MarketCycle Wealth Management

Bull Jumps the Fence

I still sometimes find that it’s a bit discombobulating when the entire world disagrees with me.

Current economic recession indicators are showing stronger recession signals than at any other time in the centuries old history of the stock market. Literally everyone (other than MarketCycle) has been expecting a crushing “hard-landing” recession and they believe that the stock market will follow suit. But when everyone expects the same thing, in this case a massive global economic recession, then something else is always going to happen.

After the recent bear market bottomed in October of 2022 and then initially moved higher, the stock market entered a seven month long sideways (volatile ascending wedge) consolidation period. Effective May 18th of 2023, the stock market appears to have jumped into a new bullish up-thrust. I reserve the right to be wrong and I still expect the market, as always, to zig-zag in its chosen path, but it appears that the stock-yard bull has just jumped the fence and that it is finally on the run again.

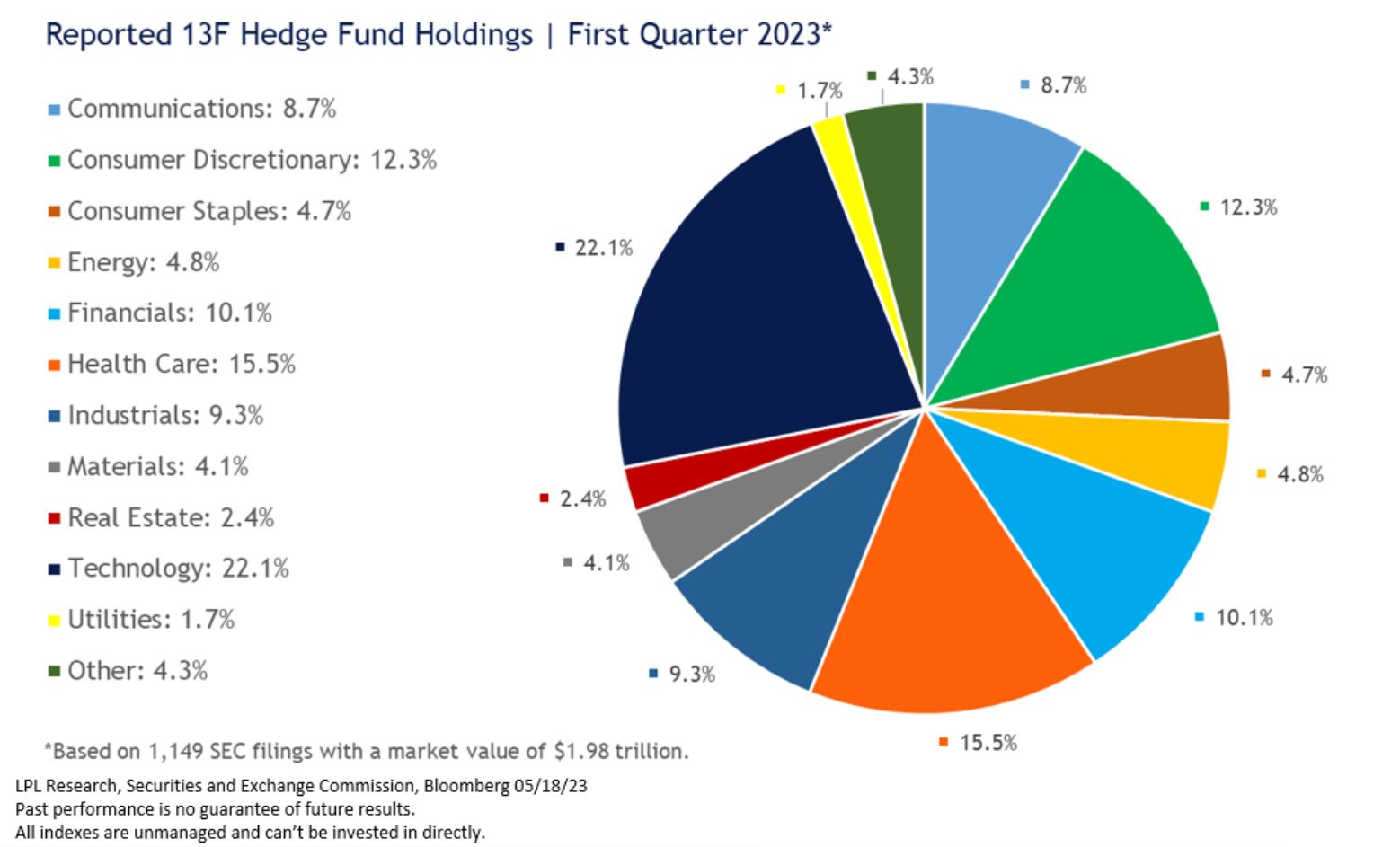

Defensive assets, investment products that normally outperform when the economy is slowing, are suddenly out of favor as the smart money slowly rotates into the oversold early-cycle assets that gain big in the early stages of