MarketCycle Wealth Management

Predictions on Gold and the Dollar

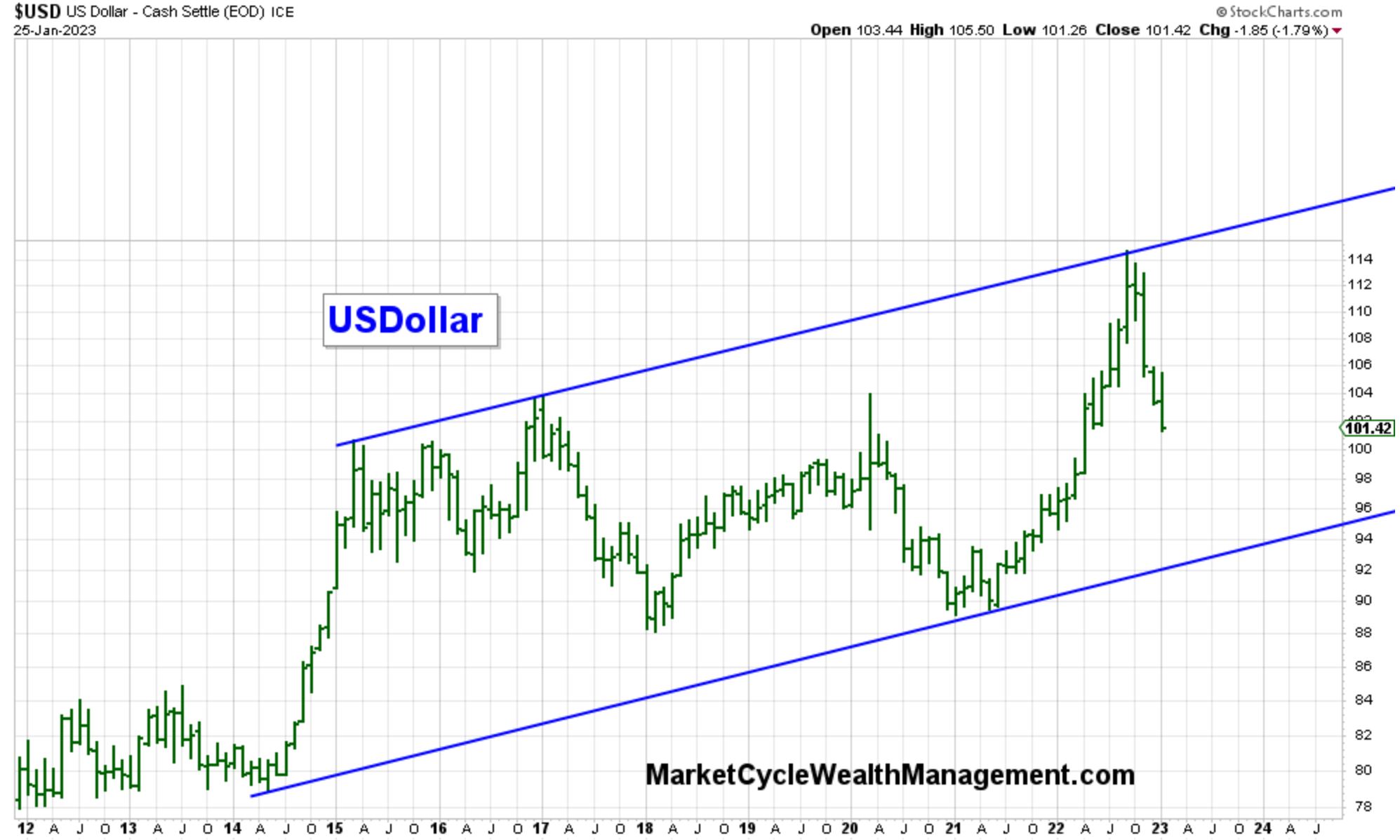

Way back in 2017, I drew the (blue line) walls of the USDollar (USD) trend channel that is shown below. A picture perfect trend channel. The USD has, quite admirably, embraced these walls. We bought the USD at the bottom line and recently sold right at the top line. While the USD may lose another 4-5% during 2023, we ultimately expect the USD to hold up fairly well for the remainder of this decade.

