MarketCycle Wealth Management

The following is a synopsis of our annual survey of what the larger professional institutions and their big research departments are expecting for 2023. Only two of the major institutions got 2022 correct. Morgan Stanley and Bank of America got most of their predictions correct for 2022, although Charles Schwab and Blackrock eventually switched to bearish during the first quarter of 2022. Most others became bearish when the market was hitting its lows in June and October… much too late to do any good.

So, below is our highly condensed version extracted from literally hundreds of pages and dozens of videos and professional-level podcasts. Some of the newsletters from which this information is extracted are quite expensive and often unavailable to the retail investor.

Some of the predictions below offer end-of-year price targets. I can vouch for the fact that nobody actually knows where the stock market will end the year in 2023. I don’t know either, but I’ll freely admit the fact. I can safely say that the very highest that the S&P-500 could go by the end of 2023 and still remain within the walls of its 14 year long trend channel is an unlikely 6000.

Last year, because we saw risk levels rapidly rising, MarketCycle predicted the 2021 top EXACTLY correct, even to the day: S&P-500 to 4800 on the last day of December, 2021. And while still in December, we predicted a difficult and high risk 2022.

Our prediction going forward into 2023 is for continued volatility that soon emerges into an obvious cyclical stock bull market that lasts for the next 6-ish years (with one big speed bump in between). We now predict (and are positioned for) a sideways USDollar and oil… and rising quality bonds and high-yield bonds, rising small-cap and value stocks and falling commodities, but rising gold prices. MarketCycle feels that the bottom is likely in (even though this opinion seems to make people angry). We see inflation continuing to fall in a zig-zag pattern as stocks and bonds continue to rise in a similar zig-zag pattern. Nothing moves in a straight line, even the light-beam coming out of a flashlight moves in waves.

You know that the bottom is in or nearly in when you see the following taking the lead: small-cap stocks, value stocks, high-beta stocks, high-yield bonds, Treasury-bonds and gold bullion. That is all happening right now. And we clearly had a capitulation, that everyone else missed, and an October re-test of the June lows. So…

MarketCycle led the pack in predicting rising inflation, peaking inflation and falling inflation. We expected a tiny bump up in inflation to show up in either the December or January data release and we may have already gotten this since “services” (a large segment of inflation) moved a bit higher in December even as everything else fell.

Current INFLATION stats:

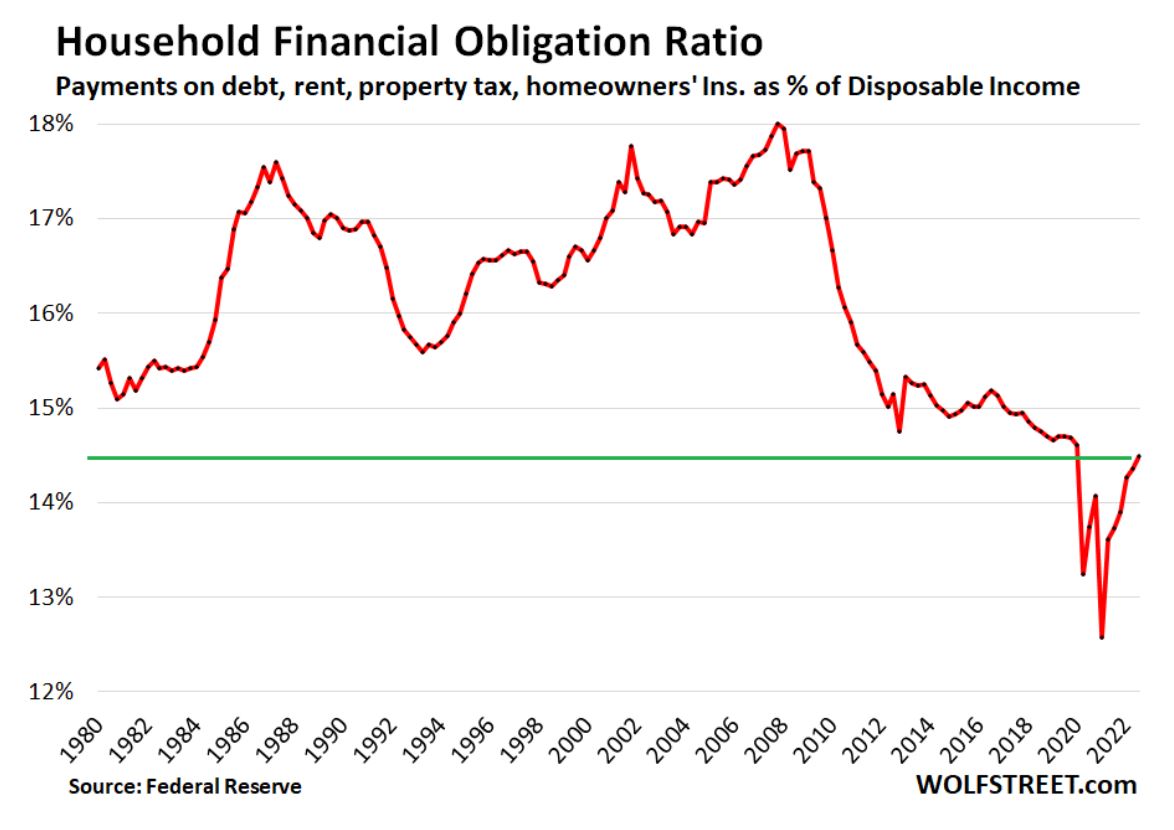

Those calling for a hard-landing recession and thus lower stock prices are not taking into consideration how incredibly strong the U.S. consumer is. This chart shows the historically low consumer TOTAL debt obligations as compared to their household disposable income level. The averge consumer is still flush with cash.

As the much respected Ed Heyman of Evercore recently quipped: “The ability to know the future is difficult.” I would add that it is impossible to predict tops and bottoms and it is equally impossible to time the market. But people always get the wrong answers because they always ask the wrong questions; this problem is constant, continual and pervasive.

The correct question? = How does one quantify risk? One can fairly accurately predict that risk is either increasing or decreasing because math quantifies data. If one gets less aggressive when measurable risk is high and more aggressive when measurable risk is low, then it accomplishes the ultimate goal of determining tops & bottoms and timing the market. In mid-December of 2021, MarketCycle saw risk rapidly increasing; the market topped on the last day of December. During just the past 20 years, MarketCycle correctly (and with zero false signals) saw risk rising in mid-2000, late-2007, late-2011, 2015, late-2018, early 2020, and late-2021. Bear markets always arrive during times of high risk.

So, drumroll please… here are the new institutional predictions for 2023:

GOLDMAN SACHS:

- End-of-year S&P-500 target = 4000 or higher

- Flat earnings and flat stock market (and likely no recession) in first half of 2023, but a strong second half.

- Only a 30% chance of a recession and if we do get one, it will be very mild.

- Hold defensive stocks along with healthcare and energy.

- Cautious on China in 2023.

- Inflation to remain very elevated in Europe.

- U.S. leads in relative strength.

CHARLES SCHWAB:

- “Mild, gently rolling recession sets stocks up for a better second half of the year as inflation receeds.”

- Consumer may weaken in 2023.

- Continued volatility in first half of year.

- Concentrate on cash-strong small-caps, dividend payers, low volatility and quality. Equal-weight indexes will beat market-cap (IE, RSP to beat SPY… QQEW to beat QQQ).

- Bullish on bonds.

EVERCORE (Ed Hyman, voted #1 Economist for the past 42 straight years via Institutional Investor’s Annual Survey):

- Mild recession during the first half of 2023, but stronger second half.

- “The Fed has already done most of its work.”

- “Inflation is falling, including rent, shipping rates and consumer services.”

- Weak housing in 2023.

- “The stock market is oversold, has already bottomed and is now heading higher. There may be one temporary and relatively mild pullback early in the year.”

RESEARCH AFFILIATES:

- Cam Harvey, the “Godfather of the inverted yield-curve,” has recently stated: “Do I expect a recession in 2023? No, and there are three reasons: 1) A labor shortage causing high employment to be normalized 2) The yield-curve is still positive & steep in real (inflation adjusted) terms 3) The current yield-curve popularity may negate its efficacy as a forecasting tool this time around.”

RAYMOND JAMES:

- “Although there is a certain amount of uncertainty, we are now seeing a more compelling risk/reward profile for both stocks and bonds.”

- “We are seeing strong signs that the peak of inflation is likely behind us, with pressures moderating rather quickly.”

- Bullish on both bonds and stocks.

HENNESSY:

- End-of-year Dow target = 40,000

- “There is cash everywhere. We see $7-Trillion in cash on the balance sheets of the S&P-500 companies. We see $10-Trillion sitting in money market funds. We see $18-Trillion with consumers in bank savings accounts.”

- “Earnings growth is still positive. The S&P-500 is more reasonably priced. We see a 16% gain in 2023.”

- Bullish on value stocks and small-cap stocks, financials and energy.

