MarketCycle Wealth Management

A shorter blog-posting today. At the bottom of this blog, you will see that the stock market has moved sideways during all of 2023. Bonds have been even more problematic.

The reason to own bonds is that they normally make profits when stocks enter a recession. They are assets that offer protection while paying you interest. Bonds are sort of like insurance that pays you to hold the insurance. Normally.

Interest rates and bond prices move in opposite directions. If rates rise, then bonds suffer. If rates fall or move sideways, then bonds prosper.

The 20 year Treasury bond is currently paying 3.65%. However, MarketCycle’s chosen 20 year Treasury bond ETF is currently paying 20.10% interest via a safe options strategy.

The bond ETFs do not track the bond indexes; the ETFs are skewed to the upside. And a performance chart of our chosen bond ETF looks like a totally different asset entirely because it is definitely skewed to the upside… that extra 20% of income is important in generating profits.

Since longer-duration portfolios gain more than shorter-duration when interest rates fall, a higher tactical allocation to fixed income and maximum extension of duration within benchmark limitations makes the most sense when rates are peaking and/or are set to decline. [MarketCycle note: When rates are peaking, buy the 20-30 year bond rather than the 1-10 year bond.] This usually occurs when monetary policy is still tight and the yield curve is inverted. When long rates are lower than short rates, it is generally a signal that the tightening cycle is near its end and that prices for Treasury bonds, particularly on the long-end, are set to increase.”

Dr. Robert T. McGee, Director of Macro Strategy and Research at U.S. Trust and at Bank of America Private Wealth Management and author of: Applied Financial Macroeconomics & Investment Strategy

Currently, we are at or near the peak in interest rate increases by the Federal Reserve, so bonds should soon perform better, and perhaps they will perform quite well.

However, there are some factors that are temporarily & currently causing bonds to falter more than they normally would be. These factors will mostly be short lived. They may drive the 10 year bond yield up to 5% from its current 4.85%. We will briefly discuss this below.

When bonds flip and bond prices head higher, the 20 year bond could make a quick 25% profit plus the interest payments would have to be added to that number. If it takes a year to unwind, then MarketCycle’s chosen bond ETFs: 25% (gains) + 20% (interest) = 45% profit.

