MarketCycle Wealth Management

Okay, if you can’t read a long blog and if you have 3-4 free minutes, then this one’s for you.

A market cycle is a (roughly) seven year long period that contains a multi-year bull market followed by a 3-18 month correction of a stock market that has gone too high; this is also known as a bear market. Once completed, the cycle repeats all over again.

Investors can make money in both directions, bull or bear.

There are secular (roughly 20 year long) bullish factors that can cause especially strong stock performance. They are caused by long-lasting market conditions, like relatively low inflation or by the market reaching ridiculously low valuations. We are currently in a secular bull market for stocks and I expect this strength to continue until some time around 2029 (2009 to 2029 = 20 years). In 2029 an entire confluence of economic and demographic factors hit a brick wall.

In a 20 year SECULAR BULL (2009-2029?): Stock bull markets are strong and long lasting and all bear markets are weak and short lived.

In the 10 year SECULAR BEAR that always follows the bull (2029-2039?): Stock bull markets will be shorter (rolling like a roller coaster) and all bear markets will be stronger and long lasting but they can be very profitable if one is positioned correctly (as in 2000-2009).

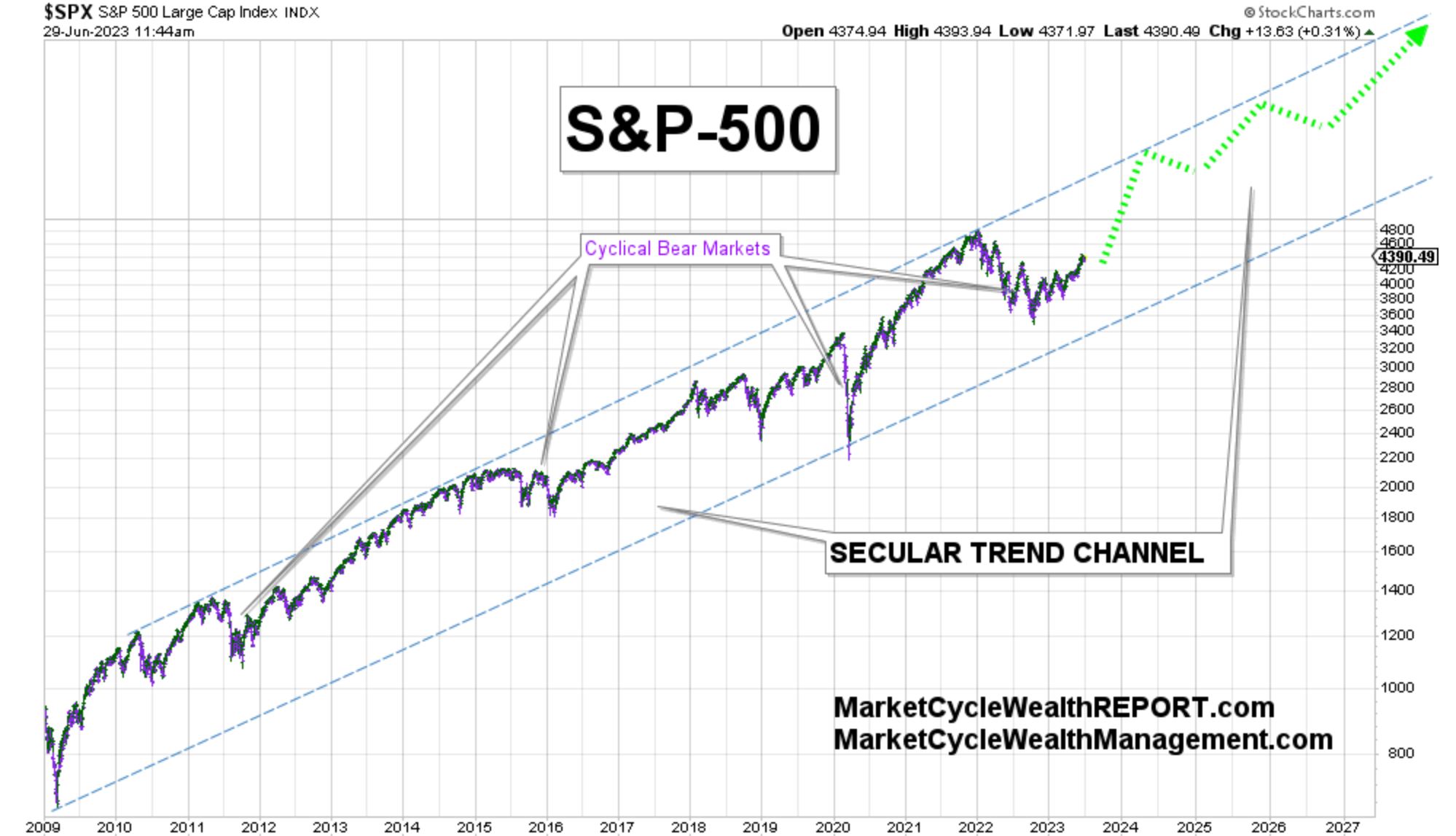

The below chart shows the multiple cyclical bull and bear markets contained within the current 20 year long secular trend-channel that will likely reach its completion in 2029. The stock market has much higher to go. My low-end target is S&P-500 to 10,000 by 2029. It likely goes higher than that and at the very end, it might melt up, moving rapidly above its trend channel just as it did in 1999:

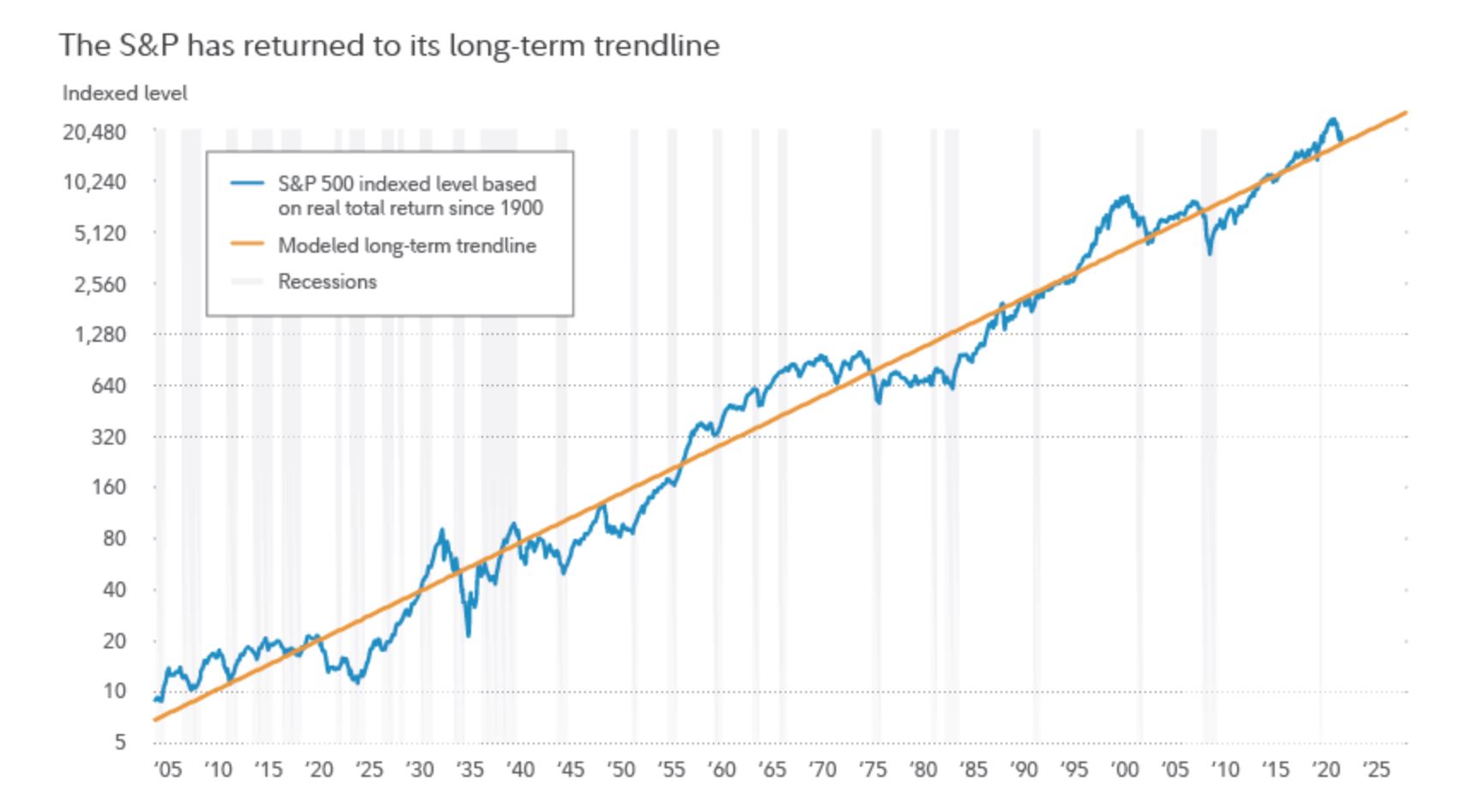

This is a chart of the S&P-500 that looks similar to the chart above, but it runs from the year 1900 to today which is 123 years. Even the interspersed secular bear markets don’t look very troubling. The profit line goes from lower left to upper right. Investing is not gambling, profits are skewed toward the investor, risk is lower than people think and patience is the investor’s friend.

