MARKETCYCLE WEALTH MANAGEMENT

This posting is sort of long, but it mostly contains images. You do not have to understand the images because they are clearly explained in the sentence above each image. There is a brief market summary (and 2 important stock market charts, short-term and long-term) at the end of this month’s posting. August and September were weak and volatile, as we predicted in a Client Market Update… not the sort of thing that you step out of the way of, but the kind of situation that just requires patience. The remainder of September might be a bit volatile, but in the intermediate term and in the long term, MarketCycle is still very bullish. This posting explains exactly why. I still expect the S&P-500 to reach the old record high of 4800 by the end of this year or by very early in 2024.

This is the tale of two houses. Both houses, shown above, are equally nice and both are essentially identical.

The house on the left is selling for $500,000; the house on the right is selling for $250,000.

You want to buy one of them. Which one should you buy?

The obvious no-brainer answer is that you should buy the much cheaper of the two similar houses, the one on the right. Valuations matter.

Yes, you are very smart.

But if this were an investment asset such as a “stock” (or bond, currency or commodity) you would likely end up buying the stock on the left even though it is more expensive. This is because you want to follow the herd; you have a fear of missing out; you want to own that very expensive stock on the left because it is obviously somehow better, even though it is fairly identical to the discounted one on the right.

Yes, investors are not always smart.

What you pay for something is important.”

Mark Cortazzo, Wealth Track, September 8th, 2023

Even though most investors are still currently hiding in “cash” (hedge funds have their highest cash allocation in history) the recent 2023 stock market runnup involved the continual buying of a handful of 7 stocks which drove the Nasdaq-100 and S&P-500 stock indexes higher while the remaining few thousand U.S. stocks lagged. Many of these stocks are as good as or perhaps much better than the 7 stocks whose buying drove the stock market indexes ever higher. I’m suggesting that folks might want to buy the early-cycle high-quality stocks that haven’t already run up to record highs; the ones that are still of value and therefore valuable. I have a list of these currently undervalued early-cycle assets below.

Which early-cycle stocks are cheap and under-valued right now?

- Cash-rich quality small-cap stocks (low quality smallcaps are not a good choice)

- Pure value large-cap stocks

- High-beta (big moving) large-cap stocks

- Technology stocks (the long-term Secular theme is innovative technology and AI and robotics)

- Consumer discretionary stocks

- Industrial stocks

- Preferred shares (must be diversified)

- Convertible bonds (bonds that can be converted into stocks at a later date… this is a huge benefit)

- Home builders (currently too late to buy, they’ve already moved higher)

Professional investors are pre-positioning into early-cycle sectors (see the light blue diamonds for current positioning. (‘Early-cycle’ means the first few years of a new bull market… Chart is courtesy of Deutsche Bank):

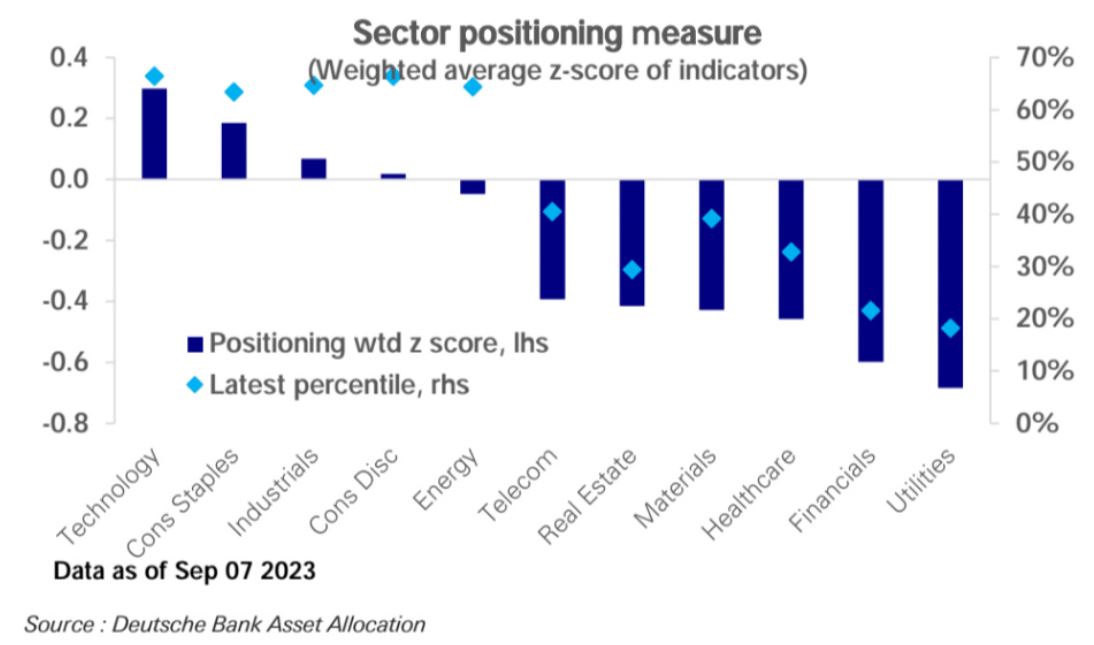

Artificial Intelligence? Most of the 2023 runnup in stocks was accomplished via 7 “AI” stocks that just happen to be the biggest holdings of the Nasdaq-100 and S&P-500 stock indexes. My thesis is that one should buy the low priced AI stocks as shown below (light blue line). Buy good values and have patience. (Chart courtesy of Goldman Sachs):

The key to successful investing is having everyone agree with you, but at a later date.”

James Grant, Interest Rate Observer, September 8th, 2023

My opinion on small-cap stocks? Good things happen to cheap assets!”

