This is a copy of the August 21, 2021 update for our MarketCycle Wealth REPORT website.

This month’s blog will show the daily thinking process that we go through at MarketCycle Wealth Management and also at our paid membership site: MarketCycle Wealth REPORT (link below). Every year we post a free copy to readers of our blog.

But first, I’d like to review our predictions from over the past couple of years and what we got right and what we got wrong. These predictions were taken from past blogs and private client market updates.

Our correct predictions:

- We stated that the economy would NOT collapse following the ‘Covid pandemic panic’ and at the exact bottom (to the day) we stated that the economy would actually become even stronger, with a roaring bull market and rapid employment gains and we further stated that the U.S. would continue to lead in strength relative to all other regions and countries.

- We stated that the USDollar would not collapse, as so many others were warning… and that currencies would basically drift sideways for a prolonged period.

- We correctly called the bottom and top and correction of Bitcoin, almost to the day.

- We said that although the Federal Reserve was already dumping its unprecedented 2020 ETF purchases, that they would announce that they would start to “taper” in 2021. They announced such on August 18, 2021. In the past year, the Fed has increased its Treasury-bond ownership from 15% of all T-bonds to 27% of all T-bonds. It is STILL buying $125-billion worth of bonds per month and this is with record stock market highs, high employment, wage gains and palpable inflation!

- And we maintained our stance that there would be no rate hike. The Fed still says “2023” but MarketCycle’s indicators have predicted that, although there could be a rate hike in late 2021, we will likely get the first rate hike in 2022.

- We saw inflation coming as early as the first week of April of 2020 and this is now the most important financial news story although inflation may now be peaking and even drifting somewhat lower, as we also predicted. Inflation will remain at a relatively high level for some time to come since both manufacturing and retail inventories are totally wiped out, causing higher prices all around. Coming wage increases will add significantly to inflation levels and as inflation rises over the next 15-ish years, wages will have to keep pace in a sort of self-reinforcing feedback loop… you will make more but you will have to spend more. Even U.S. Social Security payouts will be increasing, including for 2022.

- So, we said that while inflation would eventually go to the moon in the 2030’s, that it would initially present with multiple parabolic spikes and their subsequent corrections. The most recent (first) spike is already showing signs of backing off.

- In very early 2020 we said that all commodities, including oil, would take off and present investors with opportunities.

- We said that TIPs and gold were good portfolio assets although gold may lag other industrial and energy commodities.

- We said that bonds would gyrate and that investors would, going forward, have to take a tactical approach (and that bond “buy & hold” would be dangerous for the next 15 years).

- We said that India would lead China in relative strength and that it would do so by a wide margin; it certainly has.

- We felt that while rising inflation should cause emerging markets (like Brazil) to beat developed markets ( like Germany), that in reality, developed markets would excel (but still lag the U.S.), and they did.

- We said that the U.K. would show stronger relative strength than would Europe, although just this week we began to see some signs of weakness in the U.K. relative to Europe.

- We said that convertible bonds would beat preferred shares.

- Right at the bottom, we stated that the March Covid-crash bottom would present a major buying opportunity for highly discounted (and leveraged) Closed-End-Funds. MarketCycle added roughly 20-25% to our client portfolios.

- We felt that value stocks would catch a bid in 2020 but that growth stocks would (again) overtake them in 2021 and that large-cap momentum stocks were a good way to play this.

- We felt that technology stocks would take a hit and then recover. That said, we also now feel that stock, sector and factor selection will be of vital importance going forward and that stock indexes (like the S&P-500) will no longer outperform.

- We very accurately called the tops and bottoms and pullbacks, usually to the day. For the last pullback, one day before the occurrence we predicted a rapid 5% drop that would recover rapidly… it pulled back just shy of 5% and then did recover fully within a few days.

