MarketCycle Wealth Management

Lone Wolf

As usual, I feel a bit like a lone wolf. So many people still believe that the world is about to end. But it isn’t. It just isn’t. Although it all seems a bit new, what’s happening now has happened before.

In the Spring of 2020, MarketCycle started saying that we were moving into a period of temporarily high inflation. The last time that I saw an inflation spike come out of nowhere was back in the mid-1960’s.

In March of 2022, MarketCycle started saying that inflation would likely peak three months later. It did peak in June (and it will slowly settle down to the 3.5% area). With every inflation spike in history (in the United States), the stock market found its bear market bottom within 4 months of experiencing the inflation peak. And the stock market, according to MarketCycle, bottomed right on cue in June of 2022 and with a retest that went a bit below the June low, as we initially predicted way back in December of 2021. I should have burned my own prediction into my brain because I kept forgetting that I had even said this. So, I believe that the bottom may be in and I’m currently bullish for a host of reasons, but if anything changes I’m certainly willing to quickly change my view on this.

We have to remember that stocks lead the economy by, on average, six months. Stocks fall before it looks like the economy is in trouble and stocks rise well before the economy looks promising. Although home-builder stocks usually lead even the general stock market, and they are now slightly bullish (although I wouldn’t own them), home prices and sales tend to follow the economy, so they present with a lag. Home prices and sales will likely get worse until early Summer, but by 2029 home prices will likely be quite high. At 10:00 AM EST today (10/28/2022) the much awaited home sales data for September came out (remember, economic data is ALWAYS lagging). It reported a large 10% drop in pending home sales during September; it is likely to be even worse for October.

And if you are waiting to sell a business, the best time to sell is going to be no earlier than a couple of years from now… if you sell now, you just might regret it later.