NATIONAL BANK:

- Mild recession in first half of 2023 and bullish on second half.

- Strongly bullish on extended-duration Treasury-bonds and defensive sectors of the stock market as well as pure-value stocks and cash-cow small-cap stocks.

- Bonds and alternative assets (as in managed futures and long/short) may prove to be more profitable than stocks in 2023.

- U.S. to continue to lead in relative strength, followed by Canada.

- Inflation to continue falling.

- Sideways USDollar.

- Mild recession early in 2023, but stocks to rise before the next interest rate cut.

DWS GROUP:

- “In view of the higher interest rate level, bonds are significantly more attractive than in 2022.”

- Bullish on U.S. stocks, emerging market, India and China.

- Small-caps, value and REITS and bonds should lead.

- Bullish on alternative assets such as ‘managed futures’ and ‘long/short equity’.

FIDELITY:

- “We do not expect any significant downtrend for 2023; stocks may instead follow a sideways path.”

- “With interest rates high, bonds may provide a better support to investor’s portfolios in 2023 than they did during the past year.”

- “There may be some risks on the horizon that could rock investor’s boats in early 2023.”

- For 2023, hold value, small-caps and add some foreign exposure if the USDollar continues to slide.

- Quality bonds will add ballast to portfolios.

JEFFERIES:

- End-of-year S&P-500 target = 4200

- Bonds gaining in strength as year progresses.

- Stocks volatile until mid-year.

BNP PARIBAS:

- “We expect a weak 2023.”

WELLS FARGO:

- End-of-year S&P-500 target = 4500

- “Play defense.”

- Weak first half of year with a very mild recession, strong second half.

- Weaker USDollar.

- Gold to move sideways.

- Favor U.S. stocks, quality and defensive now, but shifting to cyclical during second half, including energy and healthcare and even tech. Prefers small-cap and mid-cap stocks.

- Hold extended-duration Treasury-bonds now.

- Strongly suggests holding alternative assets such as managed futures and long/short equity.

BANK of AMERICA:

- End-of-year S&P-500 target = 4000-4600

- “Stocks flat as corporate earnings slide but strong consumer and corporations limit the downside.” Second half very strong. “Remember that stocks move many months ahead of the economy, so buy stocks during the first half of the year.”

- Volatilty remains high.

- Inflation falls to 3.2%.

- Buy small-caps, defensive sectors and energy. Avoid large-cap stocks.

BARCLAYS:

- End-of-year S&P-500 target = 3675

- “We see the potential good news, but we still believe that it is all a low probability event.”

MORGAN STANLEY:

- End-of-year S&P-500 target = 3900

- Weak first half of 2023 because of weak earnings, but then a strong second half.

- Hold defensive sectors, healthcare, energy and quality stocks. Avoid large-cap stocks and the technology sector.

BLACKROCK:

- Weak first half of 2023; strong second half.

- Inflation falls, but stays higher than the Fed’s expected 2%.

- Buy Treasury-bonds but keep to the short-end and overweight quality corporate bonds on the longer-end.

FUNDSTRAT:

- End-of-year target for S&P-500 = 4750

- Very bullish on equities.

- “Inflation down and Fed quits.”

- “If any recession, it will be a soft-landing.”

INVESCO:

- “We will see more clarity in 2023.”

- “The bottom is already in.”

- “We’ve already priced in a recession.”

- Inflation will fall in 2023.

- Very bullish on both U.S. government bonds and corporate high-yield bonds.

- Bullish on gold and U.S. REITs (Real Estate Investment Trusts).

- Suggests a regional barbell approach to equities: United States & China.

- Very negative on commodities other than gold.

- Suggests adding cyclical U.S. sectors and factors, especially small-caps and value stocks.

WISDOM TREE (via Dr. Jeremy Siegel):

- Inflation is rapidly falling, but food and energy are a bit sticky. The first rate cut will come in the second half of 2023.

- Unemployment will continue to deteriorate as the Fed raises rates.

- We may avoid a recession.

- “I think we’ve already seen the lows in June and October. Even a recession would not cause us to hit new lows in the stock market.”

- Market surprises are likely to be to the upside (bullish).

VANGUARD:

- “If there is a recession, it will be a soft-landing.”

- Bullish on bonds.

- Favors U.S. equities particularly small-caps and value.

- “Small-cap stocks are way undervalued.”

FIRST TRUST:

- “The Fed will pause in early spring and cause stocks to rise again.”

- Commodities and USDollar weak.