Josh Brown, CNBC commentator, September 7th, 2023

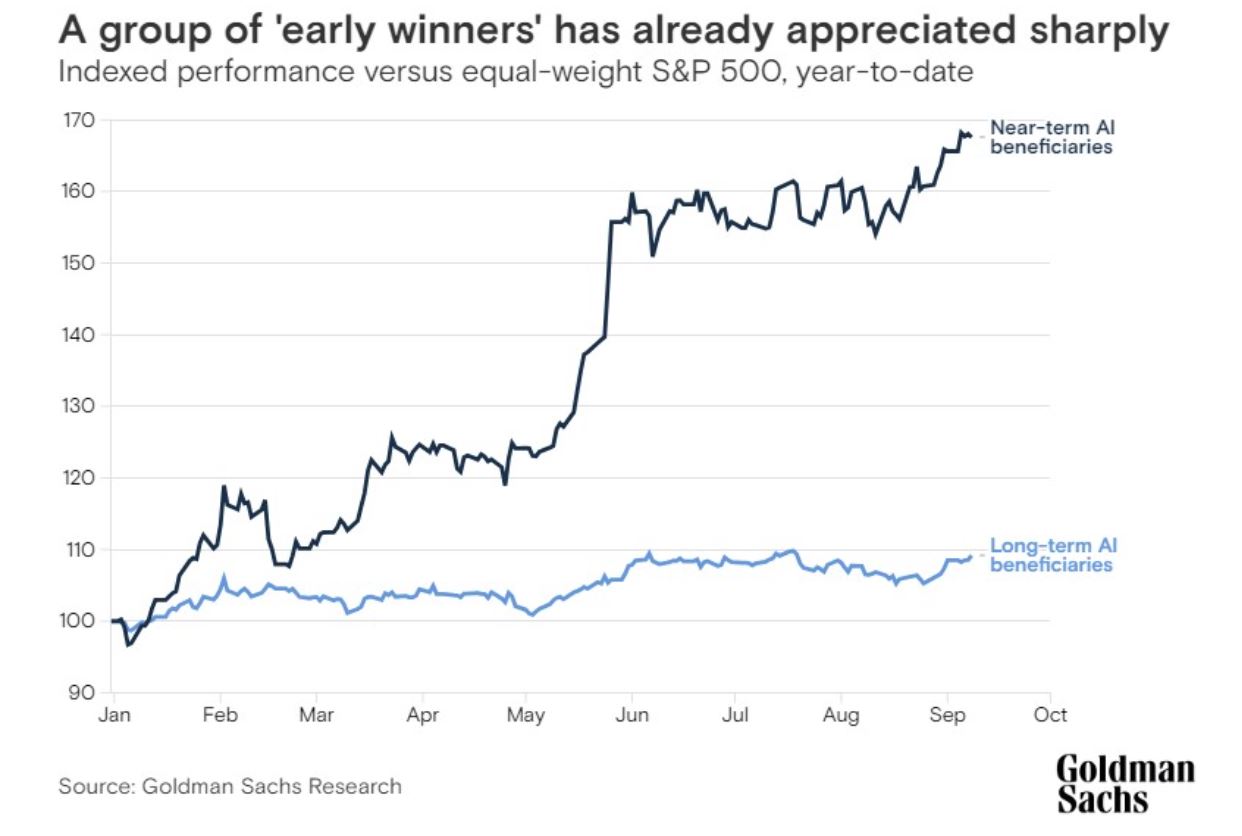

This next chart shows how cheap small-cap stocks currently are. Their P/E is at an extremely low 11.5 and this shows their current “fire-sale” prices:

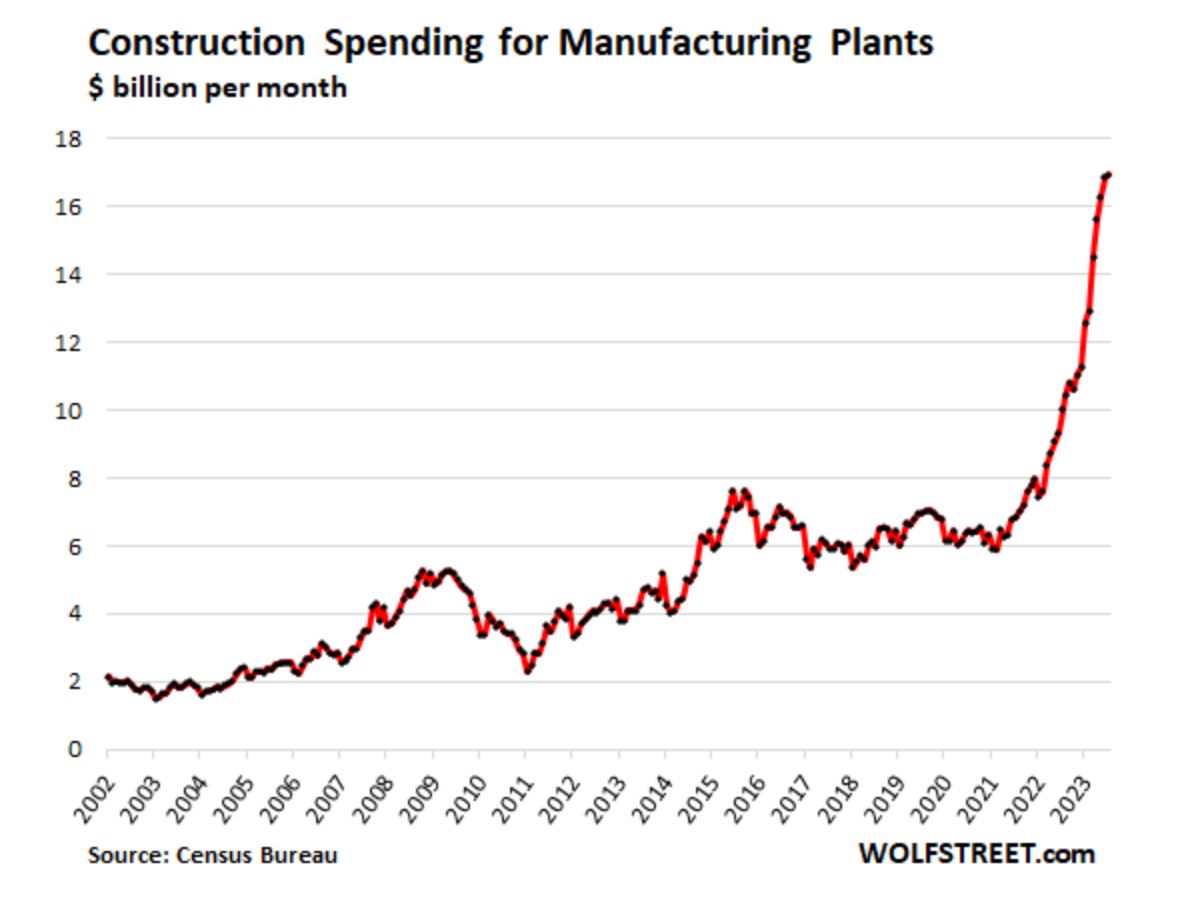

This next chart shows what is happening to manufacturing in the United States. You can see the giant move upward on the far right of this chart. Despite the continued chorus of calls for a recession, this chart actually shows the underlying renewed super-strength of the U.S. economy & stock market. Something important is happening. (Chart courtesy of WolfStreet via the Census Bureau):

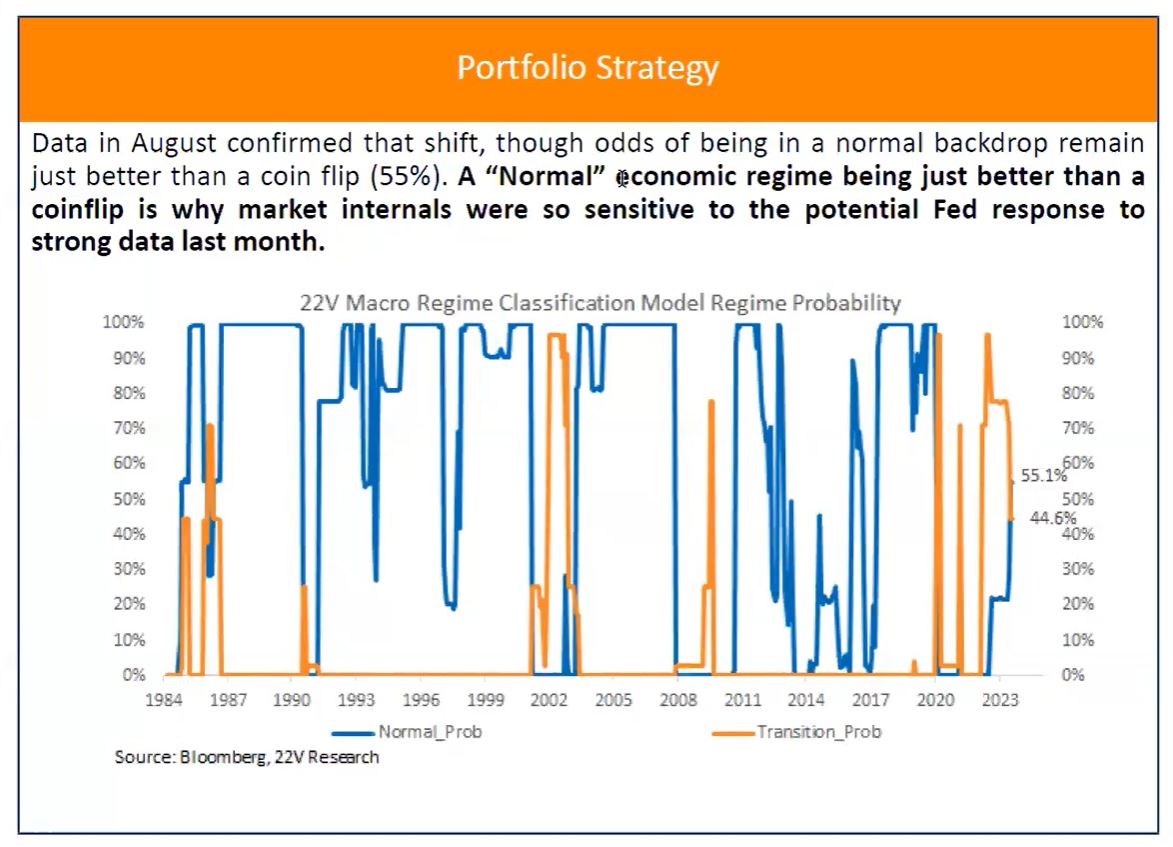

22V Research offers a very good institutional level investing research program for $5000 (or higher) per year. Below is a recent chart that they showed on a webcast. MarketCycle has stated that, while the stock market bottom was in late-October of 2022, the new cyclical bull market didn’t start until mid-June of 2023 because of the economy going through a 6 month long rolling recession. 22V Research now states that they also believe that the new (still weak) cyclical stock bull market recently started again in June.