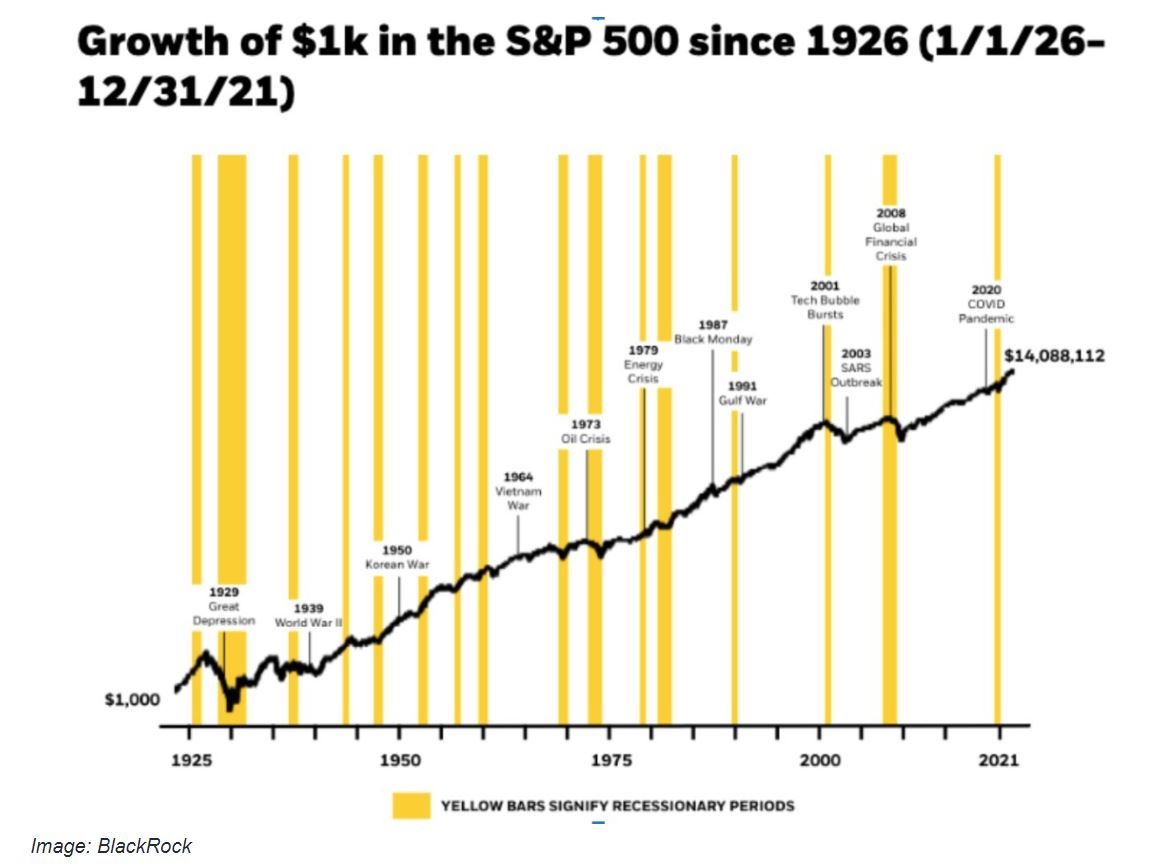

Below are some charts that recently caught my attention:

The stock market moves higher over time with investors reaping huge profits. It never collapses even in the worst of times, it merely hits temporary road-bumps. The yellow lines show all bear markets from 1926 to today. (Chart courtesy of BlackRock):