Why would the USD not just fall as so many now predict?

- Strong countries have strong currencies; the U.S. still leads in relative strength over all other countries.

- The U.S. Federal Reserve is still raising rates and this strengthens the value of the USD currency.

- The Federal Reserve states that it will likely NOT lower rates in 2023, and I currently believe them, and this also strengthens the value of the currency.

- The upper terminal interest rate level is likely to remain higher in the U.S. than in almost all other countries, offering continued USD strength.

- There is strong foreign direct investment in the United States (in ownership of companies and in real estate). The U.S. continues to attract the highest level of foreign direct investment of any other country.

- Renewed interest in holding U.S. Treasury-bonds will help to prop up the USD as foreign investors normally buy the USD with which to purchase the Treasuries. There is $250-Billion in what is normally used as Treasury-bond investment money still waiting (for some sign from above) to flow back into the USD and then into Treasuries. And there is a truly gigantic short position on bonds and when this finally unwinds, bonds are going to go straight up, making big money fast; this will likely accelerate the need to buy USD to then use to purchase Treasury-bonds.

- The USD continues to be a safe haven asset and this will only increase as people continue to worry about a U.S. recession (that even if it does manifest, may be less of a problem than some people expect). Yes, MarketCycle’s recession indicators have triggered, but that doesn’t mean that a recession would be a problem for investors.

- The USD does not make sudden moves unless the Federal Reserve is RAPIDLY altering rates… currencies meander along, often moving sideways for many years at a time.

- China moved into recession first (and for longer because of their silly Covid restrictions), followed by Europe; the U.S. will be the last into recession, although in my opinion, any U.S. recession could be mild to the point of almost ‘non-existance.’ Just because the U.S. could be the last to come out of ‘recession,’ only because it is the last into recession, DOES NOT MEAN that the USD will be negatively affected. It may, in fact, mean quite the opposite. Again, strong countries have strong currencies.

- The U.S. stock market clearly continues to remain in a Secular bull market that started in October of 2011 and that we are predicting will last until around 2029… 18 years in total, similar to all other Secular stock bull markets. This would continue to contribute to both a strong stock maket and a strong currency.