What we got wrong:

- We (probably correctly) predicted that a bear market was coming in June of 2020, but the Covid-panic unexpectedly pushed the date forward by three months. Black Swan (unexpected & rare) events cannot be predicted in advance but this one hit in an already weakening market, which we did foresee. LESSON LEARNED. The prior time that we had called an official “bear market” was in December of 2007 and this proved to be extremely important and correct and profitable for MarketCycle since we pre-moved to extended-duration Treasury-bonds for 15 months (and shorted the market for 11 months); we made a bundle when everyone else was getting killed by falling markets.

- We felt that Chinese stocks would be somewhat stronger in 2021 than they currently are (but to still lag other emerging markets, especially India); we failed to foresee the Chinese government interfering to such an extent in its own markets. LESSON LEARNED. On August 18, 2021, CNBC (financial website & channel) ran the following headline: “Hard lesson for global investors; Chinese companies do not make the rules in China.”

- Normally dangerous high-beta stocks were stronger than we felt they would be and because we started a brand new stock bull market only 1.5 years ago, we should have known better. LESSON REMEMBERED. Please note that today high-beta stocks are no longer either a safe or a good investment choice. High-beta stocks are high-volatility stocks and in a new roaring bull market, volatility causes rising spikes of profits. The correct pick now would be mid-to-large cap lower-volatility and quality stocks; lower risk stocks will now beat higher risk stocks.

Bull market? A recent quote from Picton Mahoney about what would cause the bull market to continue: “Households are now sitting on a mountain of excess savings, over $3-trillion, providing considerable resources for a consumer binge. Consumer spending will likely be turbocharged for a number of years to come. And wealth created by investment account gains will likely further support consumption levels as we approach a full economic reopening.”

MarketCycle Wealth REPORT

For August 21, 2021

Important note about the REPORT signals: The individual asset signals shown below are determined by combining the following 11 criteria…

- The trend direction of the individual asset

- Relative strength of the individual asset against all other assets

- Relative strength of all regions and countries relative to their peers

- Where we are in the current cyclical market cycle

- Where we are in the longer-term secular cycles

- Where we are in the inflation cycle

- Global Central Bank activity

- Global currency relative strength and trends

- Accelerated inflation data

- Accelerated economic data

- How much measurable risk is currently in the market

STOCKS…

United States: very BULLISH

Developed markets (ex-U.S.): weakly BULLISH

Japan: weakly BULLISH

Emerging markets (mostly commodity producers): CAUTION

China: CAUTION

India: very BULLISH

Leader in RELATIVE STRENGTH: United States

GROWTH or VALUE: GROWTH

Strongest SECTORS: consumer cyclicals, consumer staples, financials, healthcare and technology

