MarketCycle Wealth Management

A Turbid Crystal Ball

The gaze is not crystal clear, I freely admit that I might be wrong, but the following are my “predictive” thoughts about 2022 and 2023:

- Normally, a new cyclical stock bull market can only begin after the Federal Reserve has halted all interest rate increases and right now they are still raising rates, but like much else about the recent bear market, this time it might behave very differently.

- Back in December of 2021, MarketCycle correctly called the higher risk period of 2022. I felt that the market would eventually bottom and that months later it would retest by going a bit deeper than the first bottom. This happened. I have to admit that the downdraft went deeper than I had expected. Now the ‘always behind the curve’ Federal Reserve may cause the turmoil to last longer than I originally expected, although the stock market may now, over the coming months, gyrate “sideways and up” rather than just down.

- Way back in the Spring of 2020, MarketCycle was perhaps the very first to predict the high inflation period that was headed in our direction. After 40 years of falling inflation, this was an important call.

- I also correctly called the inflation peak before just about anyone else.

- I called the stock market bottom in June of 2022. People likely think that this was a bad call, however the vast majority of stocks did, in fact, bottom in June. I still believe that this prediction will prove to be technically correct.

- The market has now completed its normal “third leg down” (per prior blog) and excessive “margin” (borrowed investing money) has slowly worked its way out of the system. I now feel that the Federal Reserve will “talk down” the stock market whenever it gets “too strong” and this may cause some sideways swings before the stock market fully grabs its cahoonas and just heads up to new record highs.

- Regardless of the recent and temporary crypto-currency Black Swan event(s), I believe that the larger and more important cryptos will move higher as risk is once again slowly embraced. Before the Black Swan event, crypto had been basing sideways for 6 months right at strong support; it was getting ready to head higher again. Now, it may head a bit lower before strongly moving higher again. Bitcoin is not an investment, it is a speculation that still has the potential to offer gigantic profits via holding only a tiny portfolio position. MarketCycle has figured out how to capture the price spikes and this has now made bitcoin of interest to us. Bitcoin and ethereum base sideways and then spike and then fall… base sideways and then spike and then fall… base sideways and then spike. It looks a bit like an EKG.

- MarketCycle correctly predicted the rush up and then the peak of the USDollar (where we sold our USD position on the week of the peak). I now expect the USDollar to move mostly sideways and very slightly down (and this will not offer a good ‘shorting’ opportunity).

- I am now calling the bottom in Treasury-bonds, although it might be a messy bottom. Extended-duration T-bonds may soon provide higher tax-free interest, much lower risk and they will now likely move higher whenever the stock market moves down, offering important portfolio protection.

- I expect gold to continue to gain in strength as the USDollar weakens. By the 2030’s, investors will fully realize the importance of gold.

- I expect commodities to continue to move lower, but for food and energy (and diesel) to take longer to move down.

- My feeling is that, over the next couple of years, stock market strength will be found in small-caps, cash-cow stocks, pure-value stocks, financial sector stocks, healthcare sector stocks and high-dividend stocks (not dividend-growers and not utilities).

- The United States should continue to lead in relative strength for the next 6-7 years.

- I now feel that a recession will be “randomly called.” MarketCycle’s main recession indicator has recently triggered. Any recession may be an inch deep and a mile wide and it might have only a minimal effect on the stock market but a broadening negative effect on the economy and on the housing market. Remember, the stock market and the economy are not the same things; the stock market moves roughly 9 months ahead of the economy, both up and down. If one waits for the economy (and one’s emotions) to improve before investing in stocks, then nine months of strong profits have already been left behind. People repeatedly buy at the market top and then sell (or buy protection) at the market bottom, the exact opposite of what they should do.

- Nothing in investing moves in a straight line, everything zig-zags. MarketCycle’s inflation indicators have signaled that we might get an uptick in the inflation data (perhaps in December but more likely) on January 12th and if so, this could cause the Fed to move 0.5% on February 1, 2023 instead of the expected 0.25%… and if this all plays out, then it could cause a temporary & tolerable dip in the stock market.

- 2023 will likely be “the year of recapturing new highs.” The Dow, which is leading the market higher (just as it did after the year-2000 “dot-com” bust) will soon recapture its pre-bear-market highs.** Small-caps will eventually follow suit, especially “pure-value, cash-rich small-cap stocks.” This is why our barbell approach has been working so well… defensive (Dow) on one end of the barbell and aggressive (small-caps) on the other end.

- ** The Dow stock index has now moved above its bear market trendline, above its 200 day moving average and as of Friday, November 25th, it has now made a bullish “higher high” by moving above the prior bear market peak. The S&P-500 and the Nasdaq-100 are being held back because of their high technology-sector holdings; whatever leads in the prior cyclical bull market will not lead in the next. NOTE: Some investors make trading decisions based on the activity of the Nasdaq stock index, but this is a mistake because the Nasdaq very often lags the general market, sometimes for a decade at a time.

