MarketCycle Wealth Management

Three Legs Down and Bottoming

Three seems to be the magic number. You know the old saying: “Third time’s a charm.”

This posting explains what normally happens in a bear market, but as I’ve said in recent articles, this bear market seems to have a deep desire to fool people even while still sticking to the normal bear market pattern of three legs down. Eventually a new multi-year bull market arrives that contains three prolonged legs up. Most investors, even professionals, appear to be oblivious to the fact that market cycles almost always move in three stages up and then three stages down. The problem for even knowledgable investors is that you don’t know in advance whether you’re going to get a common one-legged market correction or a deeper three-legged bear market until you’re half way through the process.

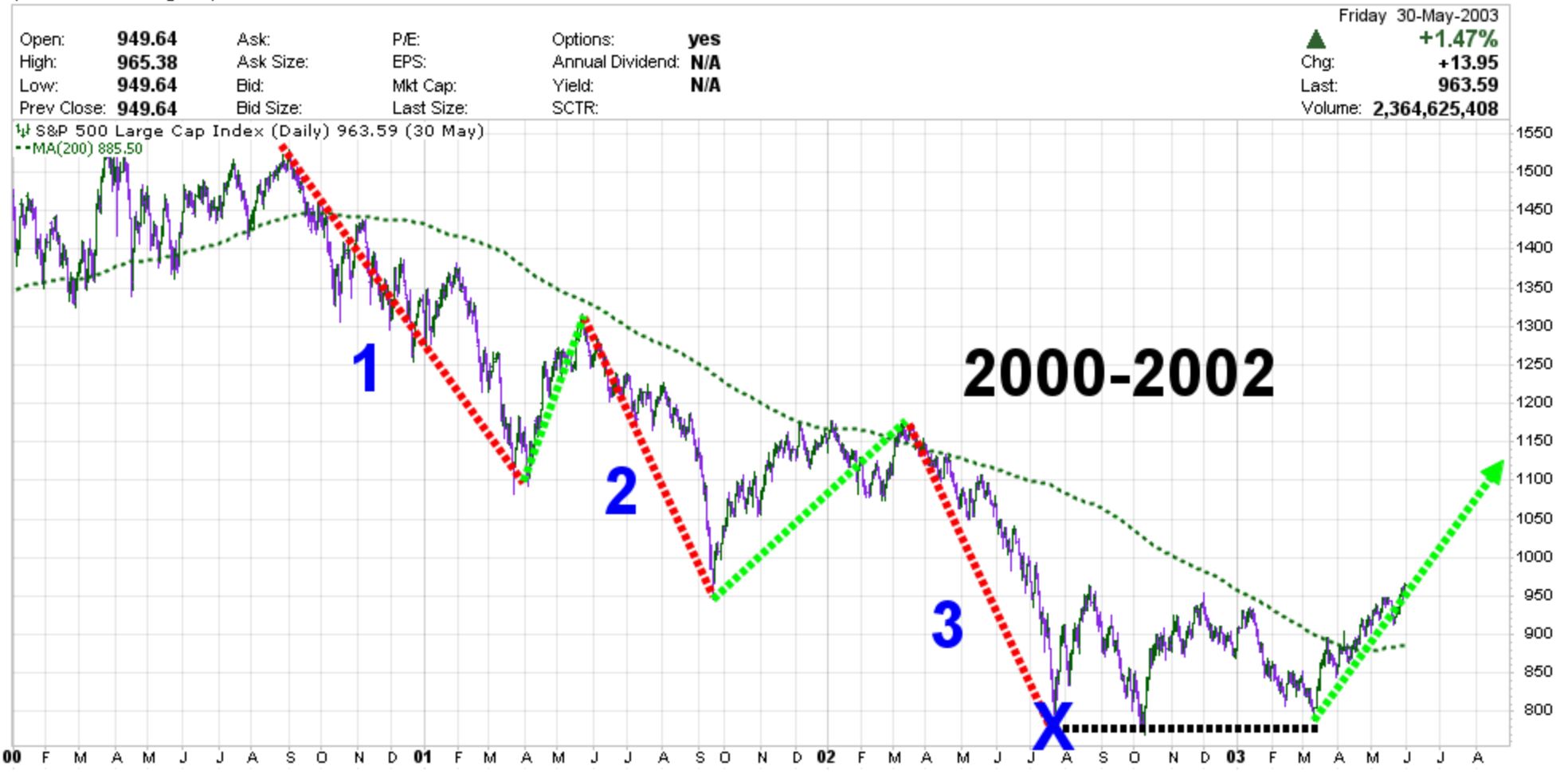

We’ll soon know how it all plays out in this most recent bear market, but we appear to have already survived the third leg down as shown by the big blue “X’ on the “2022” chart below.