Global private equity: BULLISH

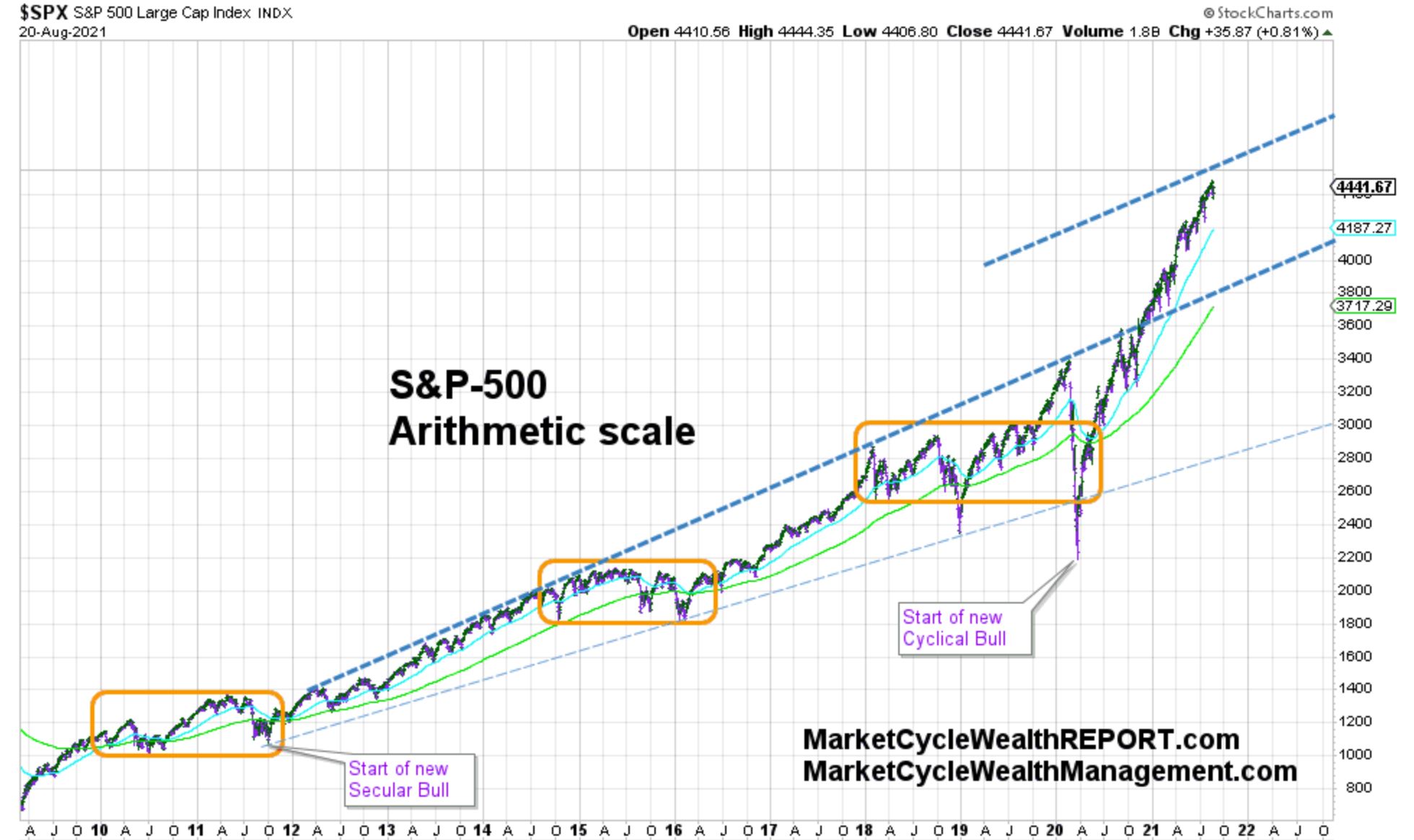

- SECULAR U.S. stock outlook (effective October 1, 2011): Bull markets will be stronger than usual

- SECULAR Emerging market stock outlook: Bear markets will be more severe than usual

BONDS…

U.S. Treasury-bond, 30 year: CAUTION (can offer portfolio protection and hedging)

U.S. Treasury-bond, 10 year: CAUTION

U. S. fixed-rate corporate bonds: CAUTION

U.S. floating-rate assets (and TIPS): BULLISH

U.S. high-yield corporate bonds: BULLISH

U.S. preferred shares: CAUTION

U.S. convertible bonds: BULLISH

Emerging market high-yield bonds: CAUTION

- SECULAR fixed-rate outlook: Bear markets will be more severe than usual.

COMMODITIES…

Gold: BULLISH (can offer portfolio protection and hedging)

Oil & energy: BULLISH

Industrial metals: BULLISH

Lumber: weakly BULLISH

U.S. home price appreciation: BULLISH

- SECULAR commodity outlook (effective October 1, 2011): Commodity bear markets will be more severe than usual

CURRENCIES…

U.S. Dollar: CAUTION

Euro: CAUTION

Yen: CAUTION

Emerging market currencies: CAUTION

Note: All currencies are gyrating sideways and this could persist.