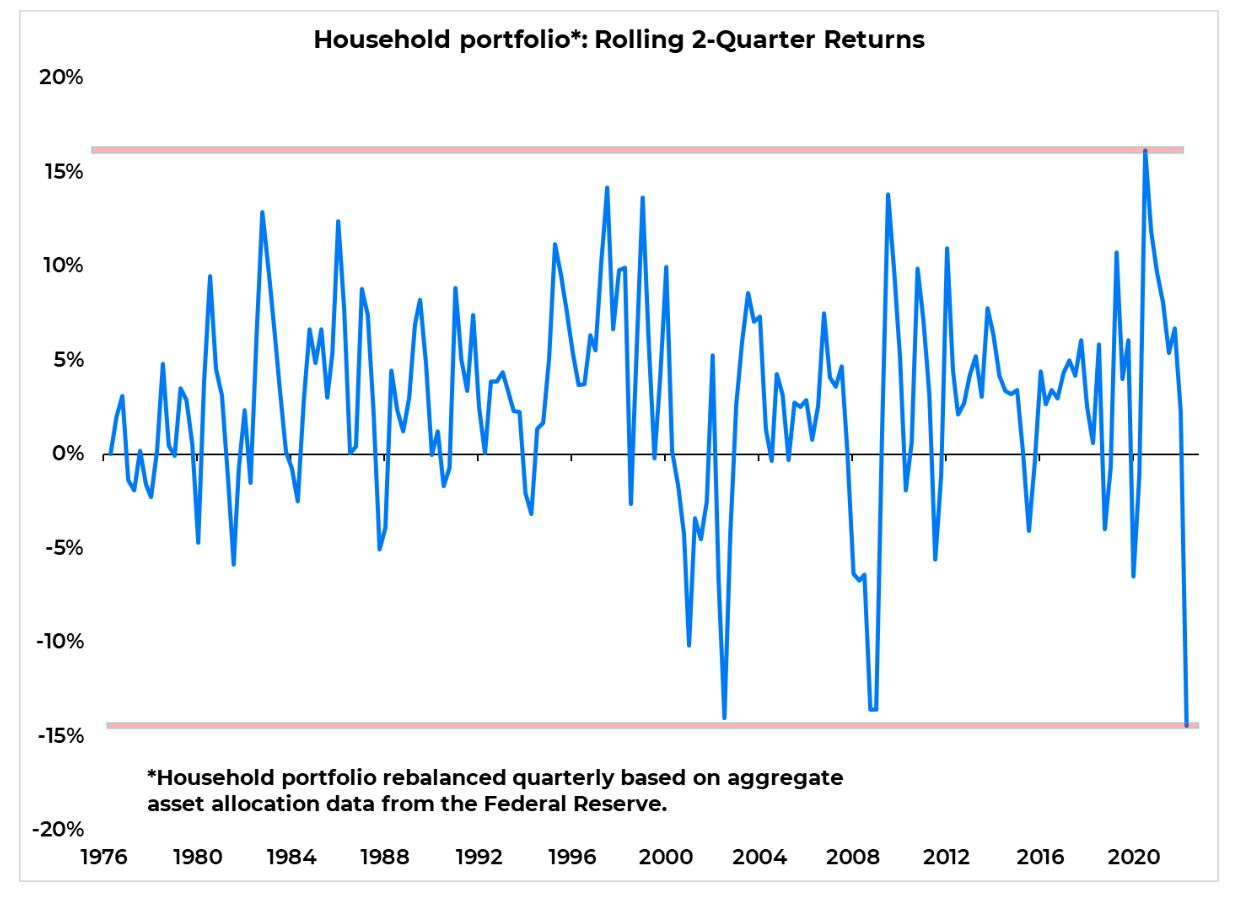

At the end of the quarter, losses were running at an extreme high; this was as painful to investors as was the Dot.com Bust of 2000 and the Financial Crisis of 2008:

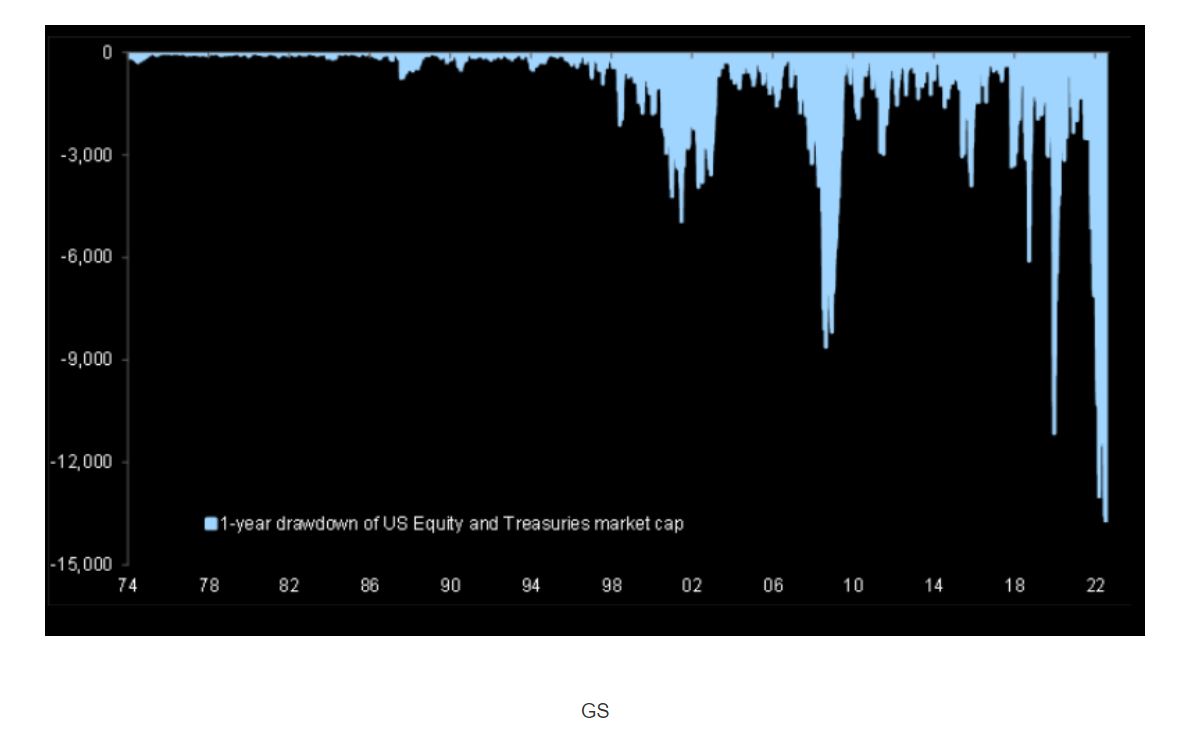

But when 2022’s bond losses are also included, this becomes the WORST bear market of our lifetimes. (Chart courtesy of Goldman Sachs):

