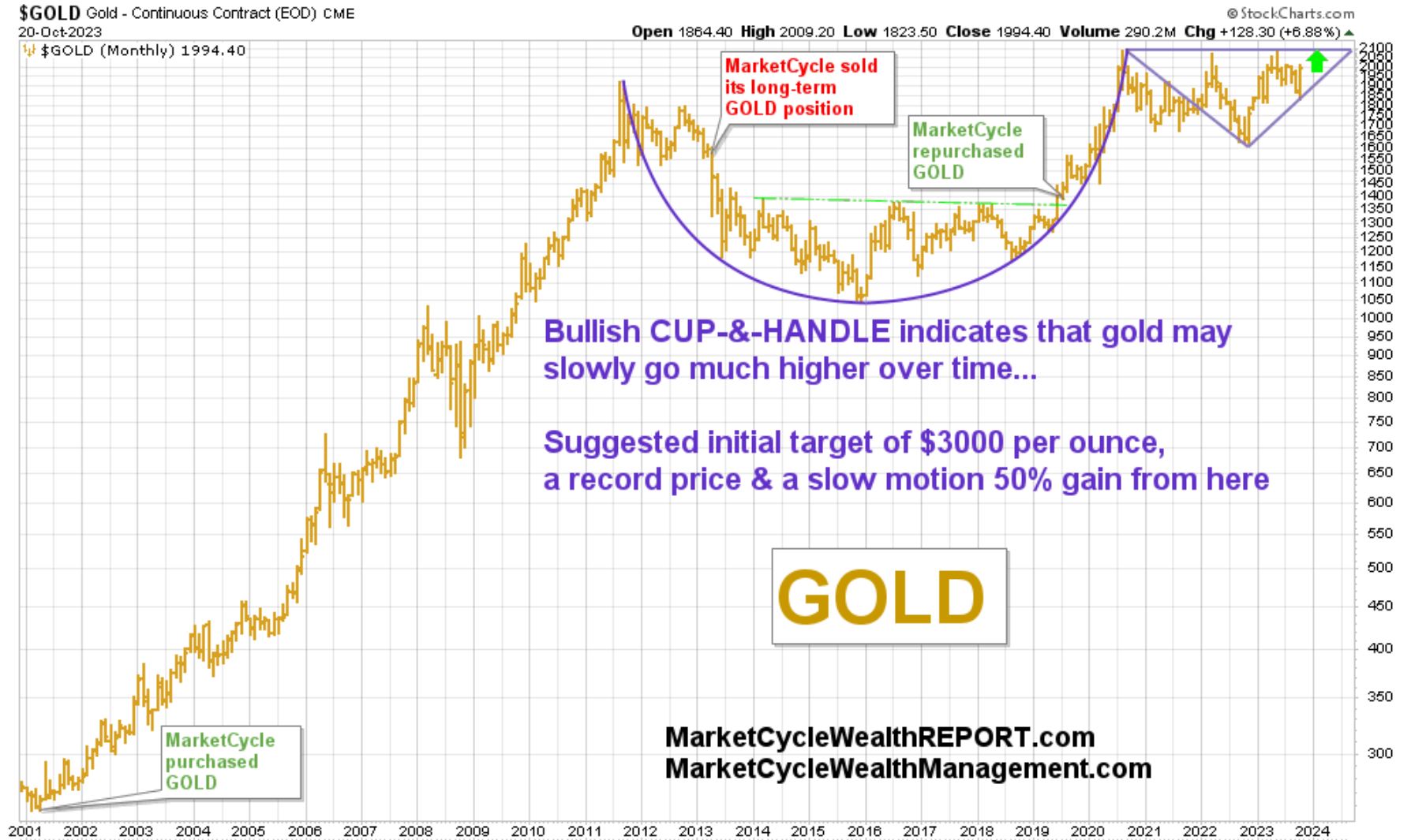

GOLD: Gold has recently broken up (out) from its intermediate-term consolidation pattern. This pattern is normally bearish, but it resolved bullish and this is good news.

And on a longer-term time frame, gold has formed the biggest cup-&-handle BULLISH pattern in the history of the universe… a decade in the making.

That was it… 12 sentences.

SUMMARY: MarketCycle’s indicators are shouting “caution.” The S&P-500 must hold the line at 4148. We said that August and September would be weak, and the third leg down in October was courtesy of Congress dysfunction and Middle-East fighting. So, stocks temporarily weaker and then stronger with a possible strong finish to the 2023 year and possible extreme strength over the next 6 years. Bonds appear to be bottoming. Gold appears ready to head higher for longer. Inflation is still falling. The Fed is at or very close to a halt in rate increases. Traders control the long-end of the yield curve and they may now drive longer-dated bond prices higher, which is what they normally do at this point in the bond cycle.

Upcoming this week of 10/23/23 – 10/27/23:

- Tuesday = PMI

- Wednesday = Housing data

- Thursday = GDP

- Friday = Core PCE and Michigan Consumer Sentiment

Thanks for reading! Please share (forward) this free blog posting with others.

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. There is a contact tab at the top of our website.