Blue line below = bullish periods… and look at all of the “orange-line” showing the bearish turmoil over the past four years! As they said in their Friday, September 8th webcast, “This has been the most difficult 4 year period in all of investing history.” I’ve stated the same thing in the past few Client MarketCycle Updates. We all suffered through the 2020 Covid Pandemic bear market, the 2021 inflation spike, an even bigger 2022 bear market, a 7 month long 2022-2023 rolling recession and a Federal Reserve that still doesn’t know when to get out of its own way… but good times are close-at-hand and I can see it clearly in MarketCycle’s proprietary system of indicators. (Chart courtesy of 22V Research):

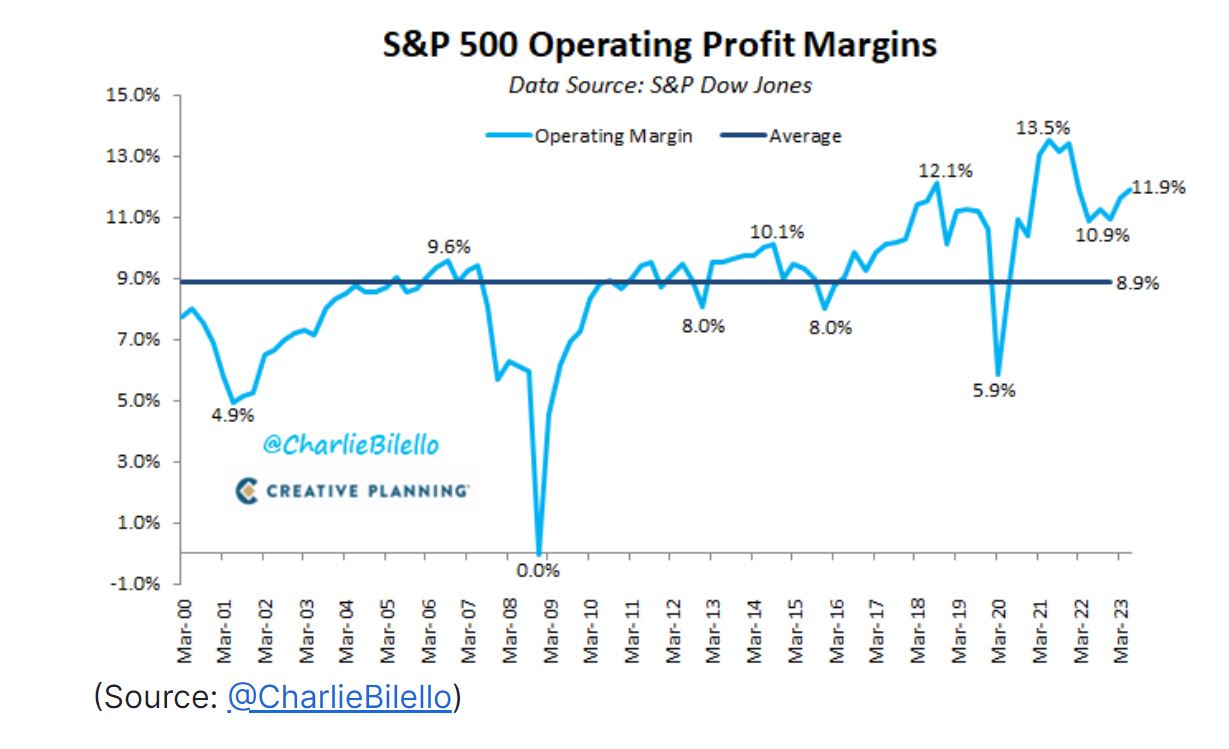

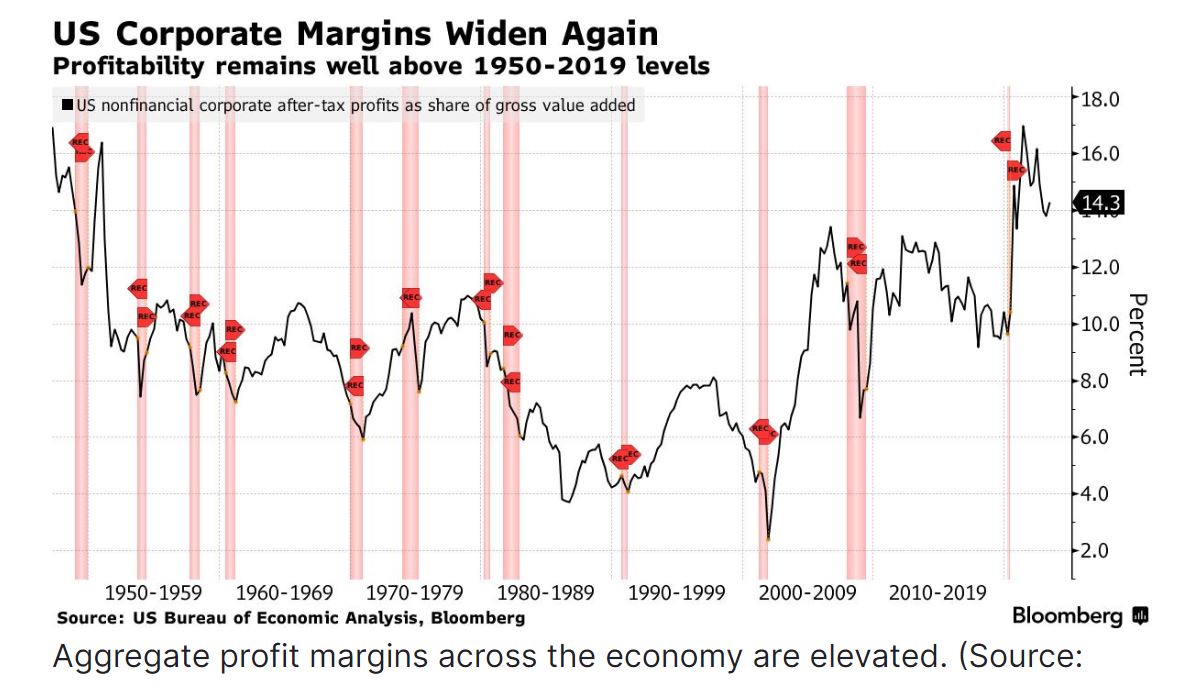

Corporate earnings will show future strength because operating profit margins are historically high @ 11.9%. This will send the stock market higher. (Chart courtesy of Charlie Bilello Blogspot):