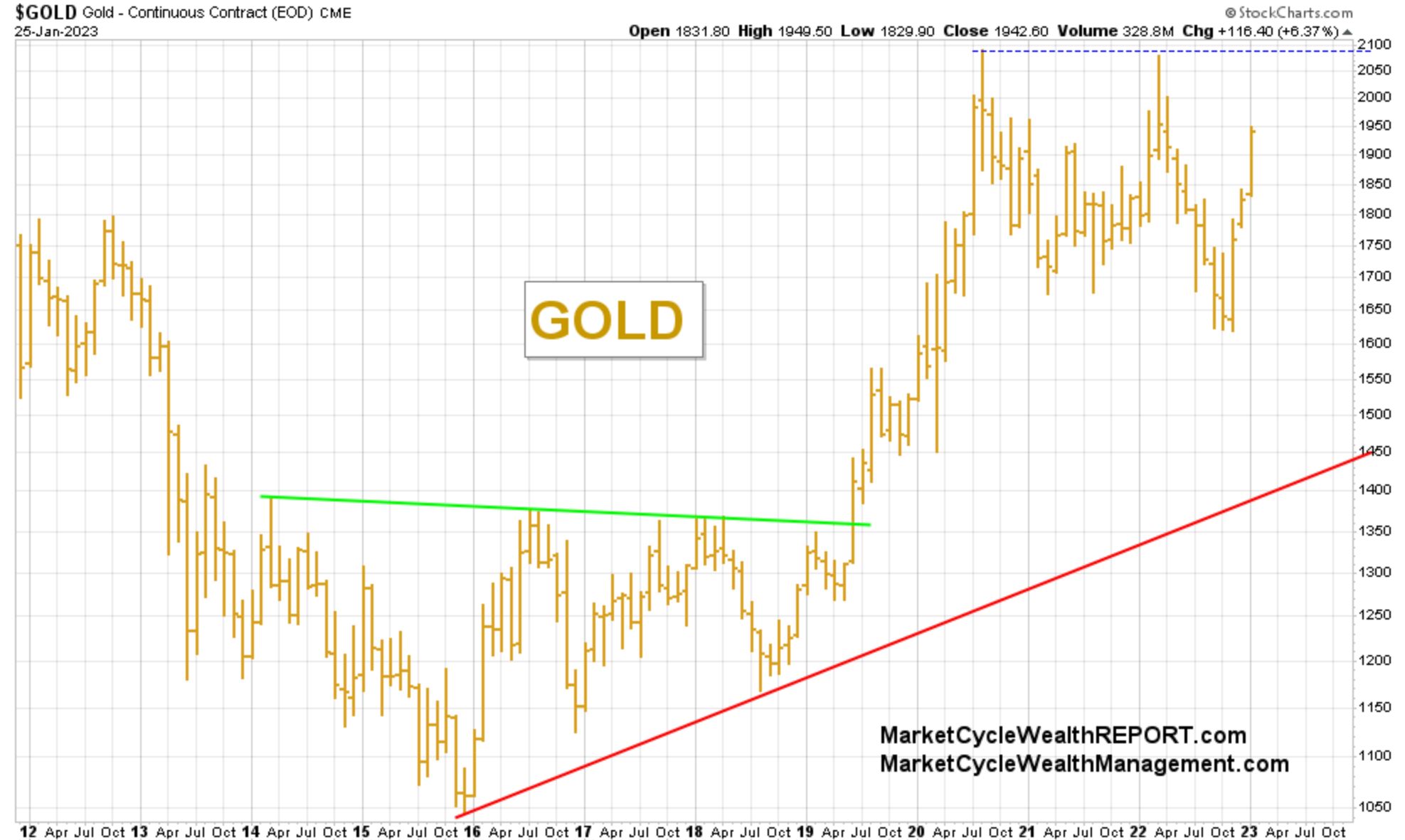

GOLD:

Gold bullion is the opposite of the USDollar although they only loosely inverse-track each other. The old saying is “If Dollar weaker, then gold stronger.” MarketCycle’s client accounts no longer hold the USD, but we do continue to hold gold. Gold continues to shine, however it will eventually bump up against its own resistance line as shown by the blue dashed line in the following chart. The blue dashed line is shown as a faint line because I do not have full conviction that it will halt the upward move in gold. Eventually, years down the road, gold will reach astronomical levels… this is one of my highest conviction long-term trades.

MarketCycle’s clients still hold a 7% position in physical gold bullion (held in the vaults of the Canadian Mint). Why invest in gold?

- Gold is a storehouse of value.

- It protects against weakness in the USDollar.

- Gold is a hedge against inflation (2030’s).

- Gold is a hedge against deflation (2040’s).

- It protects against political uncertainty.

- Demand is increasing.

- The price is rising because of production and supply constraints.

- Gold acts as a rare (uncorrelated) portfolio diversifier.

A bear market occurs, on average, one year out of every five; this bear is old and tired and it naturally wants to go back into hibernation. So, what is the biggest problem facing investors today? I’ll say it yet again for all of those who didn’t believe me months back: the problem is not “waiting for the bottom.” The biggest current problem is what to do with all of the extreme opportunities existing in almost ALL asset groups. Do you tie up investment account money holding bonds when equities are showing so much strength? Which assets to buy when so many look so good??

MarketCycle is basing its equity asset selection on a barbell combination of relatively lower-risk core equity assets (some foreign but mostly still domestic) balanced with stronger early cycle assets. We also hold some diversifying alternative assets (as in gold and managed futures). Plus we’re holding select extended-duration bonds because they are EXTREMELY oversold, offer strong current income, offer portfolio protection in case a recession does slow things down, and extended-duration bonds may finally be offering the potential for (eventual) stock like market gains. Investors must lengthen their investment horizon, seeing what opportunities exist for the next 1-3 years, not the next 1-3 months.

