MarketCycle Wealth Management

“The market is behaving pretty delusionally.” Amanda Agati, Chief Investment Officer at PNC Financial Services Asset Management Group, June 16, 2023

Of course, “delusionally” means “incorrectly or falsely.” The above statement actually means that the market is not doing what PNC Financial Services believes it should be doing. Many others are in the same boat. But it is a pretty reasonable bet that the market is, in fact, never wrong. All information is instantly priced into the market; it knows everything long before you do. It has no opinions or emotional or psychological biases. It has no ego. It has no goal. It just prices in all information instantly and it projects the trend of this information out into the future by about 6-9 months. Today, right now, it is saying what all of the current information is suggesting will be happening in the intermediate-term future. The market is very smart; the market is never wrong; the market is currently bullish.

One of the most important things that MarketCycle has developed is the ability to fairly correctly project current data trends out into the future. Our goal was to copy what the market itself was doing because the market is never wrong. This was an important discovery. This is how we knew, for example, that an inflation spike had begun way back in the early Spring of 2020, but the Federal Reserve didn’t pick up on it until 2022, over two years later. If the Fed had raised rates by even a small amount back in 2020, then the bear market of 2022 may have been a trifling three month affair.

The stock market has been doing great; up for five weeks in a row. Generally up since October of 2022, as we predicted, although it has rolled sideways for much of that time. In my opinion, this sideways period was actually a rolling type of recession where the market slowly worked off its problems over a period of months. I only saw this in hindsight.

And now? Our select assets, all picked for their normal prowess during the (multi-year) first half of any new stock bull market cycle, are suddenly doing quite well. One has to pre-position and then wait patiently. There is an old Wall Street saying: “What a wise person does at the beginning, a fool does at the end.”

And right now?? On a near-term basis, the stock market is temporarily overbought. I expect a fairly brief and shallow pullback to arrive shortly, followed by another leg up. In my opinion, all pullbacks will be opportunities to put new money to work, BUT the financial press/shows (like CNBC and Bloomberg) will bring on guests that will re-state that the world is “about to end.”

It is possible that between now and the end of this year there may be two more big legs UP with shallow pullbacks between each one.