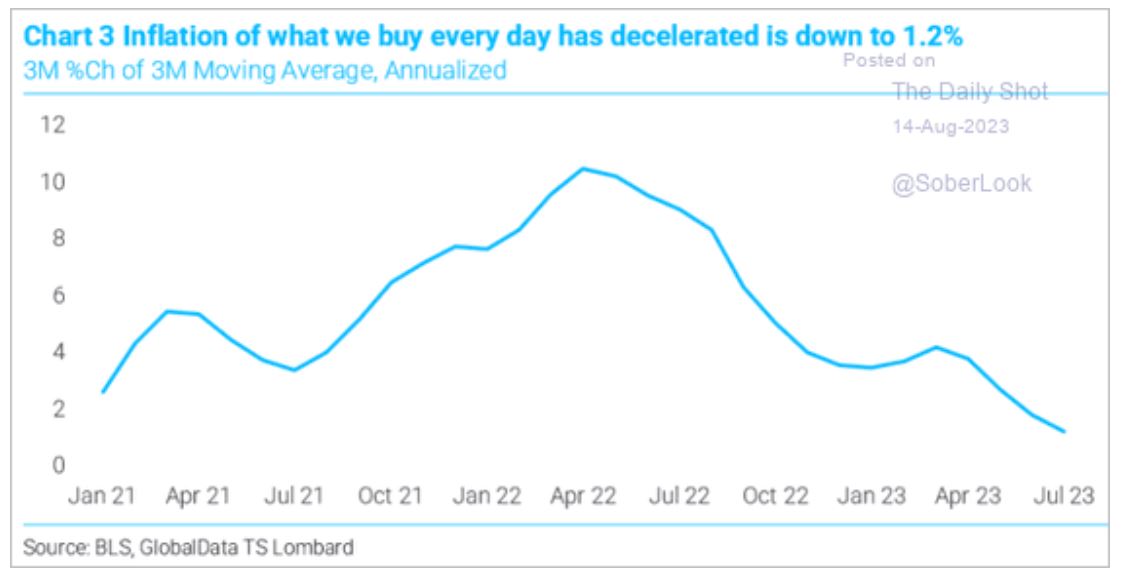

Inflation is still falling, although our indicators suggest that the pace of the fall is already slowing and that the eventual bottom, after first overshooting to the downside, will settle at around 3%-3.5% and not the Fed’s beloved 2%. I believe that the Federal Reserve will eventually embark on a program of re-training us to accept that “the new 2% is now 3% because it indicates a strong economy.” (Chart courtesy of The Daily Shot):

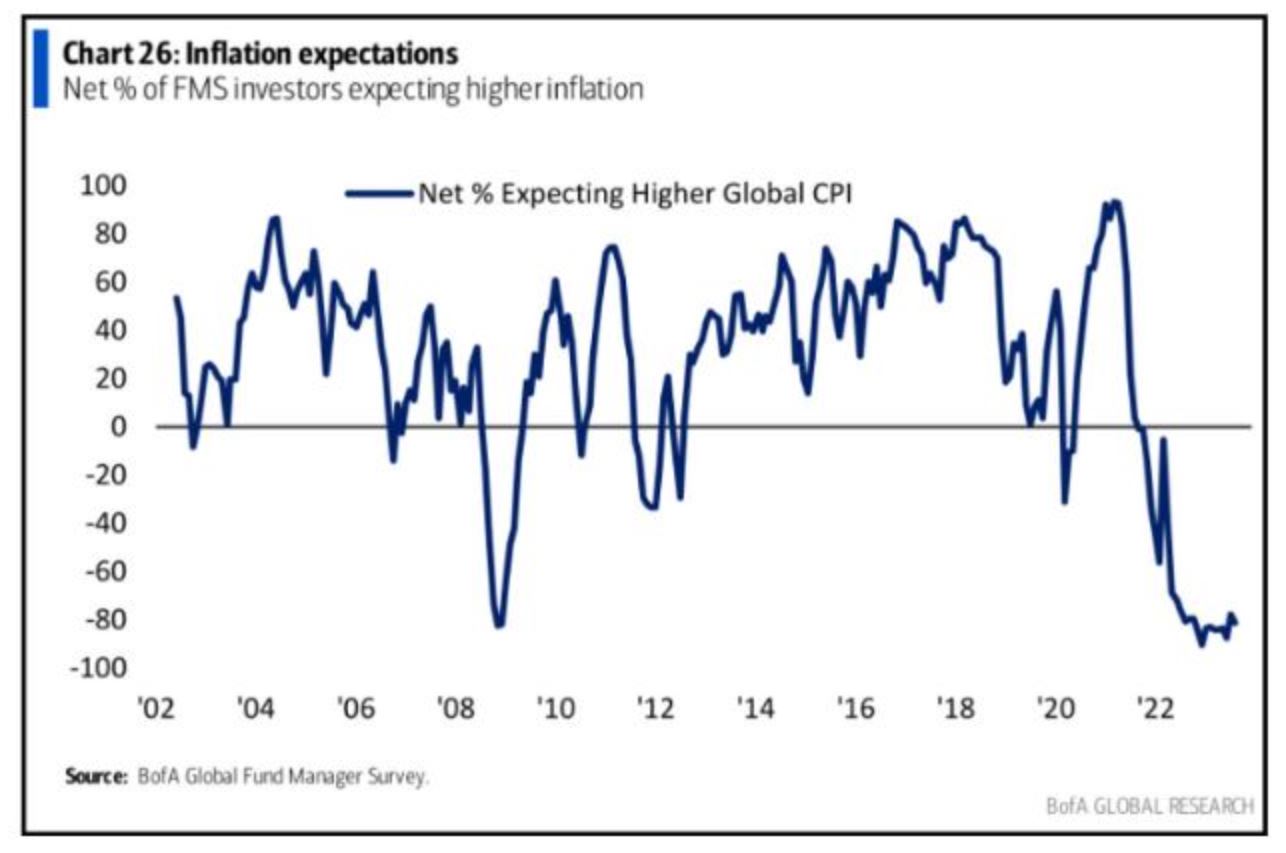

80% of professional investors believe that inflation will continue to move lower. (Chart courtesy of Bank of America Global Research):