A few quick & informative charts:

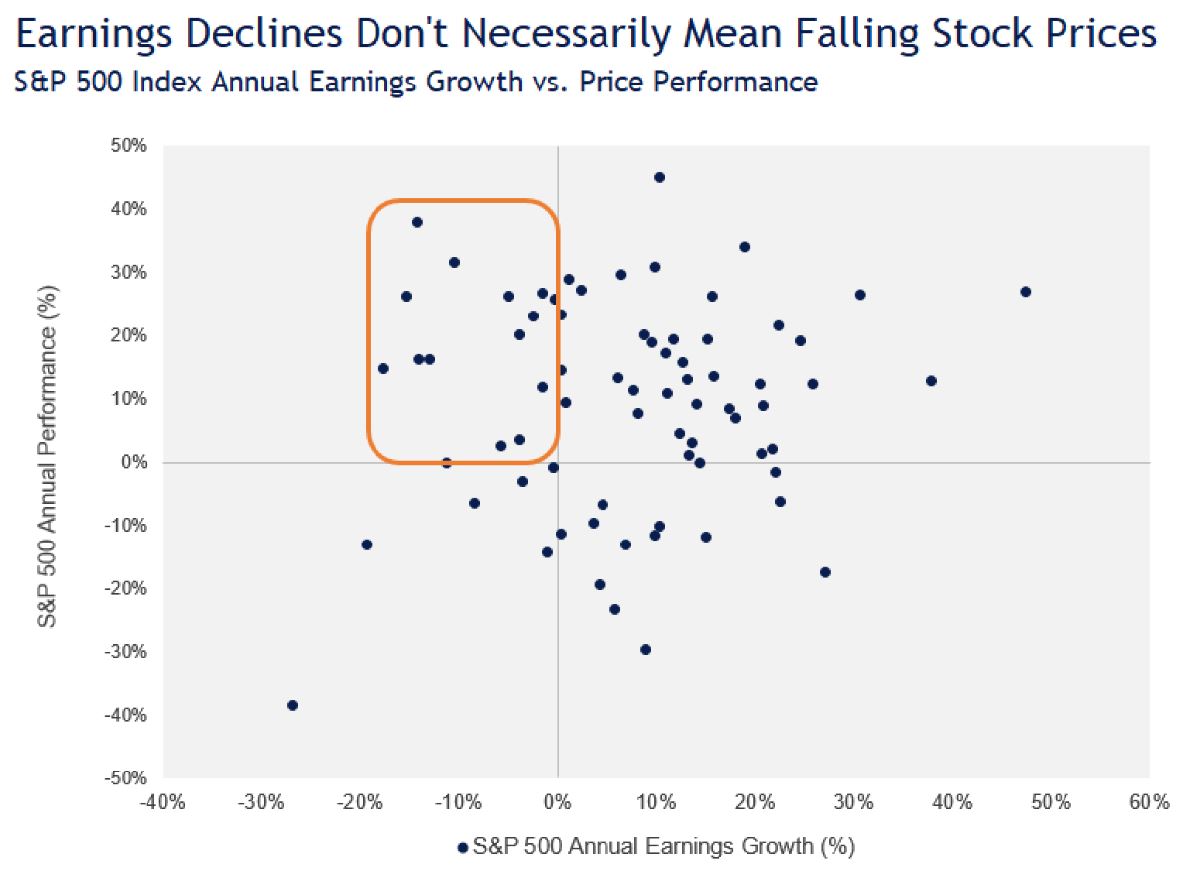

Investors are worried about potential falling corporate earnings affecting stock prices, but this doesn’t always happen:

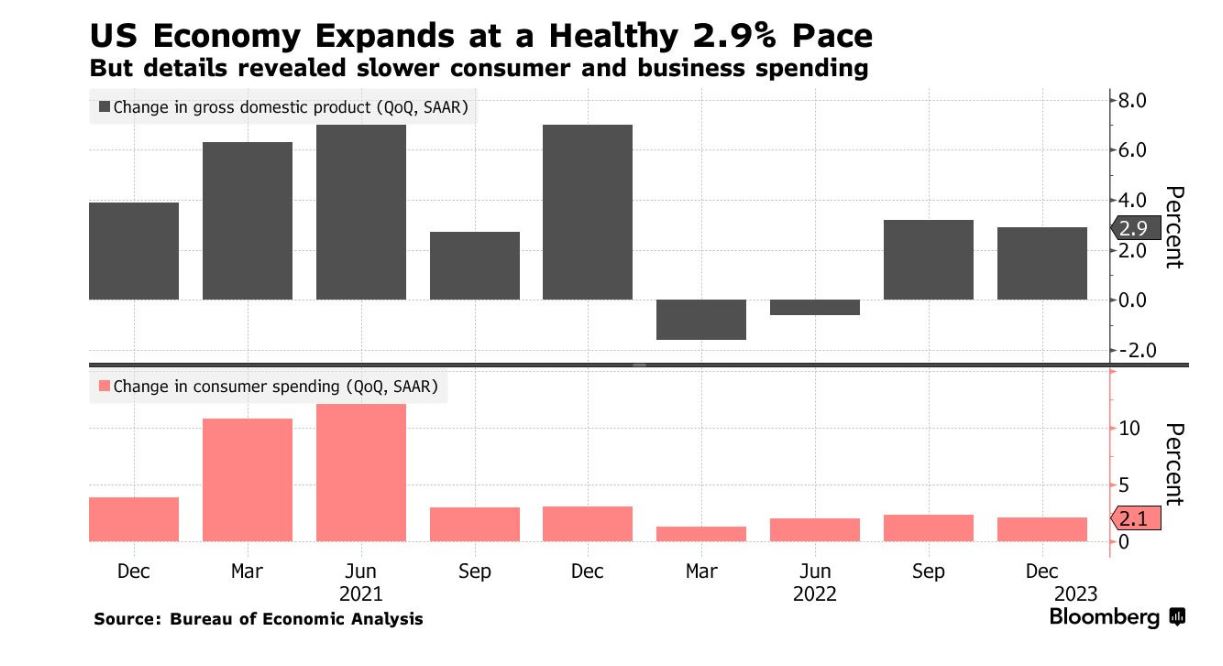

The U.S. economy remains pretty strong, no matter how forcefully the Federal Reserve attempts to strangle it. (Chart courtesy of Bureau of Economic Analysis):