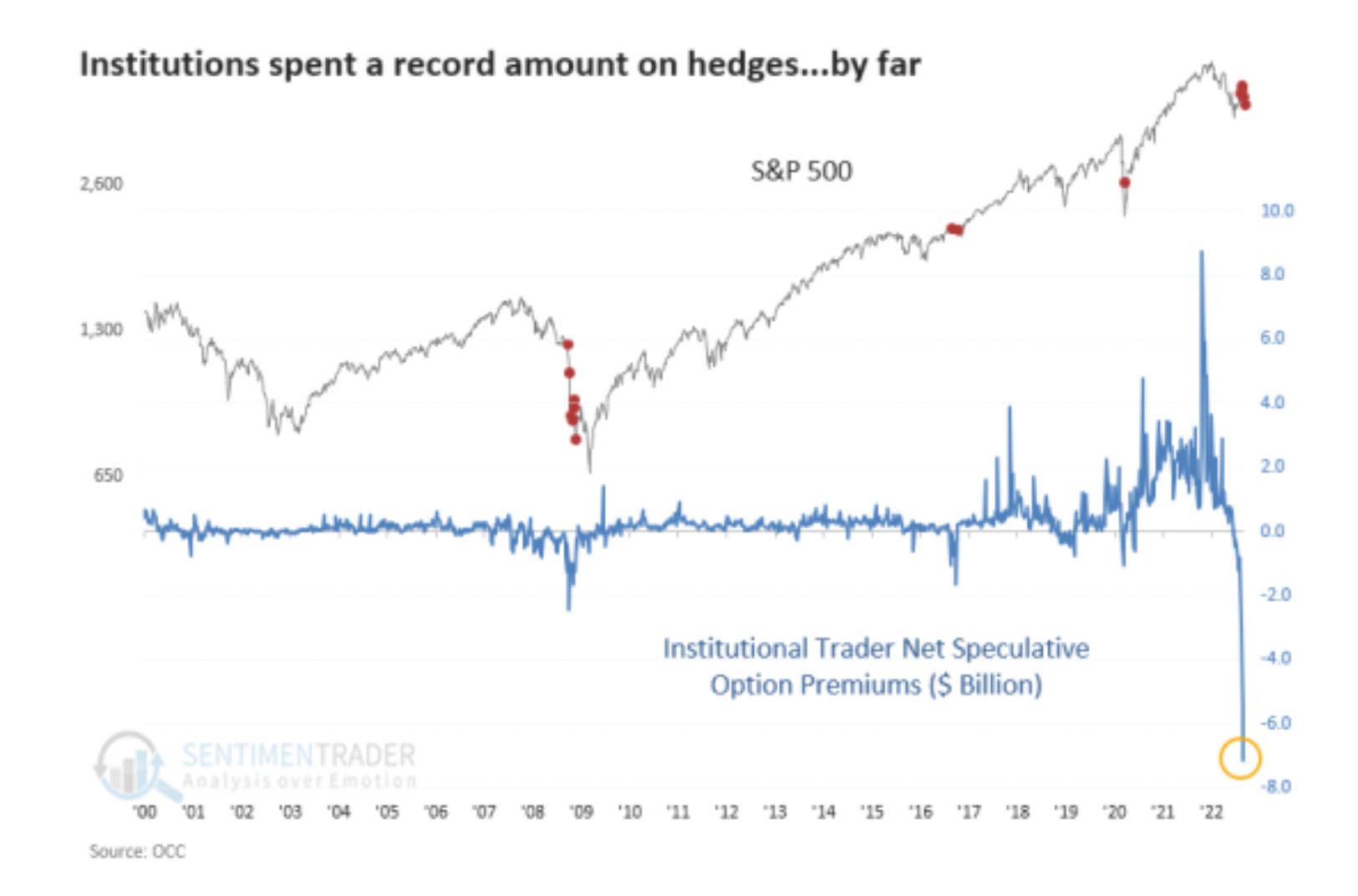

If the record protective-hedging of portfolios in June of 2022 wasn’t a panic capitulation (fearful selling), then I don’t know what capitulation is. (Chart courtesy of Sentiment Trader):