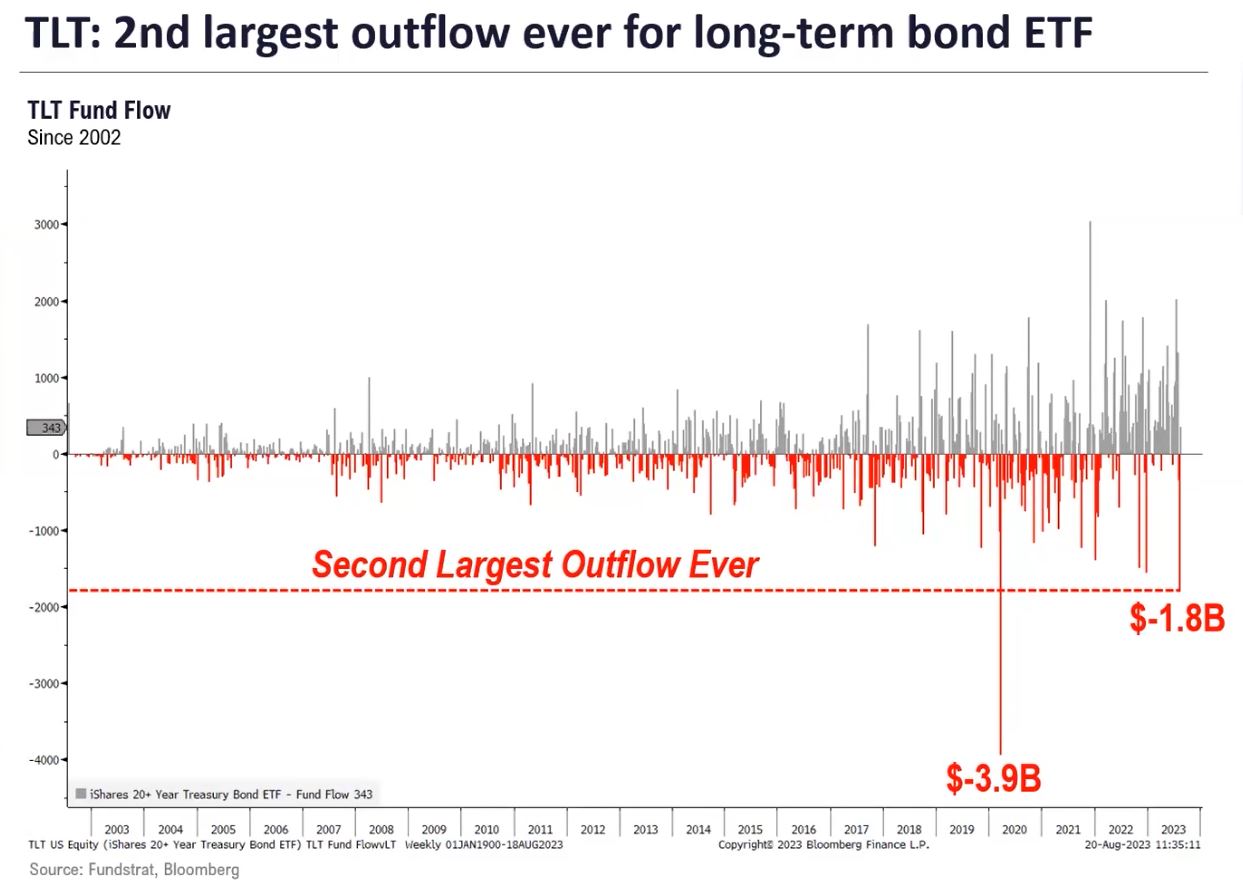

The Fed is at (or very near) the top of its rate increases. When rates stop going up, bonds stop going down since interest rates and bond prices move in opposite directions. There is a record ‘short’ position on both high-quality corporate bonds and on Treasury-bonds. A ‘short’ is a bet that bonds will fall. They are making a big mistake. When this short position unwinds, and this is not too far away, bonds may rapidly soar higher, like a dam breaking. But investors will have to pre-position into bonds to catch this move because it is likely to unwind quickly. Importantly, MarketCycle’s bond holdings are paying a whopping 19% interest because they write options; this is like a “free gift” that made me interested in bonds a bit sooner than I otherwise would have been.

Investors have given up on bonds and have now sold their ‘long’ positions. But these temporary & spiking bond sell-offs always preceed prolonged bond bull markets. (Chart from mid-August 2023 and courtesy of FundStrat Research):

The result of all of this bond selling is that bonds have never been this oversold as compared to stocks; bonds have nowhere to go but up. The higher the red dot (shown below), the more that bonds are oversold. (Chart courtesy of The Daily Shot):

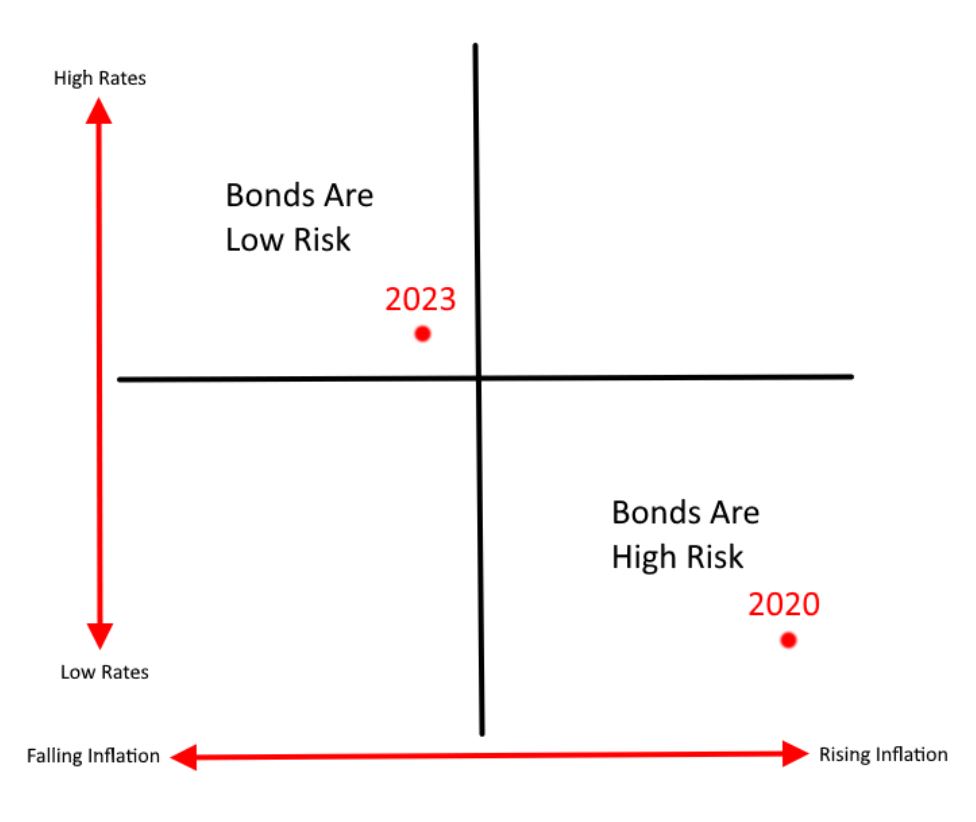

So, bonds are lower because rates are higher, they move in opposite directions. Rates were recently moving higher because people mistakenly believe that inflation will never normalize EVEN THOUGH IT ALREADY IS DOING SO!

This next graph is pure genius in its simplicity; bonds are now “low risk”:

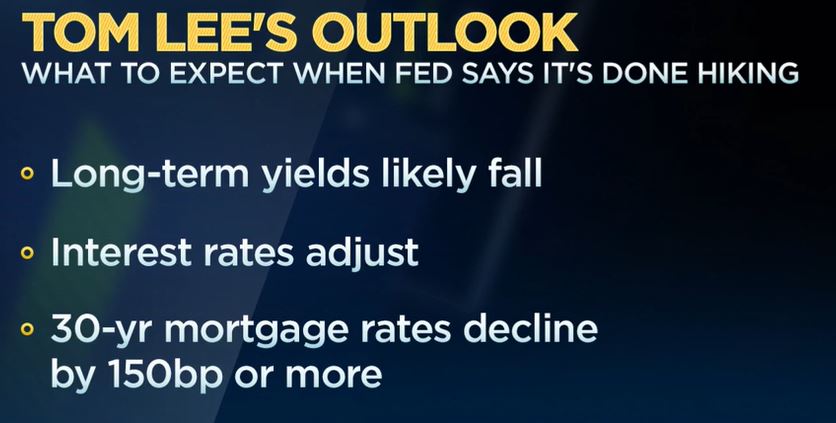

And recent advice from Tom Lee of Fundstrat Research, who believes that the Fed is already done hiking rates. He sees cheaper mortgages and profitatble bonds. (Snippet taken off of a CNBC video):

There is ‘income’ in fixed-income again. The unusual brutal year for bonds in 2022 likely won’t repeat itself any time soon.”

Liz Ann Sonders of Charles Schwab, on the podcast of The State of the Markets, August 16th, 2023

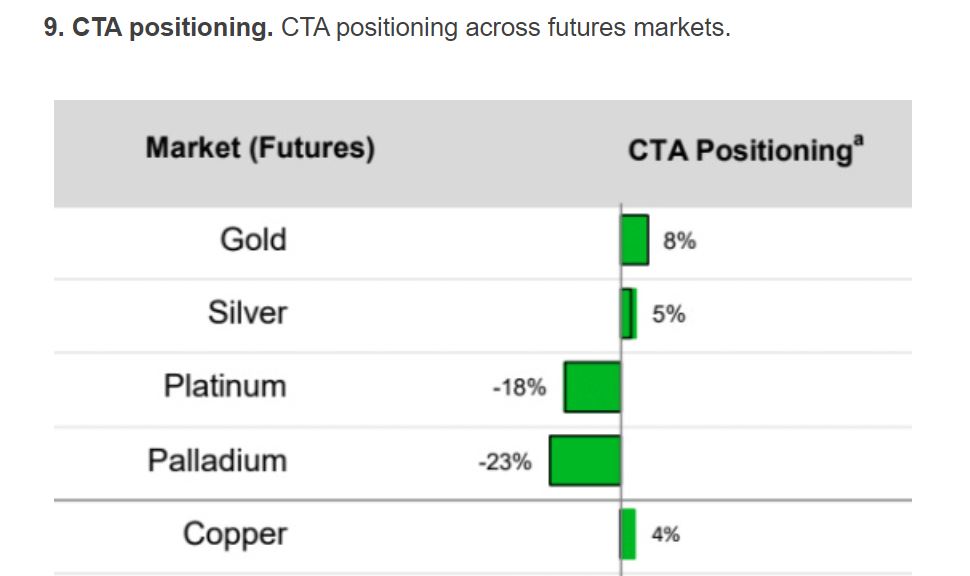

MarketCycle also believes that gold is about to enter a new bull market and, as with bonds, we apparently aren’t the only ones buying. On a long-term chart, Gold has formed a gigantic multi-year bullish cup & handle pattern; I expect gold to (gradually) reach truly astronomical levels by the late 2030’s. (Chart courtesy of the CTA):

So, where is the money coming from to prop up the economy?