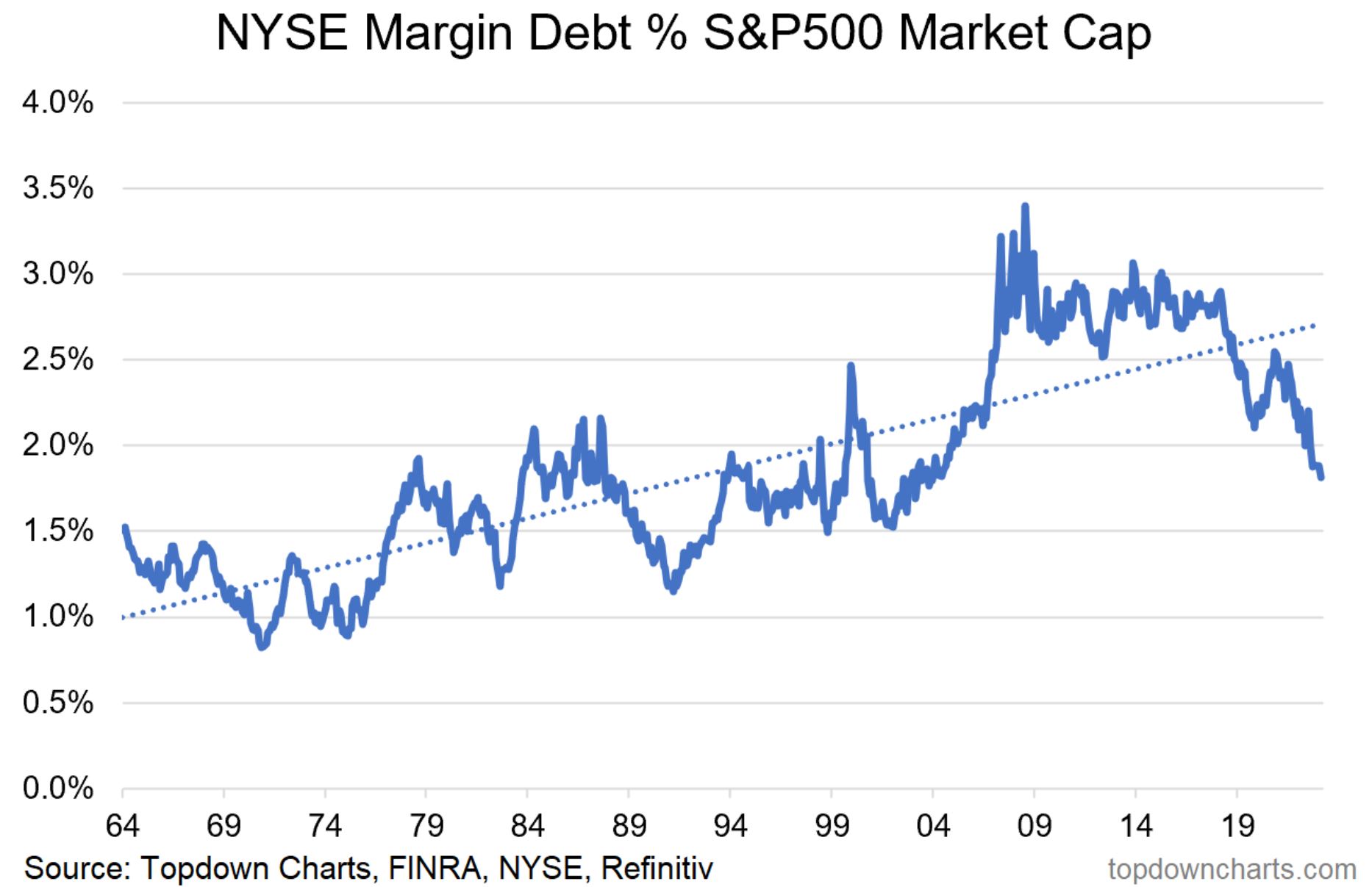

There is tons of money still sitting on the sidelines, afraid to move into the markets and “margin” (money borrowed to put into investment accounts) is still historically quite low. This represents the potential for a steady “feed” of money into the markets, and as FOMO (fear of mssing out) builds, the market could get quite excited.

Margin is still very low and this is very bullish going forward:

I could be wrong, but I now believe that the market naturally wants to touch the prior all time highs, S&P-500 to 4800, by the end of this year (or very early next year). At that point we could get a somewhat larger multi-week pullback before even more gains arrive. 4800 may be the highest end-of-year projection on Wall Street. As of last week, Tom Lee of Fundstrat Institutional Research has also upped his 2023 target to 4800. Ed Yardeni (of Yardeni Research) is just acknowledging the exact same 4800 target.

I definitely still believe that we will easily see the S&P-500 at 10,000 in only a few years from now.