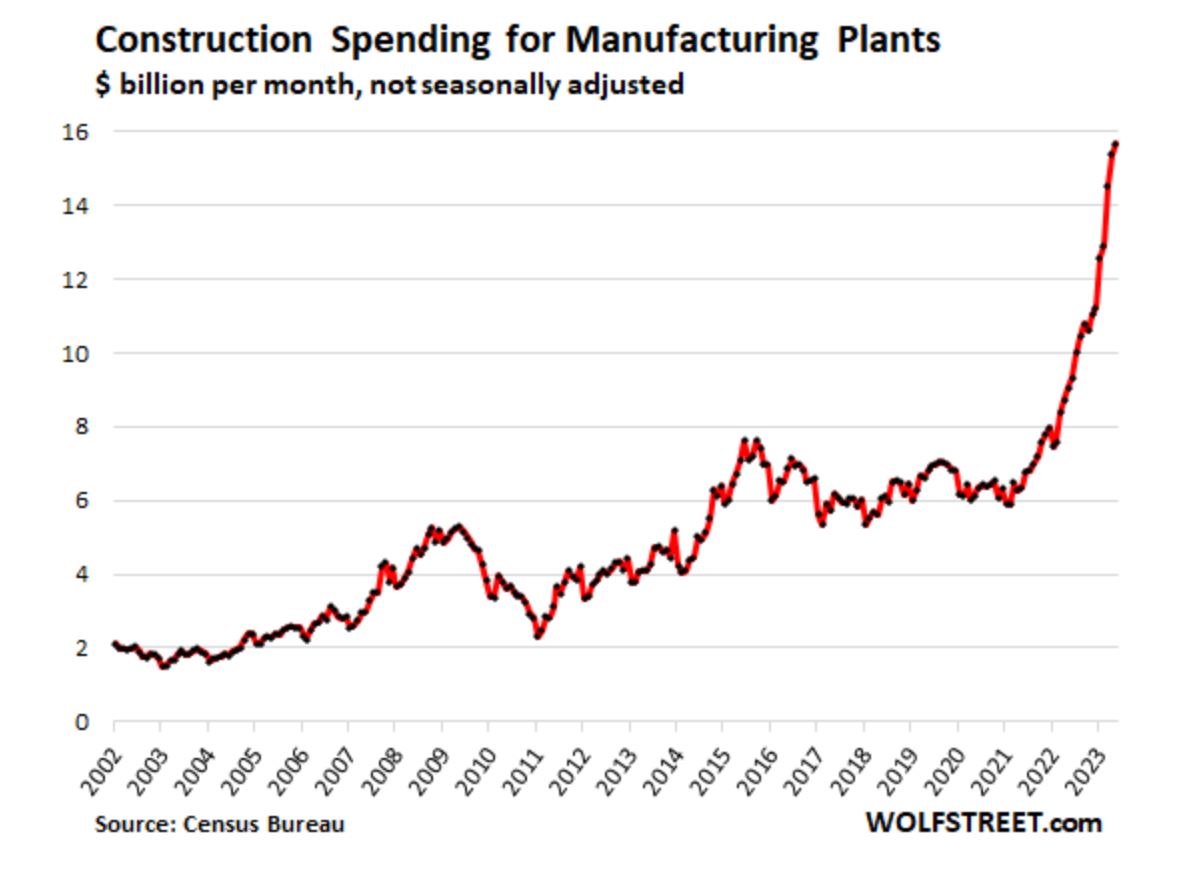

And, as has been steadily happening since 2011, all strength is with the United States economy and markets. The U.S. leads the world in technology development; AI and robotics will lead the U.S. forward and this, along with clean energy, will be the secular themes for the remainder of this secular cycle. Demographics are STRONGLY skewed toward the U.S. until 2029 and manufacturing is rapidly coming BACK to the United States as China falls from grace. This chart is one of the most powerful that I’ve see in some time. It shows what is happening in U.S. manufacturing and it is shown in “$-billions per month.” This is not a weak economy.

MarketCycle Wealth Management currently has its client accounts positioned into those specific assets that perform well during the first few years of a new cyclical bull market (plus we continually “buy-and-hold” an equal amount of low-risk core holdings). These strong early-stage assets are just now beginning to accelerate, so it isn’t too late for investors to jump in.

We constantly monitor risk levels, which we are extremely good at, and we would quickly move to protect client accounts if economic (recession?) or market conditions begin to deteriorate.

Current strength is seen in very specific early-stage stock sectors & factors & regions (that do well during the first half of any new bull market), fixed-rate quality bonds, preferred shares, gold bullion and even Bitcoin (which should only be held in a tiny allocation).

Current weakness is seen in the USDollar (it is moving sideways), most emerging market stocks (but India is strong), most commodities and corresponding stocks, utility stocks, consumer staples stocks, floating-rate bonds and low-quality bonds.

SUMMARY: MarketCycle correctly turned bullish in late October of 2022 in a world where most professional and retail investors have (finally) turned sort-of-bullish during the past couple of months.

That’s it! Thanks for reading.

MarketCycle Wealth Management is in the business of navigating your investment account through the market cycles. The process is simple. We work hard to protect accounts during high risk periods and we work hard to earn our keep.

The paid member’s REPORT site can be reached via the link on this webpage.