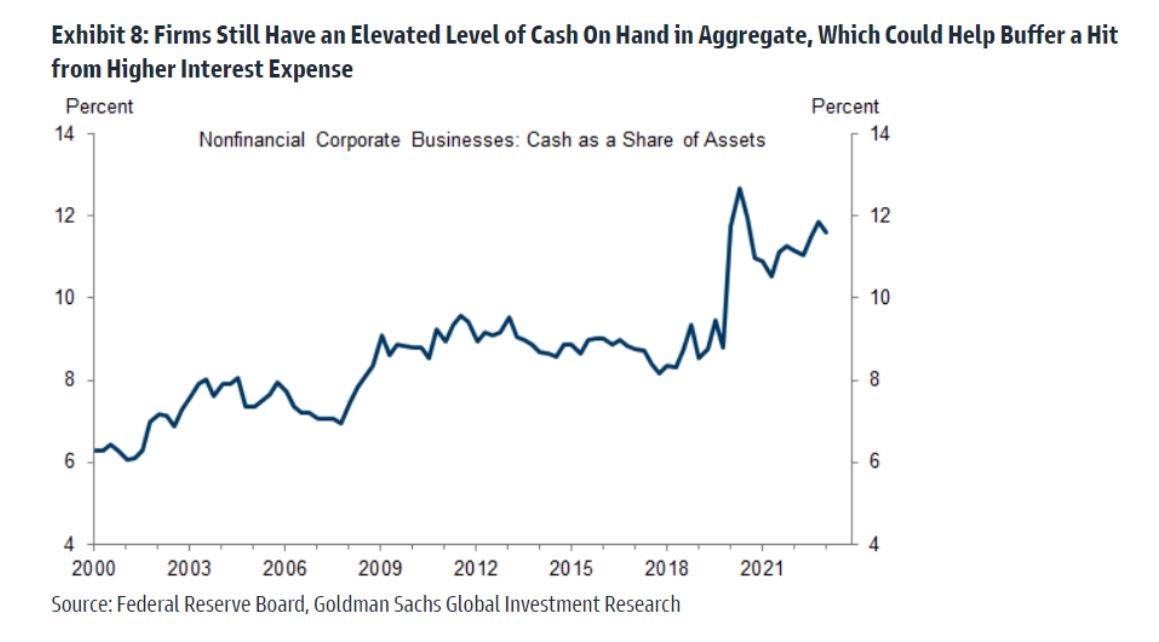

Corporations are loaded with money. (Chart courtesy of Goldman Sachs):

If you own stocks, you own a portion of the corporation that issues the stock. If you own a stock “share” from Apple Corporation, then you own (and receive) a “share” of the profits of Apple Corporation. A stock “share” is an amazing thing, it is not a gamble, it is a “share” of profits, it is a piece of the action, it is amazing!

Profits make corporations strong. Corporate profits are currently very high. Strong corporations make strong and bullish stock markets.

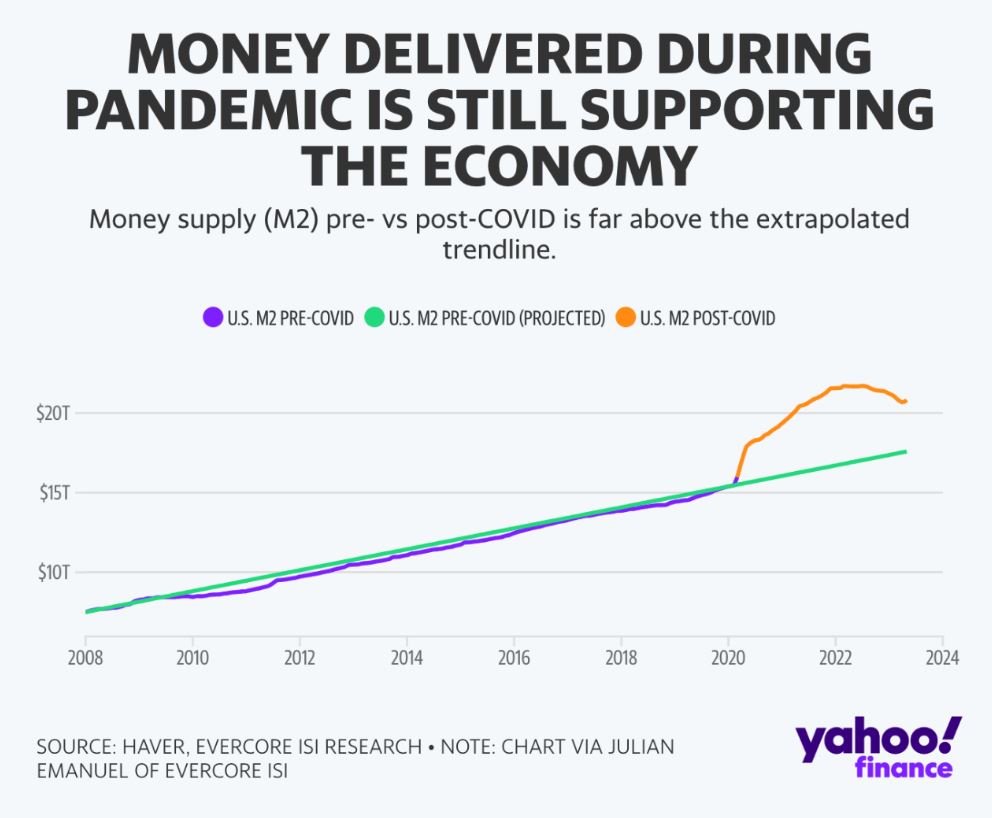

The government has been handing out money like there is no tomorrow! This loose money will help to prop up the U.S. economy for an extended period. (Chart courtesy of Yahoo Finance):