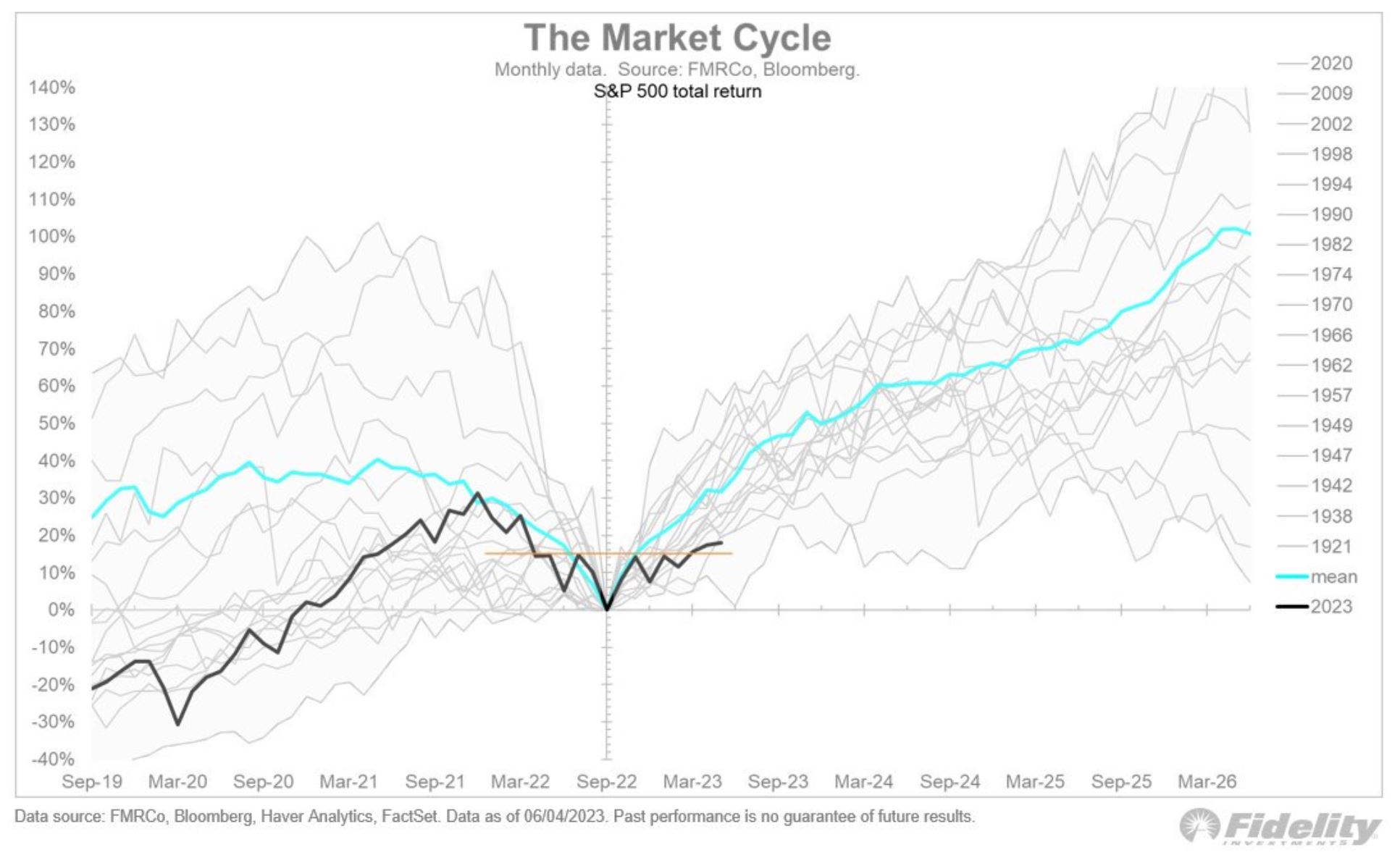

On the below chart from Fidelity Research (and Bloomberg), they believe that the current stock market (shown via the black line) will follow the pattern of the light blue line higher; they see accounts DOUBLING over the next three years (sort of a 33% gain per year). MarketCycle sees today as “just the start” of the current new cyclical bull market that likely ends in roughly 6 years, the strongest period normally being near the end of the bull market (sort of a repeat of the prior tech bubble in 1999).

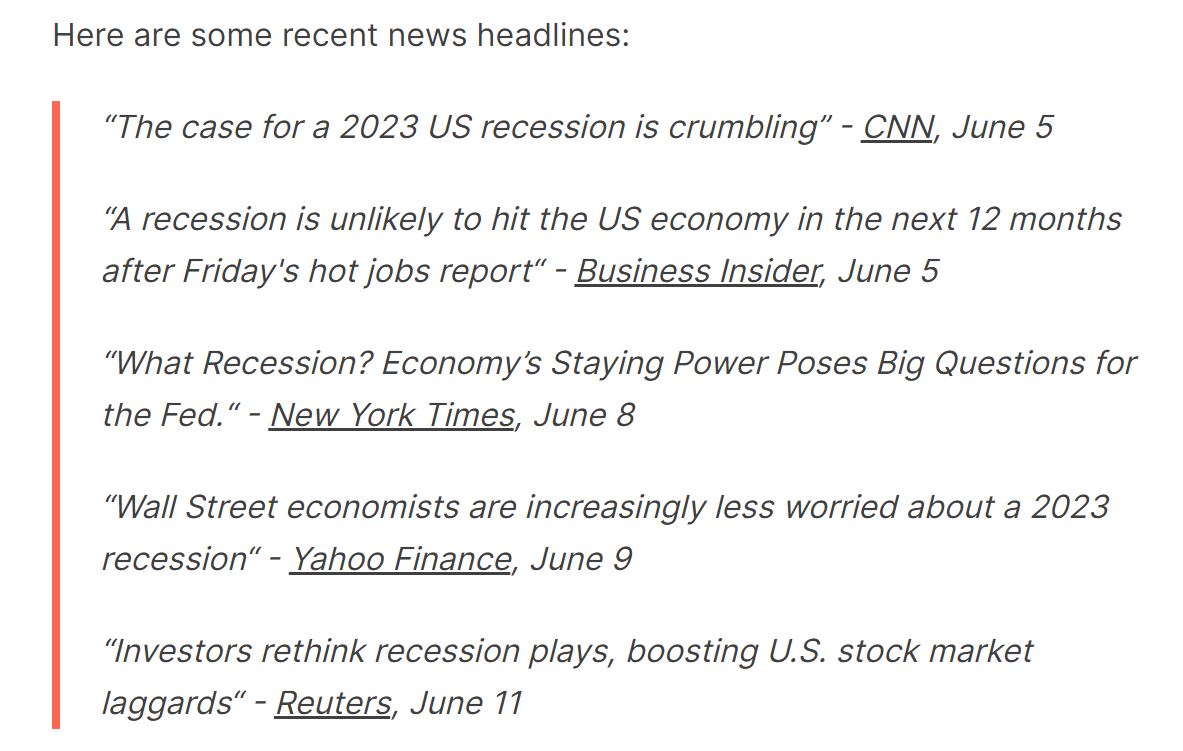

Recession? I’m about the only human that feels that it already arrived (and that it has now ended) in the very unusual form of a rolling recession:

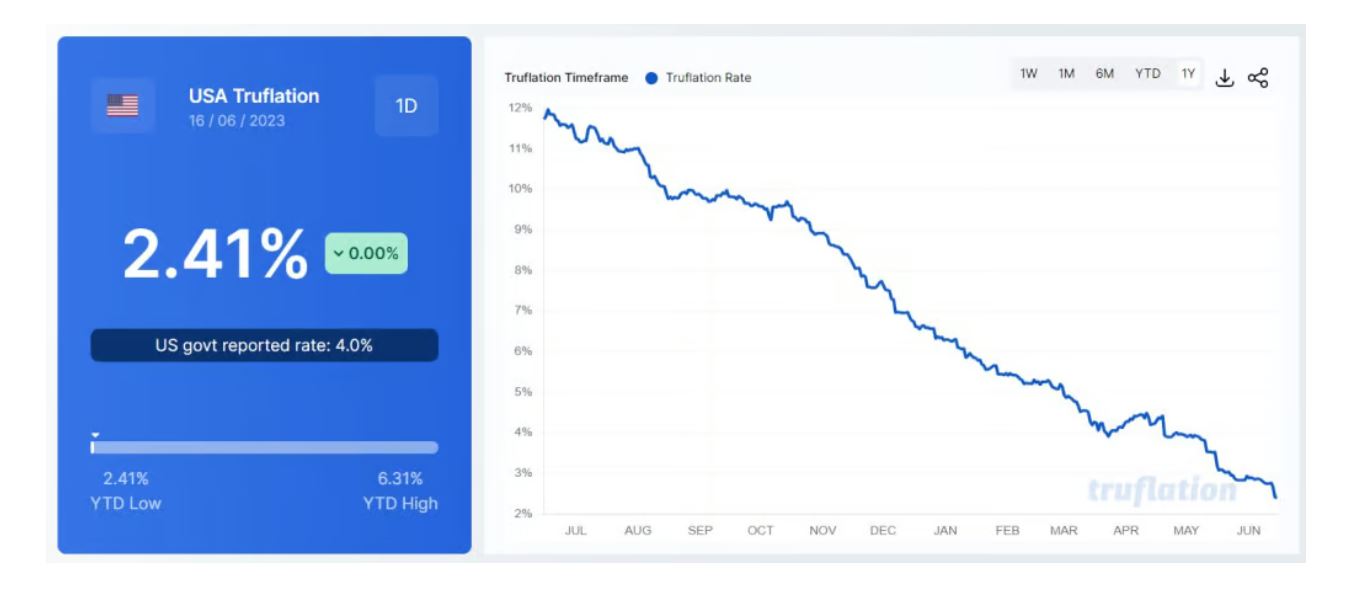

Inflation? Our system of proprietary indicators has been showing inflation falling for a year now. This is a good thing. When I said that inflation was a spike that had peaked and that it would go down, a number of people told me that I was wrong and that it had reached a new permanent high plateau. Oh, well. My continued prediction is that inflation won’t be a real problem until the 2030’s.

For what it’s worth, a chart from Truflation showing the PPI for Personal Consumption @ a very low 2.41% (I also confirmed this via the Bureau of Economic Analysis). Just one year ago it was at 12%.

Gross Domestic Product (GDP)? Strong.

Employment? Strong.

Earnings? Strong

The United States is still leading in relative strength. Europe and Japan are fairly strong. China can’t seem to be able to get out of its own way.

Gold bullion and fixed-rate bonds (and possibly Bitcoin) may all be at the early beginnings of their own cyclical bull markets.

Two years ago MarketCycle wrote a blog on artificial intelligence (AI) and robotics. We suggested that AI and robotics would be the upcoming stock market theme for the final 5 years of this secular bull market. In fact, both AI and robotics will increase corporate profit margins by such a significant factor, that stocks will have no other choice but to go higher (much higher) until this secular bull market eventually reaches its demise.