- Right now we are entering the historically strongest period of the stock market year at the same time that we have reached the strongest two years of the Presidential Cycle. The most profitable period during any new cyclical bull market is always during the first two years off of the bear market bottom (when stocks are being offered at incredibly low prices and risk is naturally lower than it is at a market top). Quality stocks are currently cheap and quality bonds may be even cheaper.

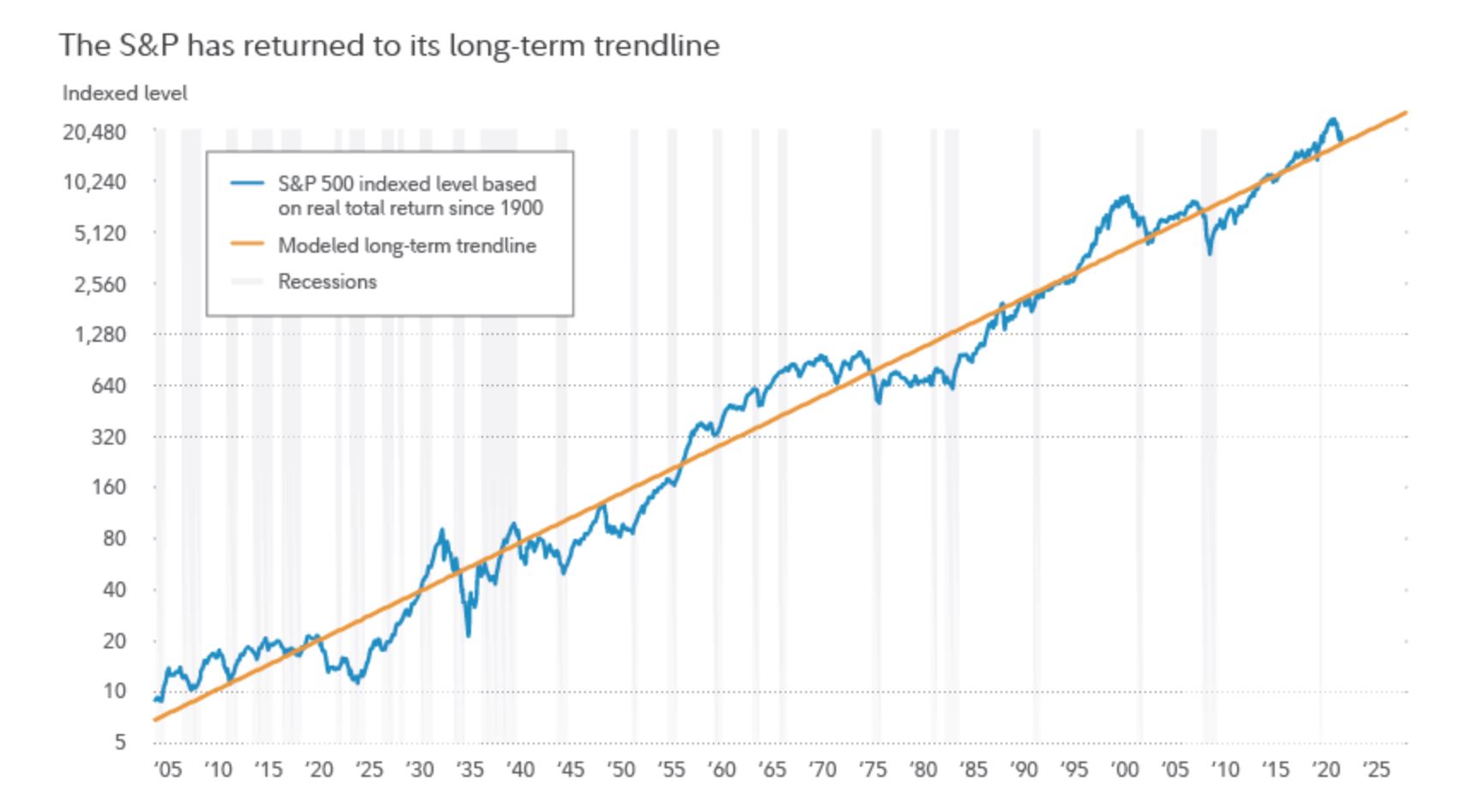

The stock market always moves higher despite the temporary corrections that cause markets to zig-zag around their median price. The below chart shows the S&P-500 stock index over the past 122 years (since the year 1900). The market gets too strong and it moves too high above the median trendline and then it corrects to or below the line in order to let off the excessive pent-up steam… then it moves higher again. ALWAYS. And the general stock market “trend direction,” as you can see below, is always UP over time. This is why it PAYS to invest in stocks (partial ownership in a corporation)… where you share in the profit gains generated by the corporation and where you can also receive continuous dividend payments directly into your investing account.

All stock market corrections and bear markets are TEMPORARY occurances that occur during all Secular bull markets. Avoidance is not the answer. The only investing technique that anyone needs to deploy during these temporary & difficult periods is: PATIENCE

Thanks for reading!

MarketCycle Wealth Management is in the business of navigating your investment account through rough waters. The new client process is easy and affordable. We work hard to earn our keep. There is a CONTACT tab at the top of our website.

Our REPORT weekly subscription service is available via the link on this website.