Bear market corrections serve the process of cooling-off an overly heated stock market. 2021 was a rip-roaring year and 2022 came along to let off some of the pent up & excess steam. This will now (or soon) allow the bull market to resume.

Bear markets seem to almost always have three legs down:

- The initial bear market drop is caused by the riskiest portions of the investment markets selling off: small-caps, high-yield junk bonds, transportation stocks (because shipping is slowing down), always over-valued technology stocks, consumer discretionary stocks because consumers naturally pull back from buying non-necessity items. This first leg down is followed by a big bounce up in stocks.

- The second bear market leg down is caused by commodities selling off from their overly high valuations and this further pulls the stock market down. This second leg down is followed by a big bounce up in stocks.

- The third leg down is caused by a combination of investor panic followed by brokerage panic causing the brokerage houses (like Interactive Brokers) to call back margin-loans (margin is money that is borrowed from a brokerage with the sole purpose of adding it to one’s investment account assets). This strong third leg down, during which the safest mega-cap stocks are finally sold, is followed by a bottoming process and then it is always followed by a prolonged and powerful and profitable bull market. Always.

The current bear market has already experienced three legs down. It has likely now either already hit its bottom or it is currently involved a sideways multi-month bottoming process. Either way, we are likely at or near the end of the bear market, not the beginning. Good times will ultimately re-emerge.

We need to forget about “recessions.” This time around we are likely to get a milder “growth recession” and much of this will have already been priced into the market during its third leg down. The Federal Reserve may attempt to force a prolonged bottoming process in order to further and more quickly reduce inflationary levels; they are the wild card. Markets went through a classic sideways bottoming process during the past two big bear markets of 2000 and 2008. For people with even a small amount of patience, this bottoming process is tolerable and it will eventually be forgotten when the new bull market begins its strong upwards march.

Normally, during the first year of a new cyclical bull market off of a bear market bottom, the stock market moves quickly higher, like a rocket… rapidly recouping any losses and generating fresh profits.

The following chart shows the bear market of 2000… three legs down and a sideways bottoming process:

And this next chart shows the bear market of 2008… three legs down and a sideways-and-down bottoming process:

And this chart shows the current cyclical bear market of 2022. I expect this bear market to be milder than those in 2000 and 2008 because we are also in an overlapping Secular stock bull market that likely won’t end until around 2029. But this one is already showing three perfectly executed legs down (see the blue “X”) with a bottoming process that is likely either completed or entering into a multi-month bumpy period (moving mostly sideways, but it could briefly dip down again like it did in early 2009). In my opinion, without the recurring and well-timed trash-talk by the Federal Reserve, a brand new multi-year cyclical bull market would already be rising and unstoppable. Perhaps it technically already is.

And for my final comments:

Investing is investing; it is not gambling. In investing you win; in gambling you lose. A long term chart of gambling would be choppy and downward sloping because gambling is a gamble. But owning stocks actually means that you are a partial owner of a strong and normally profitable corporation; it is an investment that, over time, pays continually and steadily via price gains and dividends. If you own H&R Block stock, you can absolutely claim to be a partial owner of H&R Block corporation. Of course, for safety reasons, investors always divesify amongst many stocks; if you own 500 stocks and one goes bad, well, who cares.