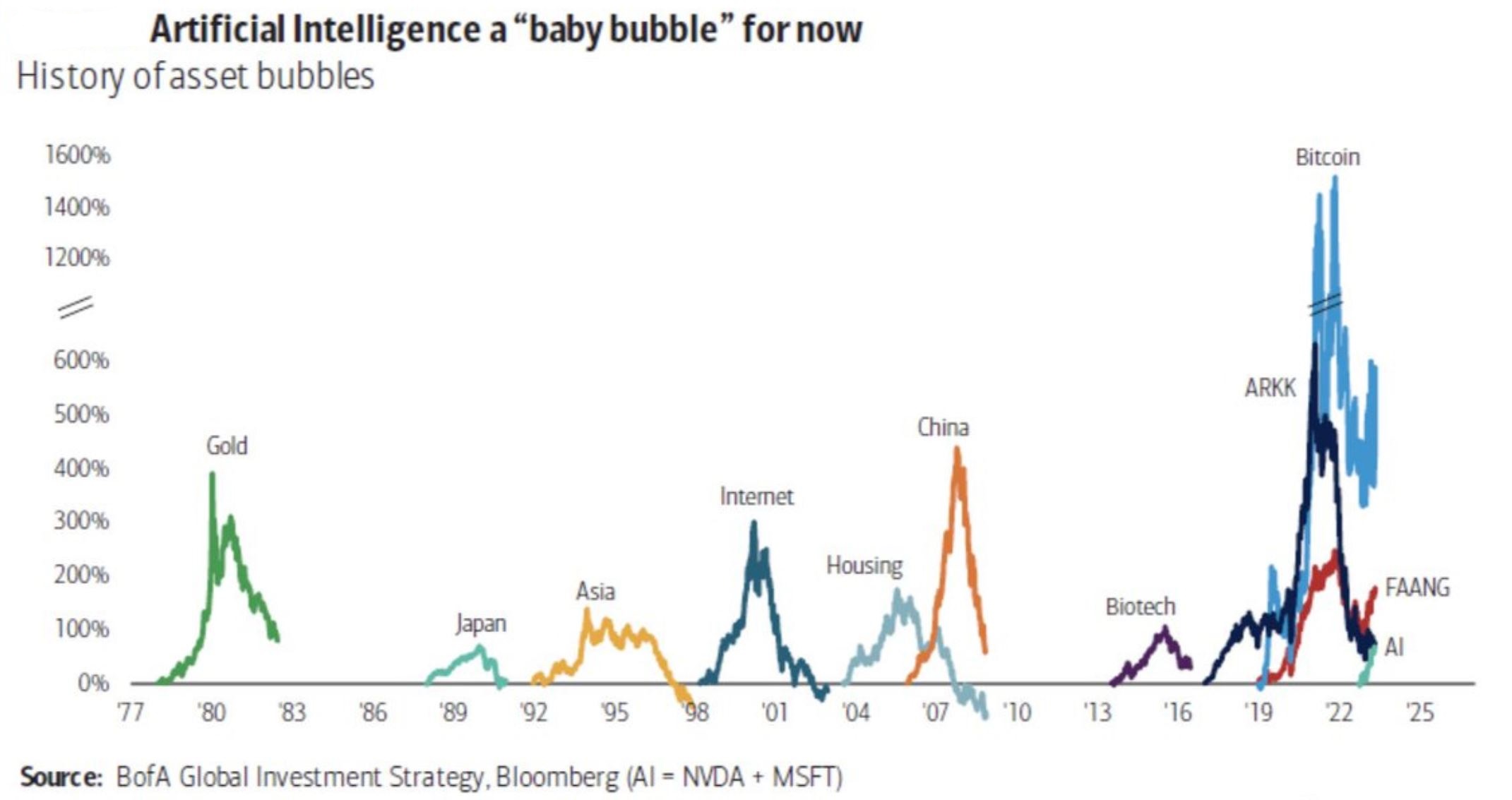

The AI “bubble” (far right, tiny green ‘AI’ line below) that people are talking about is just in its infancy… it has a very long way yet to run:

So, as always, I’ve been pushing against the wall of market participant’s beliefs ever since October of 2022. I’ve been bullish and I’m still bullish… but I’m willing to change my mind. I’ll worry about risk when our proprietary array of risk indicators start to show that risk is rising… and that most certainly is NOT happening right now.

Thanks for reading!

This posting was written on Sunday June 18, 2023

Our paid member’s REPORT site can be reached via the connecting website link.

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. There is a “contact” tab on the website. It’s easy! And advice is always free to anyone.