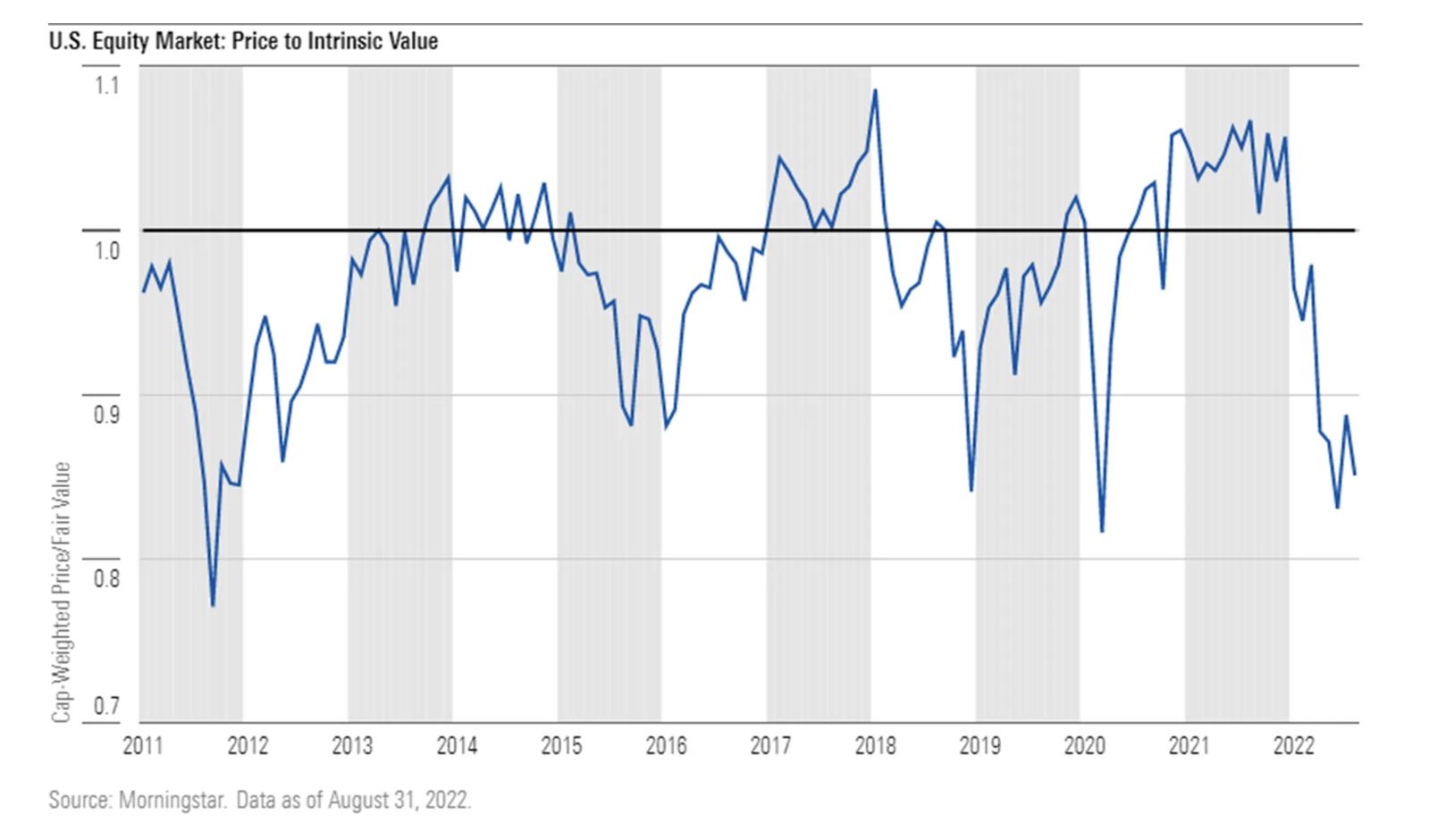

And even if we have not reached the exact bottom, stocks are now being offered at fire-sale prices because “current price to true intrinsic value” has collapsed. (Chart courtesy of Morningstar):