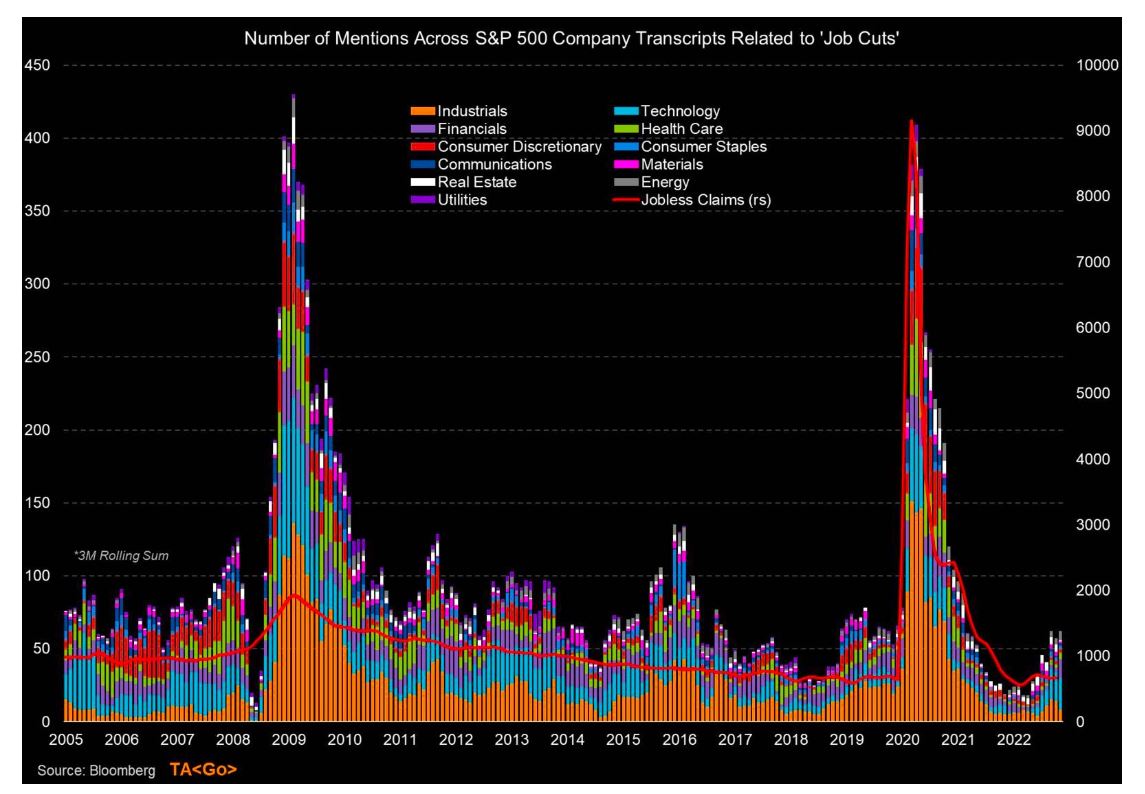

Planned job cuts, which are common in bear markets, are much lower today than they were during the Financial Crisis of 2008 and during the Covid black-swan event of 2020:

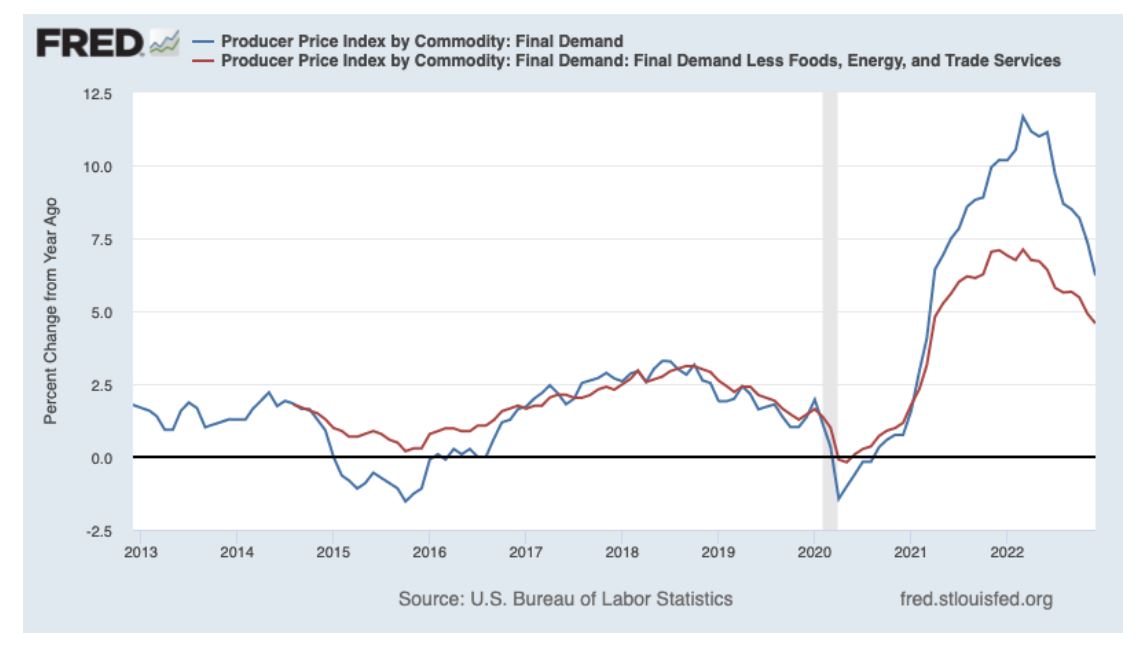

Investors are worried about high inflation, but inflation is rapidly falling. (Chart courtesy of the Federal Reserve):

