MarketCycle Wealth Management

Predictions on Stocks and Bonds

Stock bear markets usually arrive twice per decade, last for one year, and present with a total of “three legs down.” This leaves eight full years out of every ten for the stock market to go higher, which is what makes investing so profitable over time. At the completion of the third leg down (the third plummet), the market goes through a scary capitulation (panic selling) bottoming process. We seem to have completed this in October of 2022.

The resultant new bullish trend has shown some hesitancy because typical recession signs are presenting concurrently. Months back I suggested that we would have a “growth recession” rather than a hard landing and this may be what we are presently going through. Strong tailwinds combined with moderate headwinds are creating passing turbulance.

My next ‘leg up’ projection is to S&P-500 @ 4400 with a 75% chance of hitting this by late spring or early summer of 2024. While it may jump around for awhile yet, we remain in the overriding long-term secular stock bull market for U.S. stocks that began in late October of 2011. Secular stock cycles normally last for 18 years and the final 6 years usually show the most strength and they do not require a low interest rate environment in order to achieve lofty levels. They do require very specific asset selection. Those six years just recently began and with the bear market either now over or soon over, my advice is to not miss this upcoming super-bullish period.

Current S&P-500 chart, updated on March 2nd open:

Fixed-rate bonds such as Treasuries, after having a rare difficult year in 2022, are likely setting up for a stronger 2023. Both fundamentals and technicals are now becoming fairly bullish and bond valuations are low and oversold on both a short-term basis and a long-term basis. Bonds may move sideways for awhile yet.

So, I’m still bullish. Although it can change quickly, MarketCycle’s entire (fairly extensive) system of proprietary indicators is currently bullish for stocks, bonds, gold and crypto. We are neutral (and definitely no longer long) on the USDollar and most commodities. The U.S. still leads in strength relative to all other countries, although it would likely benefit most portfolios to hold some (10%?) developed market and emerging market stocks.

A “recession” is a temporary slowdown in economic activity… that’s all it is. Yes, common recession indicators have all fired, but this might end up being less important than most analysts are expecting.

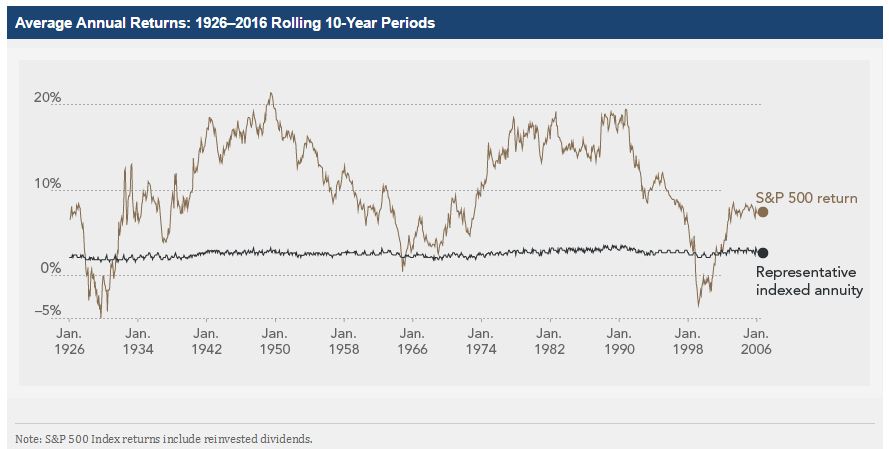

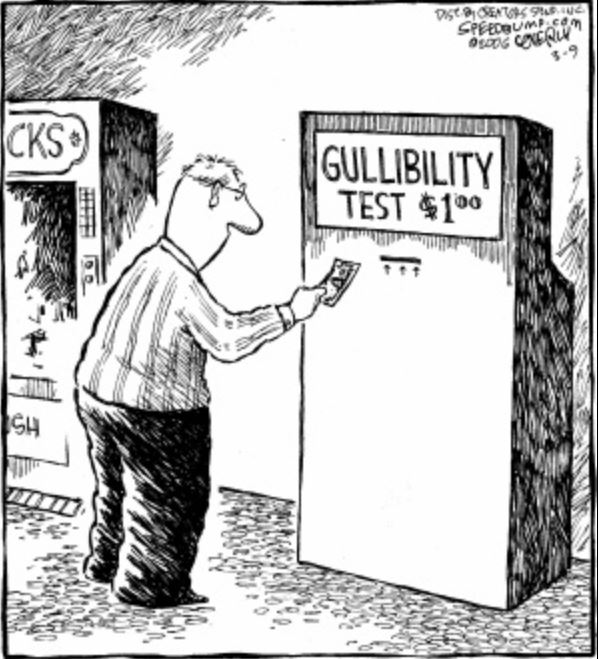

In the following, I am not saying that annuities or CDs are bad products or that they don’t have a place in the investment world, but some investors, being fearful of experiencing a “temporary slowdown in economic activity” will gravitate toward locking their money into annuities and CDs. These products lag stocks by huge amounts over almost all years. This next ‘century long’ chart shows stock market 10-year rolling gains (gold line) superimposed over indexed annuity gains (black line). If the gold line is above the black line, then stocks are, by far, the better investment. The periods when stocks lag are short lived and they are many years apart (and there were only four brief lagging periods during the past 100 years). Fear is not an investing technique, but patience most certainly is.

As the famous Charlie Munger light-heartedly stated: “If you’re just not crazy, you have an investing advantage over 95% of the population.”

.

MarketCycle Wealth Management is in the business of navigating YOUR investment account through rough waters. Setting up is easy; it is affordable; the first three months are at no charge; we try hard to not only earn our keep, but to pay our way via earning extra dividends and interest. And we expect great times ahead; for legitimate reasons and contrary to popular thought on the subject, I believe that the next 6 years may be SUPER-STRONG.

Our REPORT site can be accessed via the link on this website.

.

AMARKET CYCLE — DUAL MOMENTUM — TREND FOLLOWING — LOW VOLATILITY — HEDGE FUNDS