MarketCycle Wealth Management

GOLD shines…

Gold bullion is a protective asset that can shine in both stock bull and bear markets. Gold tends to run in long bullish trends of up to 10 years where it then consolidates sideways for another 10-ish years while it patiently awaits its turn to shine again. Now may be the time for gold to shine.

Gold moves higher whenever:

- inflation is higher than normal

- when we are about to enter a dis-inflationary period

- when the Federal Reserve is finished with a major rate increase period

- when people are losing faith in the long-term safety of banks

- when people are losing faith in the USDollar

- when the economy appears to be ripe for an economic recession or a lower Gross Domestic Product (GDP) rate.

That is all happening right now.

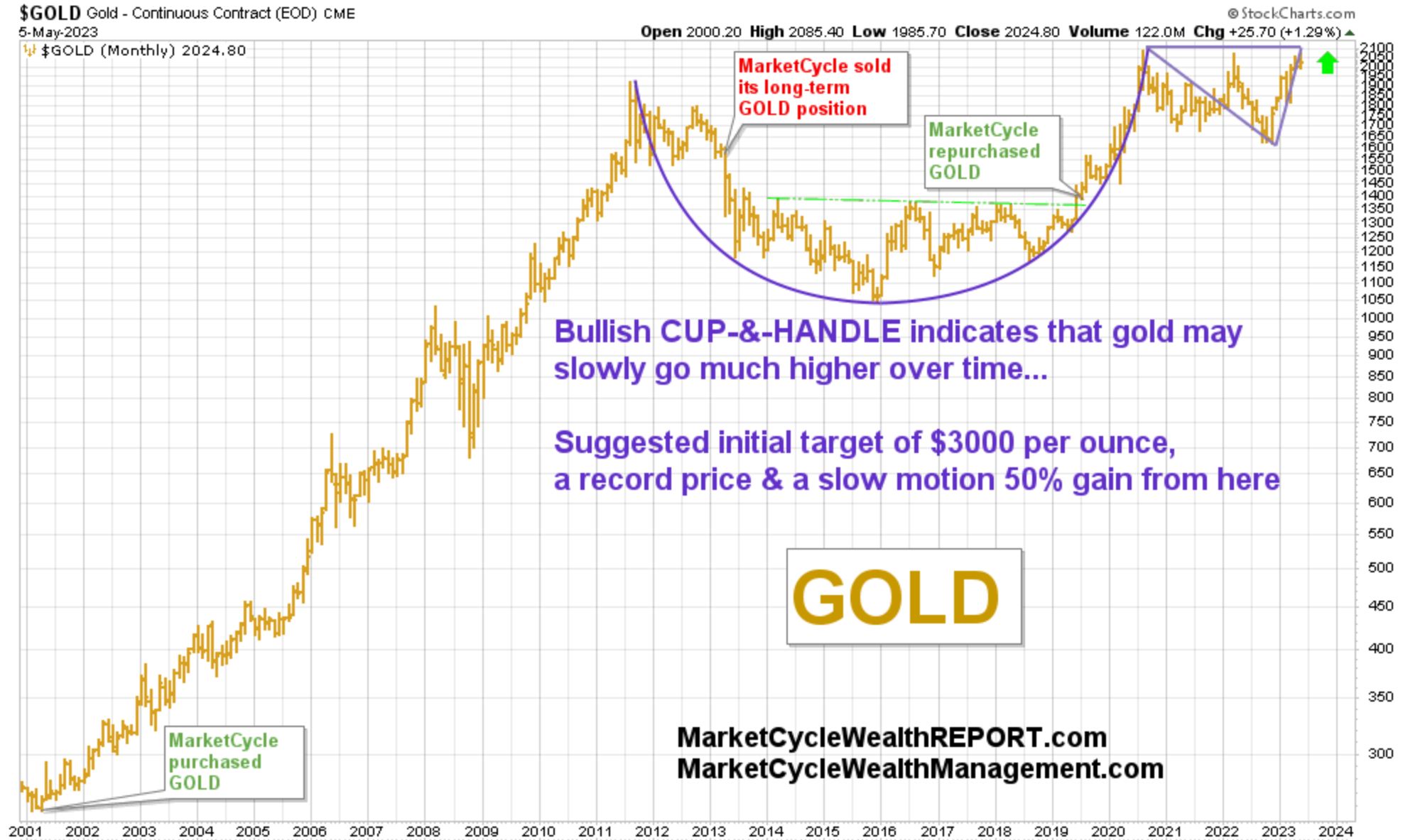

Technical Analysis practitioners look for patterns in the charts that suggest future price changes in an asset based on historical precedent. A Cup-and-Handle is one such pattern and it suggests, on a monthly chart as shown below, a potential MAJOR move higher in an asset price (and especially when the pattern is seen on a multi-decade chart). There are many millions of global investors & traders that rely on technical analysis in their decision making and when they finally see the gold chart pattern shown further down below (when they eventually look at a decade long chart of gold) then they will likely stampede in mass… a running of the bulls.

SAMPLE Cup-and-Handle chart pattern:

In my opinion, the current chart pattern for gold (below) suggests a move higher with an initial consolidation stop @ $3000 per ounce; this would be a major bullish move, especially for a protective asset (often, if stocks drop, then gold goes up).

MarketCycle’s client accounts have been holding a 7-8% position in gold bullion, coins physically held in the vaults at the Canadian Mint. We may soon up the allocation to 10% since this is a long-term high conviction holding.

Below is a 22 year long chart of the price of gold. I originally bought at $200 per ounce back in 2001… sold at $1650 in early 2013 (for a giant profit) and we repurchased again in 2019.

That’s it… thanks for reading!

And just in case anyone cares, no I didn’t block you. Awhile back I deactivated my social media accounts (including for posting my blog); it was like pulling a splinter out of my brain… nothing but relief. After deletion, I happened to read the book: Stolen Focus, by Johann Hari. This is an incredibly important book, specifically chapters 1-7 (you can skip the rest). Johann Hari explains exactly how and why, all in the name of promoting their advertisers, social media has been purposely designed to agitate & addict and to send you “down the rabbit hole.”

MarketCycle Wealth Management is in the business of navigating your investment portfolio through rough waters. Let us help you… it is easy to do! This current Secular bull market for stocks isn’t anywhere near completion.

The paid-subscription REPORT site can be reached via the connecting link on this website.

MARKET CYCLE — TREND FOLLOWING — RELATIVE STRENGTH — HEDGE FUNDS