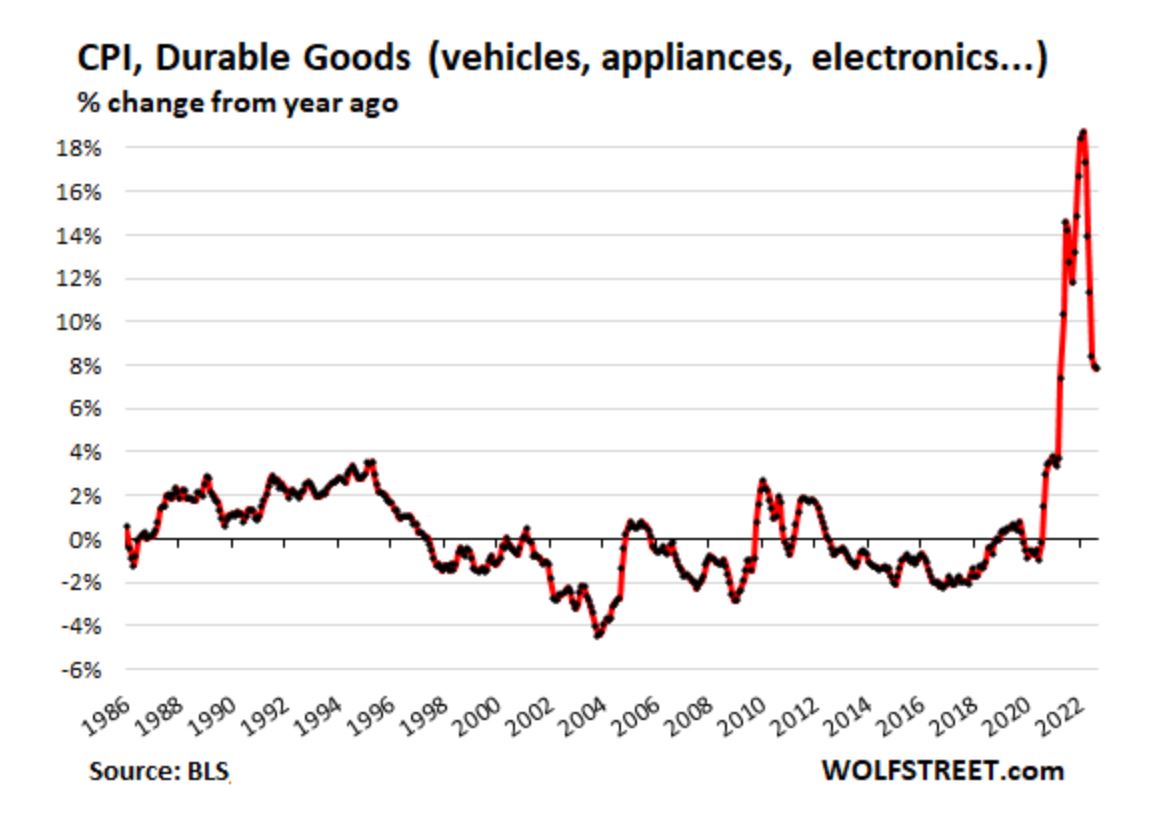

Inflation data is older, past data. You cannot tabulate numbers for current or future inflation data because the numbers do not yet exist. So, we have to keep that idea in front of our eyes; with data, we’re looking in the rear-view mirror. The normal path is for the inflation of “durable goods” (IE, appliances, etc) to fall first, and this has already happened, and for the inflation of “services” (IE, pedicures, etc) to fall last, and this is happening now. (Chart courtesy of WolfStreet):