a brand new stock bull market. Investors are worried; the stock market is not worried. The smart money is quietly hoarding the types of stocks that do well when a brand new bull market is getting under way.

Hedge fund positioning as of April 1st 2023… moving away from their prior heavy defensive positioning and toward early cycle positions such as consumer discretionary, technology, industrials and financials, but still holding health care as their only major defensive position. Small-cap stocks and high-beta stocks and value stocks are currently all oversold and that is where the big players are now looking:

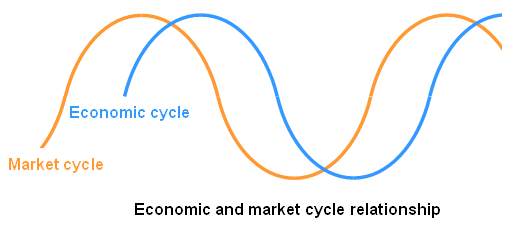

Although it is counter-intuitive, the stock market always becomes strong many months BEFORE the economy reaches its weakest point.

The take-away concept? In my opinion, investors might want to buy aggressive early cycle stocks in the weakest parts of the markets when everyone else is fearful and expecting the economy to sink, and that sounds like now. I’m suggesting that investors might want to ignore their fear and get more aggressive with their portfolios because the recent stock bear market is likely over even if the economy itself still has further to fall.

The stock market cycle moves many months ahead of the economic cycle… they are not the same thing:

MarketCycle PORTFOLIO POSITIONING:

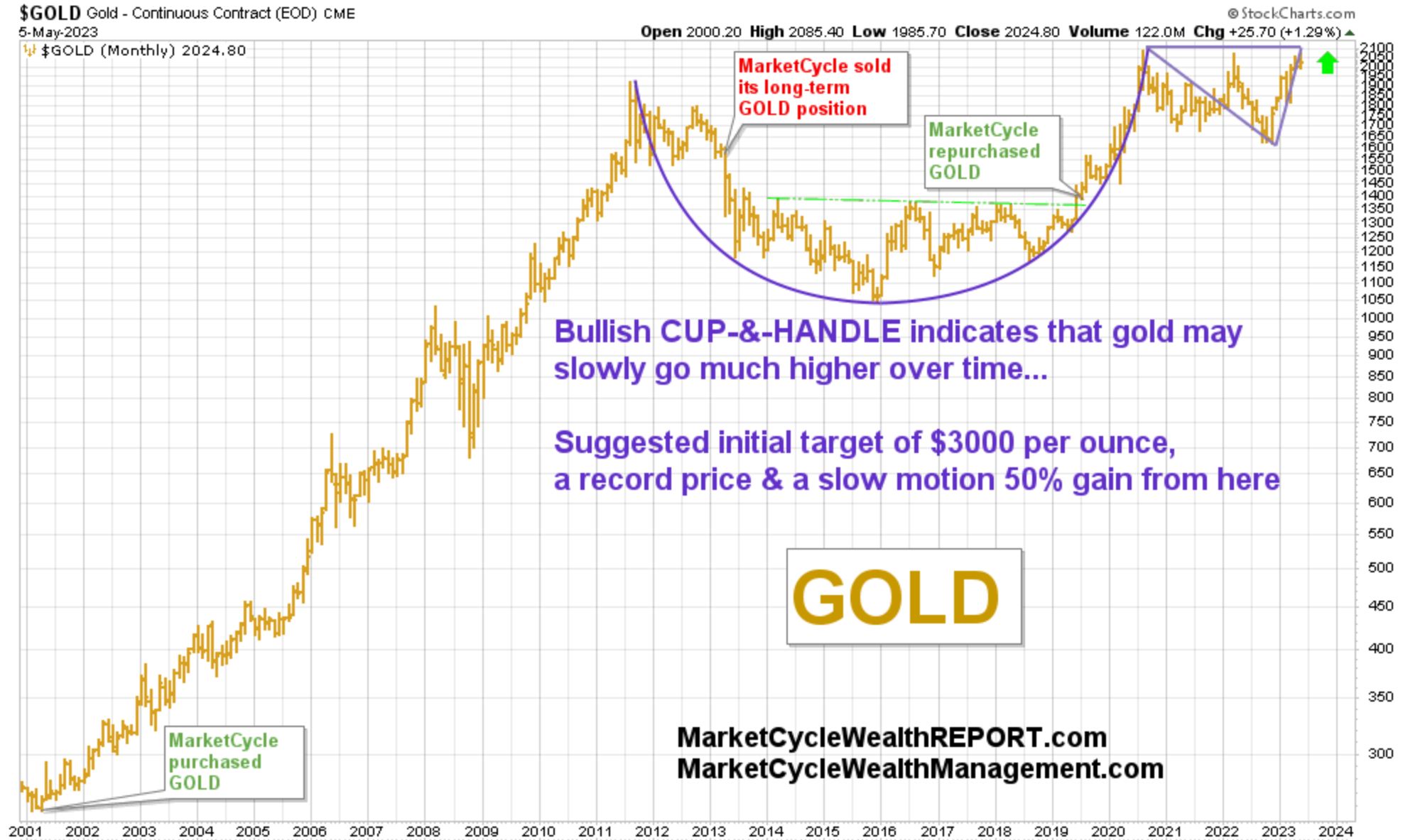

- MarketCycle is bullish on select U.S. and global stocks, fixed-rate bonds in the U.S. and in emerging markets (paying 6%), preferred bonds (paying 12%), gold, most foreign currencies (especially of emerging markets) and Bitcoin.

- MarketCycle is somewhat bearish on most commodities, late-cycle stocks & defensive stocks and the USDollar.

- While the volatility may not be over, we already feel strongly that regional bank stocks are extremely (too) oversold. Financial stocks have the “tripple whammy” going for them: They are an early-cycle sector, an early-cycle value play and they are being offered at ridiculously low prices.

- In our opinion, much of the “recession” was burned off via a half-year of volatile sideways price gyration which we have just now apparently broken (up) out of.

- MarketCycle has become even more bullish as of May 18th 2023, even if we do get another brief and relatively shallow whipsaw.

- For the first time in over a decade, developed market stocks (as in Europe & Japan) are as strong as are U.S. stocks. Emerging market stocks (as in most of Asia and in Mexico & Brazil) are already coming out of recession and they are likely to become stronger over the coming year.

- When I first mentioned the coming inflation period back in the spring of 2020, I said that inflation would spike and peak and fall (the fall is happening now) and that it would bottom at around 3.5% (not the 2% that the Fed expects). I feel that there might be one more similar inflation spike followed by another drop (to 5%?) before stagflation becomes a steady problem in the 2030’s. At that time, “stagflation” will host rapidly rolling bull/bear stock markets, stronger emerging markets, high commodity prices, soaring gold prices and plummeting bonds… and one then makes money by positioning portfolios according.

- And speaking about (the causes of) inflation, the U.S. debt ceiling talks may create some additional short-term volatility, but does anyone seriously believe that this will not be worked out? (for the 75th time in the past 68 years!)

- But… we’re patiently BULLISH NOW and likely bullish for the next half decade!

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. The process is easy… contact us now!

MarketCycle’s paid member’s REPORT site can be reached via the link on this website.