RISK ASSESSMENT…

- Calculated future U.S. economic-RECESSION probabilities (markets can correct without being in recession): LOW

- Global (ex-U.S.) Economic Weakness Indicator: BULLISH

- U.S. Federal Reserve’s Survey of Professional Forecasters: BULLISH

- Are energy costs HIGH enough to crush the economy? NO

- Are energy costs LOW enough to stimulate the economy? NO

- Hindenburg Double Omen within past 6 months: Just had one but require a second one in September to confirm

- If post correction, does the VIX Rate-of-Change show that a near-term bottom may be in? N/A

- High-yield to T-bonds – price divergence: BULLISH

- High-yield to T-bonds – spread: BULLISH

- S&P-500 to T-bonds – spread: BULLISH

- Global (ex-U.S.) stocks to T-bonds – spread: BULLISH

- Percent of S&P-500 stocks above-to-below the 200 SMA – divergence: BULLISH

- S&P-500 Price to Momentum – divergence: BULLISH

- S&P-500 monthly RSI – divergence: BULLISH

- S&P-500 Advance/Decline Price Line: BULLISH

- S&P-500 Advance/Decline Volume Line: CAUTION

- Small-cap Advance/Decline Volume Line: CAUTION (as we move into the mid-cycle, we expect small-caps to show relative weakness)

- Small-cap direction of 300 day Simple Moving Average: BULLISH

- Micro-cap to large-cap divergence: CAUTION (erratic behavior of micro-caps might be caused by the new phenomenon of “Robinhood Traders”)

- Small-cap momentum: BULLISH

- Mid-cap momentum: BULLISH

- Large-cap momentum: BULLISH

- Dow Theory divergence: CAUTION (could be a false signal because of Covid related airline weakness)

- Home construction divergence (triggers early): BULLISH

- Lumber price divergence (triggers early): BULLISH

- Copper price divergence: BULLISH

- Cyclically Adjusted Price-to-Earnings Valuation Ratio: BULLISH

- Warren Buffett Valuation Metric: BULLISH

- Q-Ratio Valuation Metric: BULLISH

- U.S. 3-month:10-year interest rate yield-curve: BULLISH

- Likely future direction of U.S. interest rates: FLAT then UP

- 12 month trend of inflation levels: INFLATIONARY

- Inflation/Deflation Extremes Indicator: BULLISH

- Volatility trading-range: BULLISH

- Un-employment trend (leads employment data): BULLISH

- U.S. Leading Economic Indicators EXPANSION or CONTRACTION: EXPANSION

- U.S. stock market combined SEASONALS (updated monthly): CAUTION

- Is there too much BULLISH ENTHUSIASM in the stock market? NO

- ∗∗ Calculated chance of a multi-week stock market CORRECTION of >10%: only slightly above AVERAGE

- ∗∗ Calculated chance of a multi-month stock market RECESSION of >20%: NONE

- ∗∗ Calculated chance of a multi-year global DEPRESSION of >50%: NONE

- Minor OVERSOLD Indicator most recent buy-the-dip date: March 23, 2020

- Major OVERSOLD Indicator most recent buy-the-dip date: March 23, 2020

- U.S. SECULAR THEME… “MY” Ratio (investing demographics) is bullish until 2029

- U.S. very-long-term SECULAR THEME… inflation or deflation: INFLATION

S&P-500 shown as of Saturday, August 21, 2021… most likely path is to touch and then scoot along the new upper dashed line as it did in 2013-2014 when the Fed was last tapering, but we’re watching closely.

Thanks for reading!

We do not advertise. If you like what you see, please share and tell others!!!!!

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. The entire process of setting up with MarketCycle is easy and the first 3 months are at no charge. We earn our keep.

You can SUBSCRIBE to this free, no-spam MONTHLY blog via the website.

The LINK for the REPORT website: https://MarketCycleWealthREPORT.com/

Graham & Dodd: “The essence of investment management is the management of risks, not the management of returns.”

Ralph Wagoner: “The market is like an excitable dog on a very long leash in New York City, darting randomly in every direction. The dog’s owner, who ultimately determines the primary direction (trend), is walking from Columbus Circle, through Central Park, to the Metropolitan Museum. At any one moment there is no predicting which way the pooch will lurch. But in the long run, you know he’s heading northeast at an average speed of three miles per hour. What is astonishing is that almost all of the market players, big and small, seem to have their eye on the dog and not the owner.”–

MARKET CYCLE — TREND FOLLOWING – DUAL MOMENTUM — GLOBAL MACRO – HEDGE FUND

Thanks for supporting us… Steph Aust