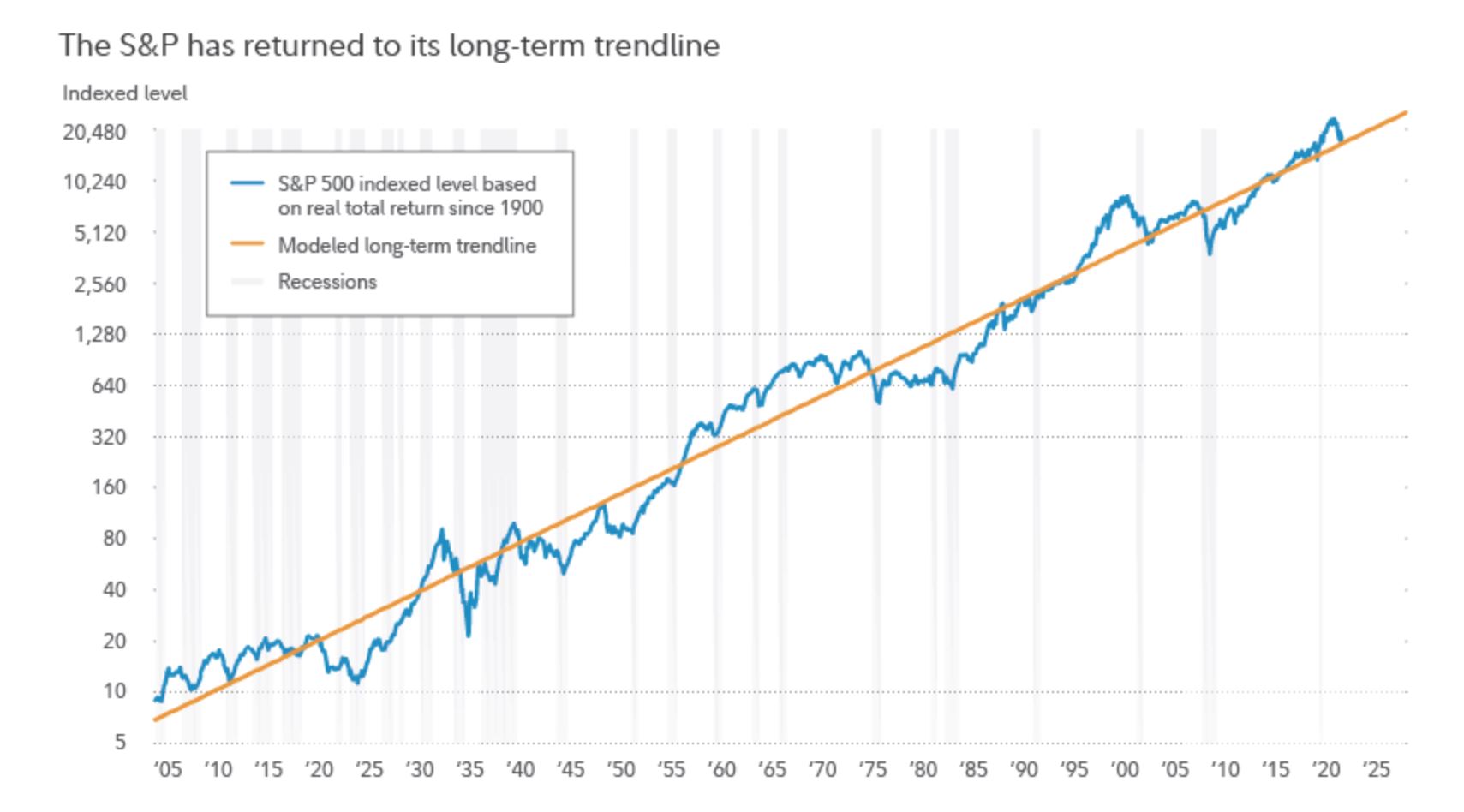

This final chart (below) shows the stock market profit path over the past 122 years. Stocks move above the orange median-trendline and get overheated and then they have to move back towards the orange median-trendline to cool off, as they just did in 2022. They only move and stay BELOW the orange median-trendline when stocks are also in a Secular bear market, as they were during the 1970’s and the 2000’s and that is not happening now (we are currently in a Secular BULL market that likely runs from 2011 to 2029). [“Secular bull” just means that the over-riding tendency is to move higher for longer regardless of any temporary corrections and bear markets and recessions.]

While they do zig-zag as I often repeat, they ultimately just keep going higher because stocks are INVESTMENTS, they are a piece of the action, they are YOUR piece of the action.

Bear markets are common but they never last long; the stock market is primarily bullish and that is clearly seen on this 122 year long stock market chart; it just keeps going up. Gambling is 50/50 at best, for example you have a better chance of being abducted by Martians than you have of winning the lottery, but people that invest are clearly ALWAYS rewarded over time.

$1 invested and held in a stock index starting at the very beginning of this chart (in the year 1900) and held until today would have generated a gain of 8,727,946%. You could buy Europe with that amount of money. lol

Stocks can earn in one day what a “safe” money market fund can earn in one year. MarketCycle’s stock positions did this on Friday. In just a few months, stocks can earn what a money market fund would earn during an entire human lifetime.

My point is that if investing were gambling, then this PROFIT line would not only go in one general direction, which is up.

SUMMARY: Bull market coming back soon to a neighborhood near you.

Thanks for reading!

MarketCycle Wealth Management navigates investment accounts through troubled waters. The process to join is easy, simple and affordable. We strive to earn our keep.

MarketCycle Wealth REPORT is available via the connecting link on this website.