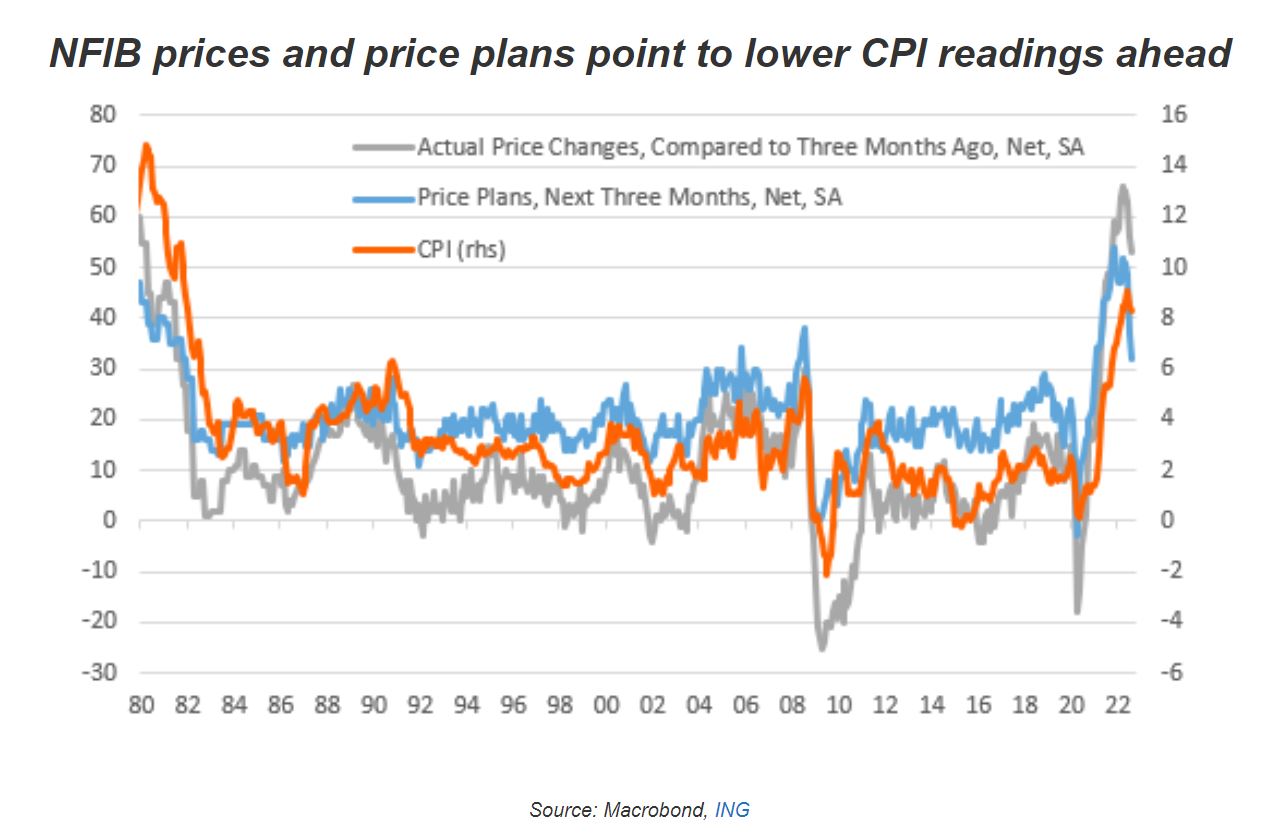

Prices are already falling and the next CPI (inflation) reading will likely start to show this (the orange line will follow the blue line lower). Chart courtesy of ING:

Some months back I wrote to clients that I felt that the FAANG stocks (large cap technology such as Facebook and Amazon) would suffer off of any potential market bottom and that they might lag in the new bull market. This seems to be panning out as both Facebook and Amazon lost a huge chunk of their value this past week and this is on top of their already big 2022 losses.