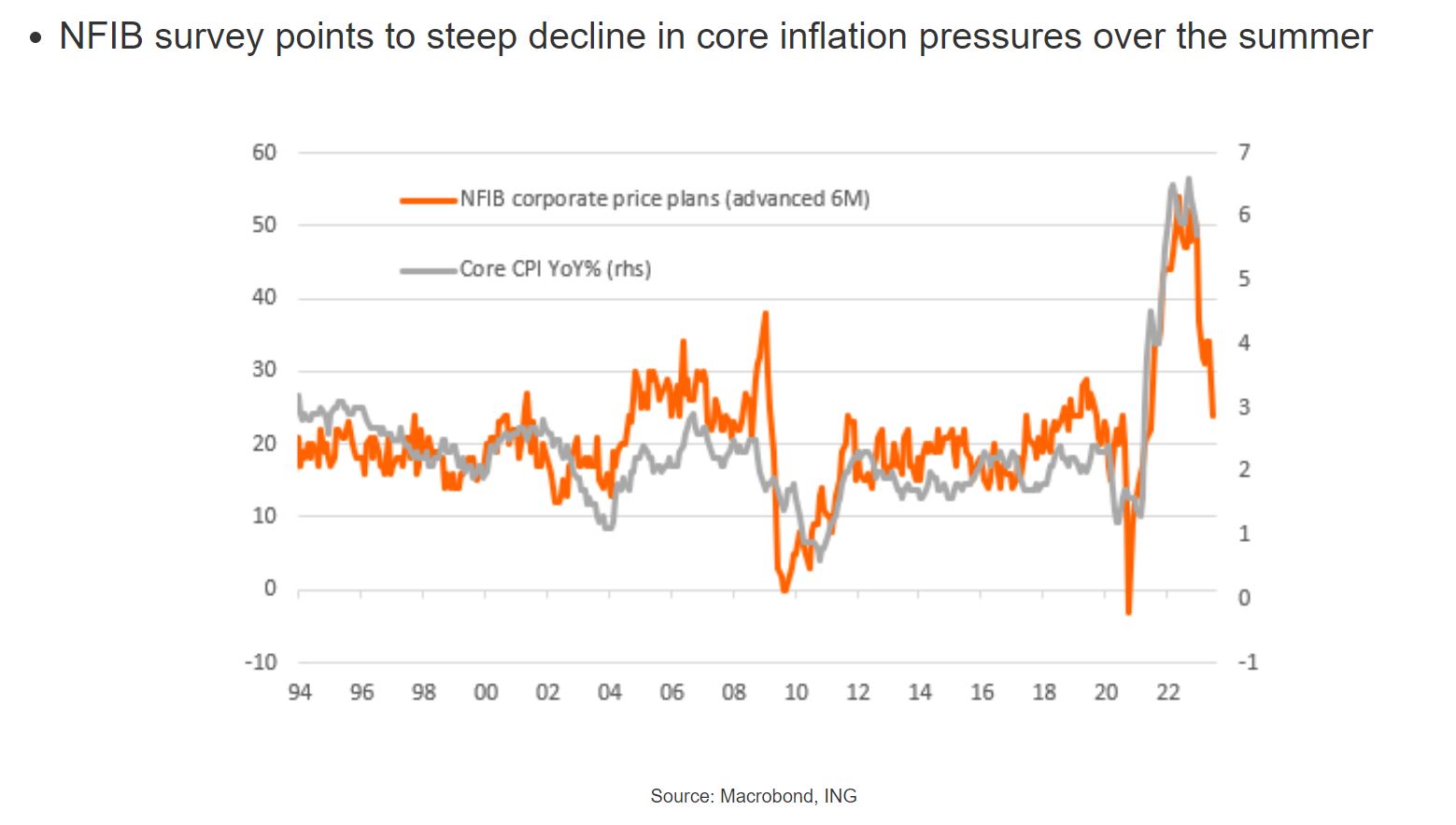

And inflation is expected to fall at an even faster pace in the coming months… the grey line will likely drop to match the orange line. (Chart courtesy of Macrobond):