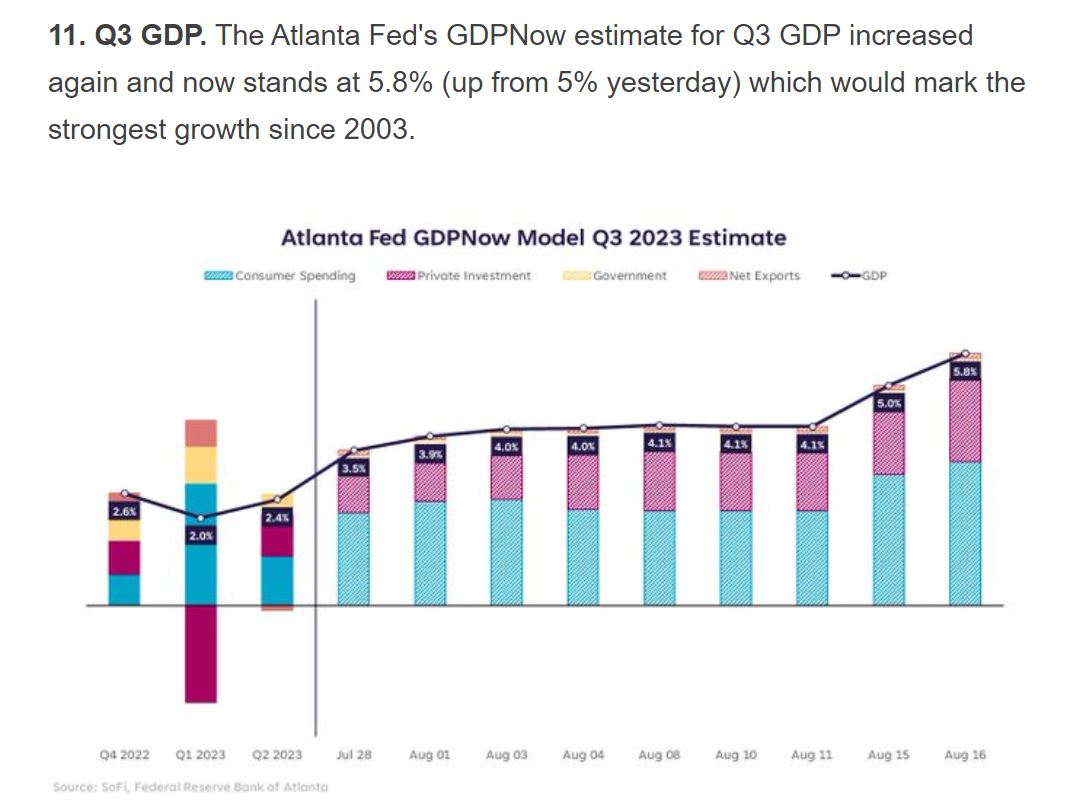

U.S. Gross Domestic Product (GDP), what the economy produces, is STRONG. (Chart courtesy of the Federal Reserve):

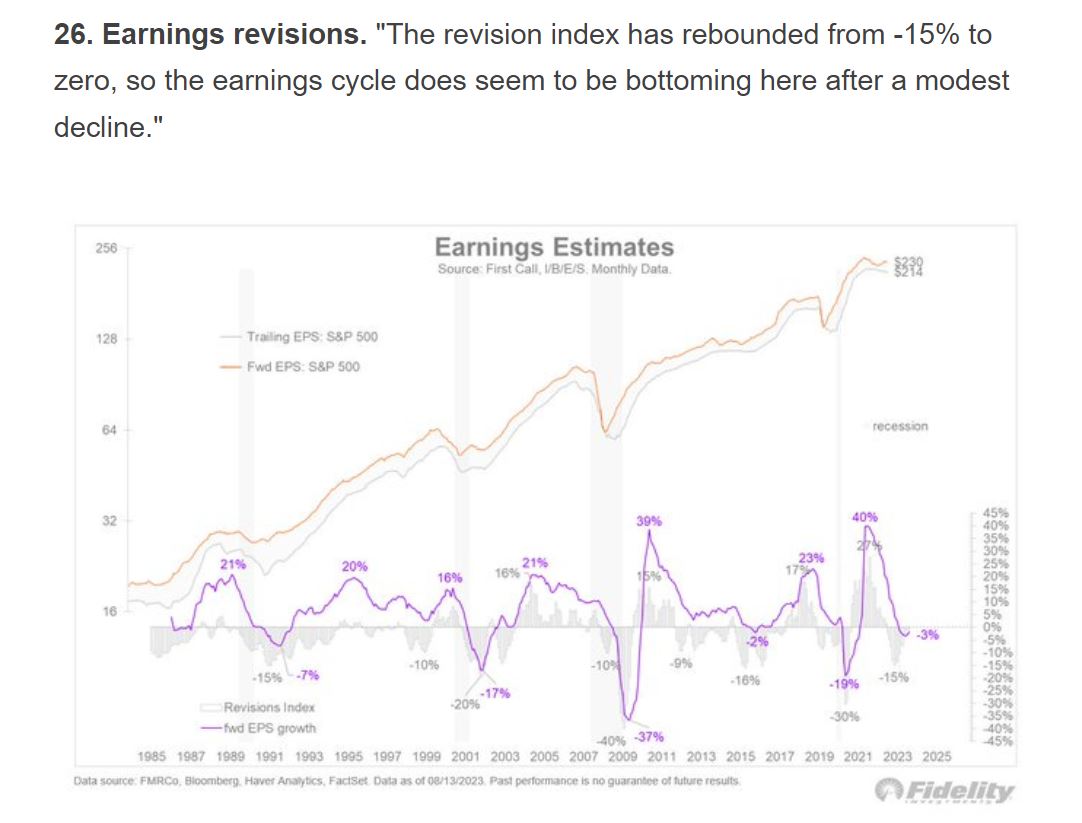

Corporate earnings have apparently bottomed and are turning BULLISH. Corporate earnings directly determine the direction of the stock market. (Chart courtesy of Fidelity Research):

Eight men hold as much wealth as 3.6-BILLION other people.”

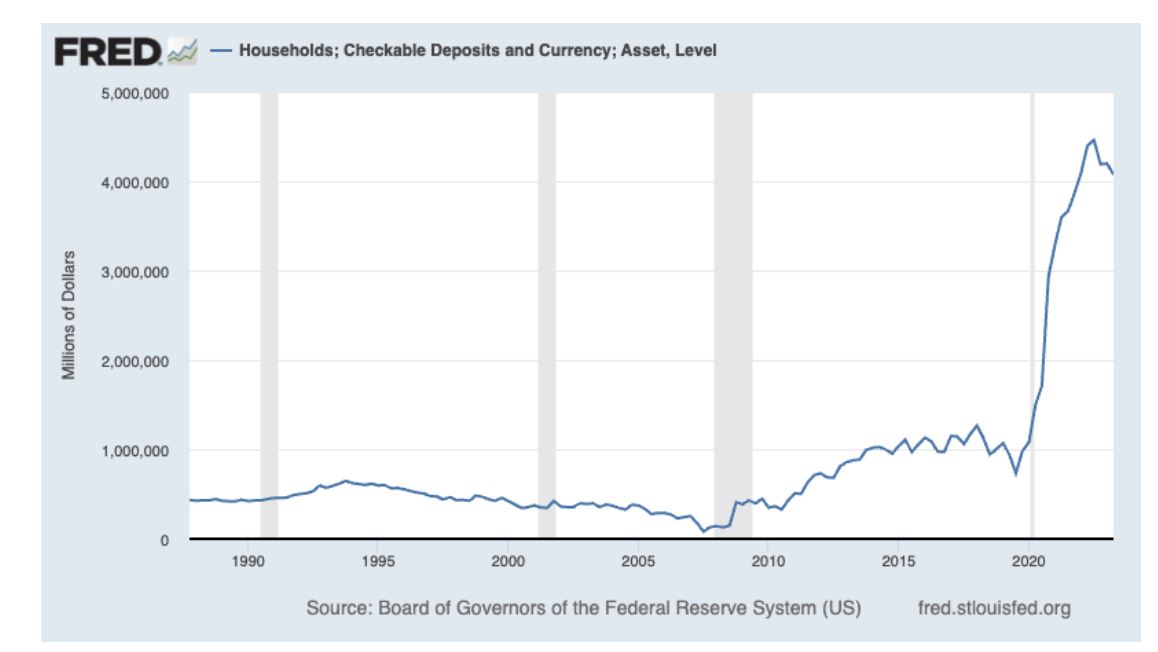

Individual households have unusually strong balance sheets; they are sitting on a lot of cash that is going to eventually find its way into the stock and bond markets, steadily driving profits higher. (Chart courtesy of the Federal Reserve):