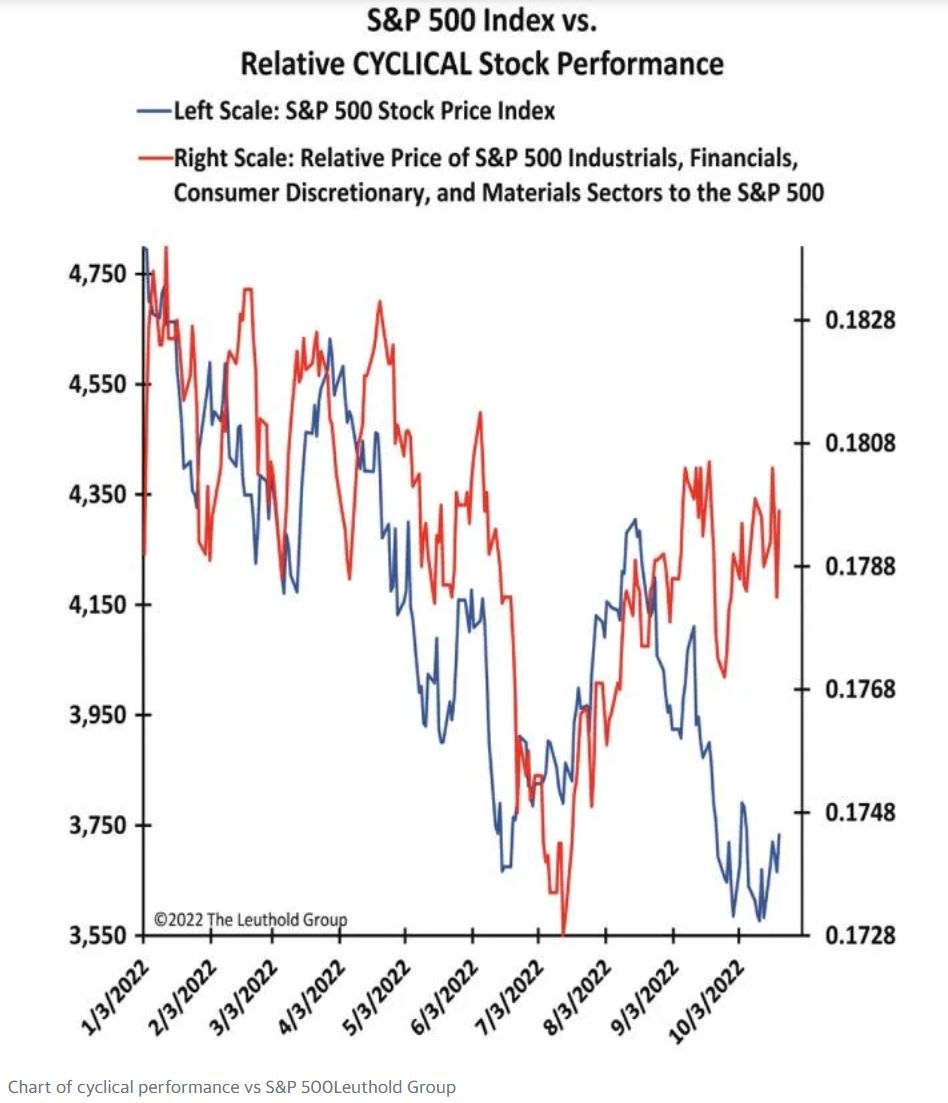

Right now, whether we are in a large rally or a new bull market, cyclicals are leading the market higher. MarketCycle holds a barbell approach of safer health-care, staples and low-volatility stocks on one side and small-cap-cash-cows and deep-value stocks and high-yield financial stocks on the other side of the barbell. This past week we added a small extended-duration Treasury-bond position. We also hold a managed futures position and a small allocation to gold (we just sold our long USDollar position). We are even holding a recent 2% position in crypto-currency since it is making such an obvious bottom and because, after 7 years of non-stop attempts, MarketCycle finally figured out how to exploit the spikes of crypto. And we are avoiding the technology sector because our prediction is that the financial sector (and value) will take over leadership from technology (and growth).

Right now they are bullish, but if our indicators turn negative again, I’ll gladly switch back to include more hedging and protection.

As I stated in a recent Client MarketCycle Update, this bear market has been a sort of moving target and it seems to want to fool the most people that it possibly can. Whatever typically happens at a market bottom may not happen at all this time around. People may wait around in anticipation of a typical bottoming process that may not even happen; maybe the market will “just go up” because this does not have to be a repeat of 2008. Maybe it is already going up. (Chart courtesy of Leuthold Group)

We have new leadership in the stock market:

WE ARE STILL IN A SECULAR BULL MARKET FOR STOCKS! The normal oscillations in a long-term secular market are made up of repeating and alternating cyclical bulls and cyclical bears. Right now, the cyclical bear market of 2022 appears to be giving way to the brand new cyclical bull market of 2023.

People often quote the very smart Mike Wilson (of Morgan Stanley) to me and he has been bearish since late 2021 (he is one of 6 analysts that I will always listen to). Please note that he has, just this past week, TURNED BULLISH. He states that we are in a super-strong bull market rally that may prove to be so powereful that it may represent the start of a brand new bull market for stocks. I like the sound of that.

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. There is a contact tab at the top of our website. The process is affordable and easy. The first 3 months are at no charge. We work hard to earn our keep.

Our MarketCycle Wealth REPORT (paid member) website can be reached via the connecting link on this website.