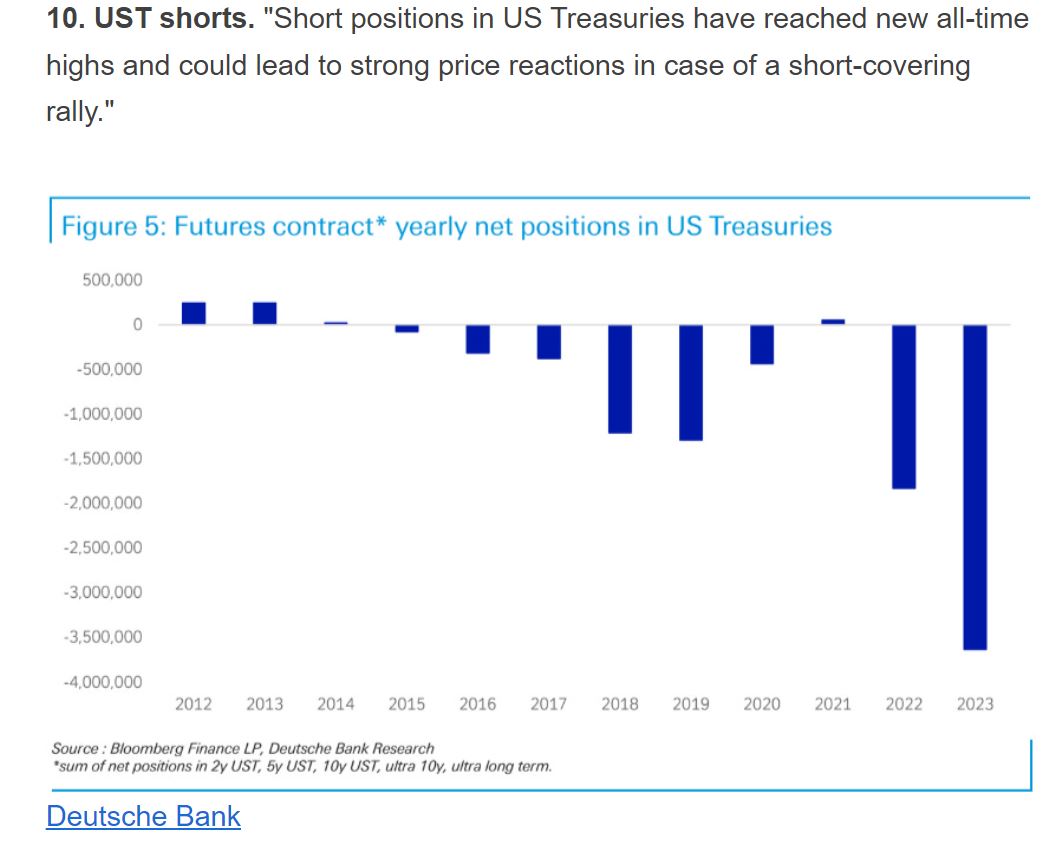

The move may be fast because of the incredibly high number of investors that are ‘short’ bonds. A ‘short’ is a bet that rates will continue to go higher forever and ever, amen. But this won’t happen. Parabolic moves do not last and when they unwind, the move is powerful. The 20 year Treasury bond could make a fairly fast 25% profit. (Chart courtesy of Deutsche Bank.)

So, why are rates temporarily heading higher than the Federal Reserve intended?

- China, India, Russia and several less important emerging market countries are reducing their Treasury bond holdings.

- The recent U.S. credit downgrade is causing countries to ask for higher interest payments on their bond purchases.

- The Feds quantitative tightening, as an addition to their rate increases, is causing a drift higher in interest rates.

- Japan is about to end its Yield Curve Control program which may cause the Japanese retail investor to have less interest in buying bonds outside of their own country.

With the exception of #1 above, none of this will be lasting or of much importance longer-term.

The currently popular belief that rates will head higher forever is not, in any way, a new paradigm or a new regime change. That said, in the 2030’s we may get chronically higher rates. In fact, I believe that some time in the 2030’s, when inflation and rates are chronically high, the astronomical debt of the United States may become unpayable But in the near to intermediate term? In my opinion, bonds will soon swing back into their own bull market.

Rates are about to fall. Parabolic moves cannot last. The time has come to add bonds to the stock mix.”

Carter Worth… Worth Charting, October 4, 2023

Current worries? I normally do not care about how temporary news or political events may affect markets, but what am I closely watching? I’m watching who is elected Speaker of the House in the United States (next week?) and what opinions they have previously expressed about funding the prior debt of the United States (the battle starts all over again in mid-November). But the likely outcome is that the debt will be funded. As Kim Wallace of 22V Research said just a few moments before I posted this article: “A shutdown won’t happen because a shutdown is not a good campaign ad.”

And stocks? 2020 was the Covid Pandemic bear market… 2021 gave us sky high inflation… 2022 was a very difficult bear market year… 2023 has been a difficult sideways year. Yes, sideways. But sideways does not mean that it is a “bear market.”

As investors, we get what the market offers, but I do feel that the good times start again very soon and that they will last for about 6 years. A fact in investing is that the longer the sideways (consolidation) period during a bull market, the bigger the coming upward move.

Because of occasional extended sideways stock market periods, MarketCycle’s client accounts now have half of their portfolio holdings paying incredibly large amounts of interest & dividends.

The U.S. stock market in 2023: A sideways headache that will soon end. [Please note that the frighteningly large swings below look much less significant on a longer term chart.]

Thanks for reading.

You can contact me at MarketCycle Wealth Management via the tab above on the website. We manage investment accounts. And I will answer anyone’s questions promptly and at no charge.