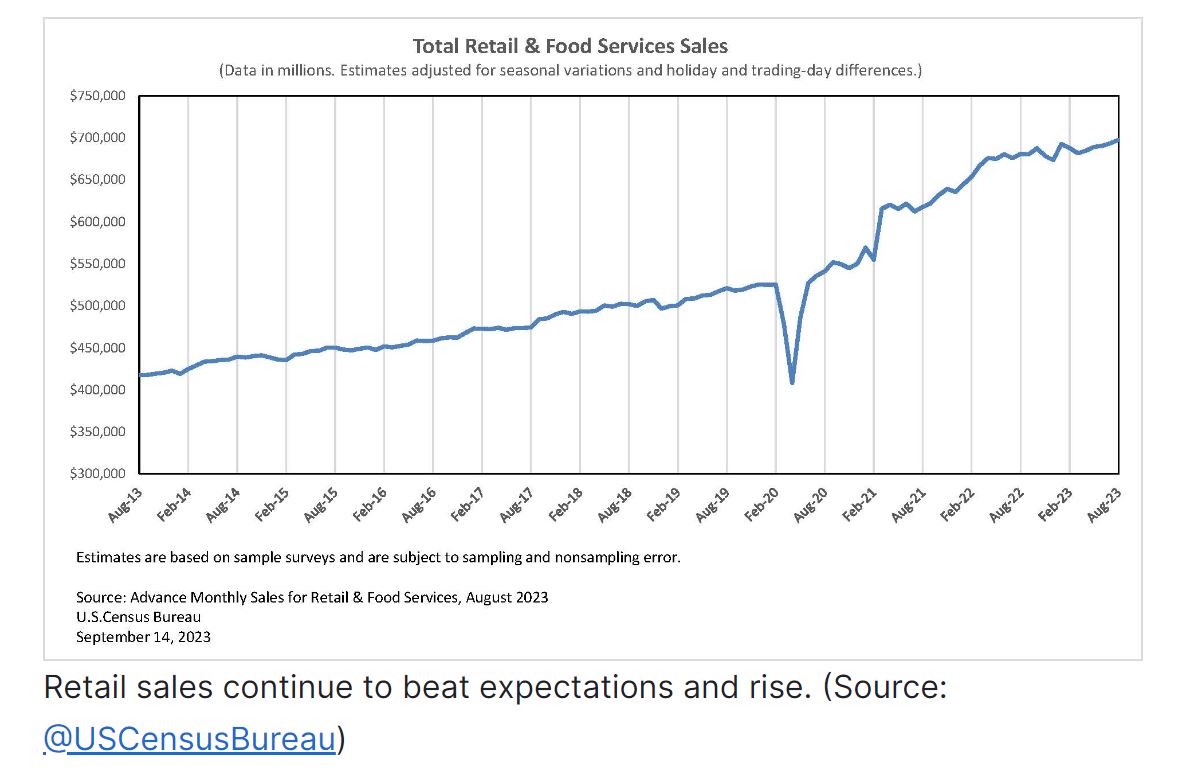

And consumers keep spending and this keeps the economy strong. (Chart courtesy of the Census Bureau):

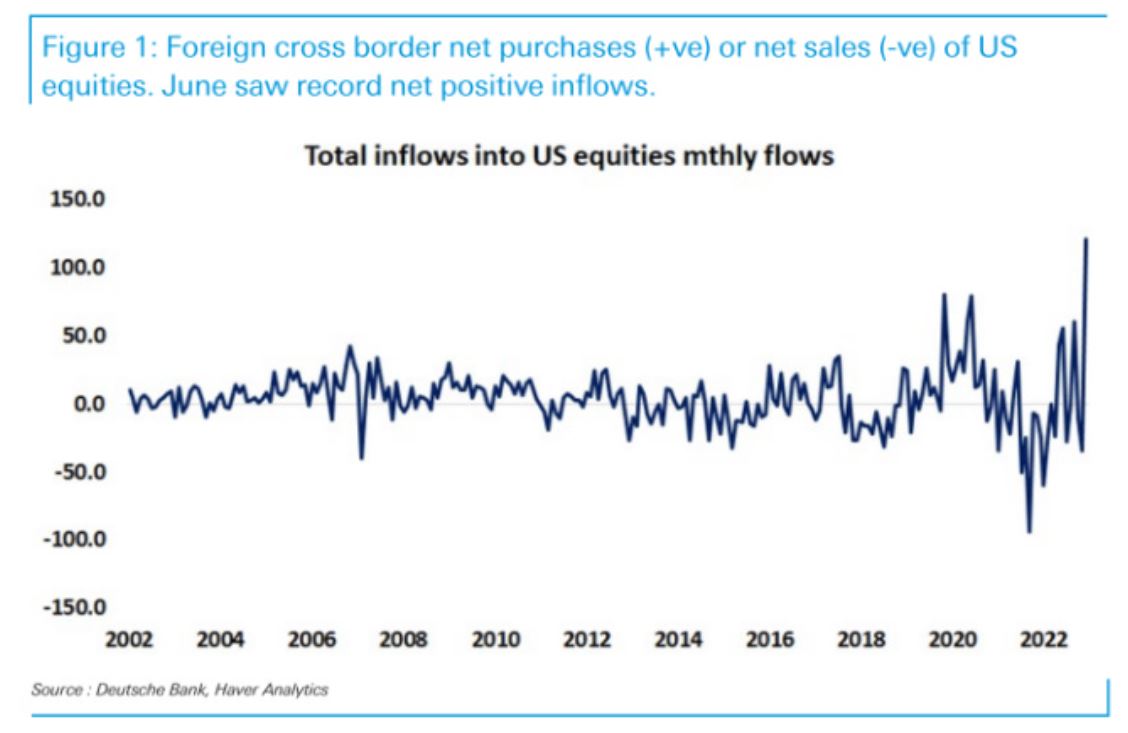

Money from all over the globe is flowing into the U.S. economy and markets. (Chart courtesy of Haver Analytics):

SUMMARY: BULLISH

Near-term headwinds that MarketCycle is watching:

- Resumption of student loan payments (although past payments were not considered headwinds)

- Possible temporary Federal Government shutdown if funding not approved before October (but this will be worked out)

- Reduced auto production and manufacturing if the UAW strike continues for a longer period (but this will eventually be worked out)

August and September are often weak months for the stock market and that has certainly proved to be true this year. We may have another week of turbulance, and in fact the market might be down again during the week of Sept 18-22, and then we have a good chance of moving higher with a year end target (or beginning of next year) of 4800. We must be patient.

The S&P-500 long-tern chart shows a continuation of the secular bull market, as the third leg higher begins in earnest:

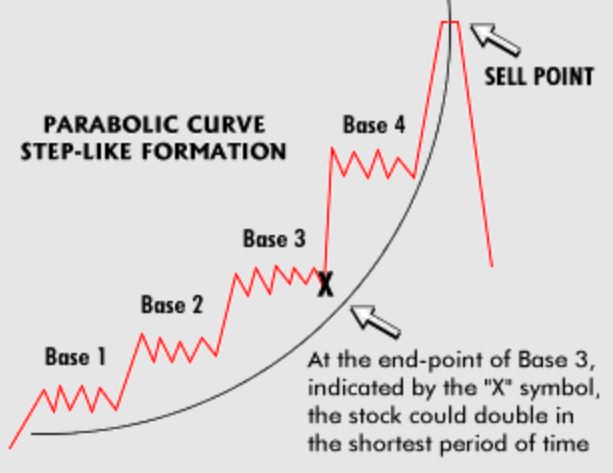

I’m excited about oversold assets such as pure-value stocks, quality small-caps, high-beta large-cap stocks, select sectors of stocks, convertible bonds, high-quality corporate bonds, long-dated Treasury-bonds, gold-bullion, etc. We have to remember that we are still in a SECULAR bull market, so the tendency is going to be for the markets to grind higher over time. The strongest portion of this Secular bull market is likely to be in the final years of 2024-2029, where stocks may eventually go up parabolically, especially in its final years.

PARABOLIC: We are likely now at the “X” on this next chart. In my opinion, 2029 is the likely Secular bull market end point with a big gain in the works and with dividends and income further increasing the final absolute return. My advice is to let every penny ride along… and just be patient.

Outstanding investors are patient. The stock market is a device for transferring money from the impatient to the patient. Time and compounding are two of the most powerful forces in markets and in your portfolio.”

Warren Buffett

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters… give us a chance!! There is a contact tab at the top of our website.

Our paid member’s REPORT site can be reached via the connecting link on our webpage.