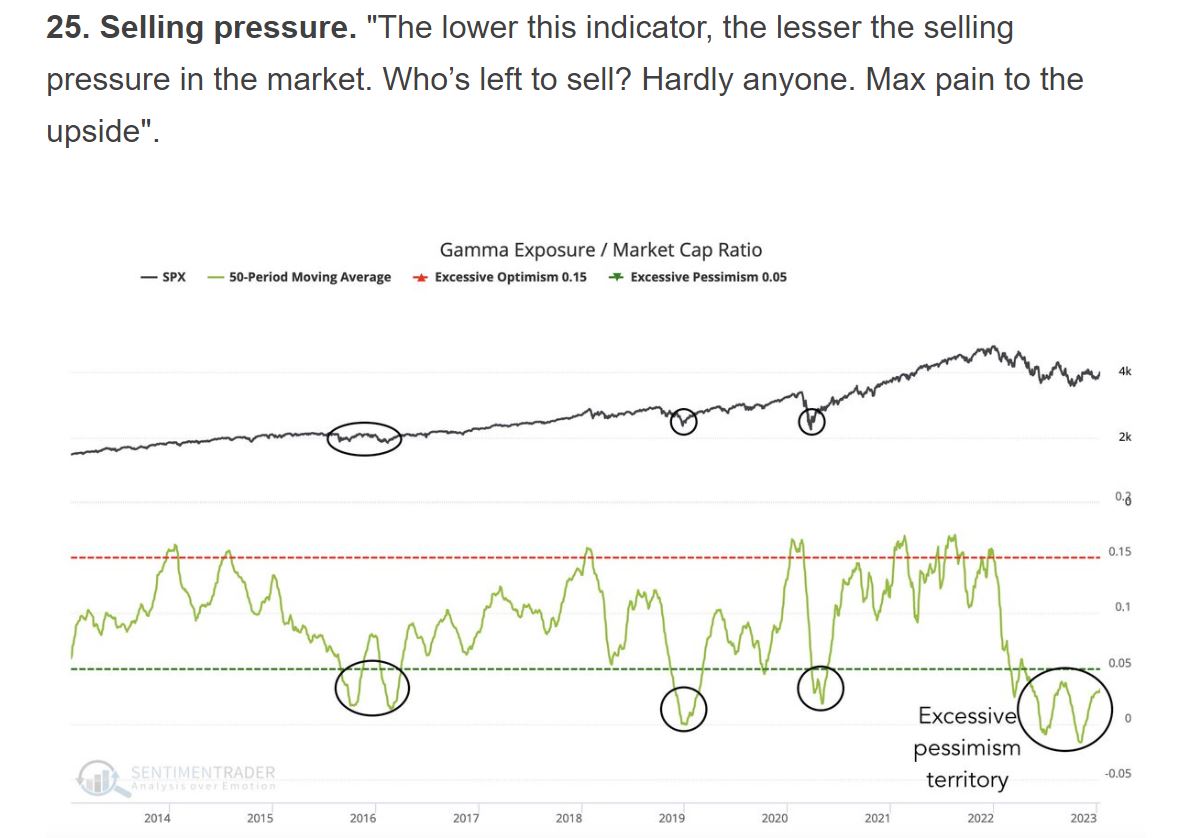

And finally, at this point maximum pain will be felt via missing out on the bull market rather than from avoiding any potential further downside (Chart courtesy of Sentimentrader):

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating YOUR investment account through rough waters. The first three months are at no charge, the cost is low and we work hard to earn our keep, even generating extra income and dividend payouts to cover the costs involved in management.

Our paid member REPORT site can be accessed via the website.

Signup for this free monthly blog is easy and this is also done via the website.