FRANKLIN TEMPLETON:

- “Bond markets are already improving; they will show attractive returns even in early 2023. It will take a bit longer for stocks to find their footing… likely in mid-2023.”

- “Bonds will, going forward, privide ballast to portfolios in 2023.”

YARDENI RESEARCH:

- End-of-year S&P-500 target = 4800+

- The economy is in too good of shape to enter a full recession; we’ll get a soft landing.

- Fed eases in late 2023.

- Bullish on energy, financials and later on technology.

JP MORGAN:

- End-of-year S&P-500 target = 4200

- “We see a retest of the 2022 lows, but they will hold. Strong second half of the year”

- Hold defensive sectors, healthcare and energy.

- Treasury-bonds to be strong in 2023.

- Strong China.

- Bullish on gold.

- Weak emerging markets.

- Sideways USDollar.

- Managed futures and long/short continue to help portfolios.

OPPENHEIMER:

- “Double digit stock market gains in 2023.”

- Slowly work into holding cyclical stock sectors.

- “There will be no noticable recession.”

LEUTHOLD GROUP:

- Bullish for 2023.

- Sees the Fed as being done and that they will drop rates in the second half of the year.

- Falling yields will help Treasury-bonds.

- Falling rates and commodities will help to stimulate the stock market.

CREDIT SUISSE GROUP

- End-of-year S&P-500 target = 4050

- “A year of weak, non-recessionary growth and falling inflation.”

- Buy Treasury-bonds.

- Barbell approach of defensive sectors and cyclicals.

UBS:

- End-of-year S&P-500 target = 3900

- Predicting a U.S. and global recession.

- Hold defensive sectors and quality stocks.

RUSSELL INVESTMENTS:

- “U.S. equities offer the best outcome with limited downside.”

- Emerging markets will do well, but only if China releases significant stimulus.

- Bullish on bonds, especially on U.S. Treasury-bonds.

- Commodities to move lower, USDollar to move sideways, REITS to move up.

DOUBLELINE:

- Expects the Fed to overshoot and raise rates too high, which causes a weakened economy and rapidly falling inflation leading to actual deflation, which makes bonds a stronger asset than stocks in the first half of the year.

LPL RESEARCH:

- “Low chance of a recession and if we do get one, it will be mild.”

- Falling inflation.

- Housing market begins to rebound in late 2023.

- Bullish on bonds.

- Bullish on stocks in second half of 2023 with a 17.6% gain expected by the end of the year.

- Prefer U.S. stocks, small-caps, value, defensive and healthcare.

RIVERFRONT:

- “2023 will transition into a new stock bull market, but some additional bumps first. Bull markets usually have ‘false starts’.”

- U.S. stocks will lead in relative strength.

- Small-caps, value and dividend stocks will lead.

- Bullish on bonds, especially government bonds.

RBC ROYAL BANK:

- End-of-year S&P-500 target = 4100

- Choppy market in 2023.

- Any retest of the 2022 lows would hold.

DEUTSCHE BANK:

- End-of-year S&P-500 target = 4500

- Quick recovery in the second half of the year, after recession.

- Suggest cyclical stocks for second half.

CITI GROUP:

- End-of-year S&P-500 target = 4000

- Mild recession caused by poor earnings, but still buy during the first half of 2023 since stocks move ahead of the economy (and recession).

- Do not overweight U.S. stocks because the U.S. will be the last into recession, buy overseas.

- Healthcare and materials.

- Winner = China equities.

ISHARES:

- Bullish on stocks, particularly the United States, small-caps, value and the healthcare sector.

- “Investors should just continue adding bonds to their portfolios in 2023.”

STANCHART (Standard Chartered Bank):

- Fed cuts rates by 2% by end of 2023.

- Commodities down and USDollar down.

- Gold up to $3070 per ounce.

BMO:

- End-of-year S&P-500 target = 4300

- Recession is barely noticable.

- Hold U.S. stocks especially small-caps, value, financials and healthcare.

- Any retest of the 2022 lows would hold.

- “The market cares more about falling inflation than it does about any slight earnings misses.”

Our 2022 CHARITY: Each year, I take a good-sized chunk of the money received from the management fees of client accounts and give it to one charity… community playgrounds, needy children, etc. This year a check was written to the Natural Resources Defense Council.

FOX MOUNTAIN RETREAT: Clients are allowed to stay in our Airbnb, one time, for 3 days at no charge (and bring a group of up to 5 total). I’ve not met the majority of my global clients, so this is a chance for us to meet. This peaceful retreat house is on our property in Charlottesville, Virginia. The retreat house is also available via Airbnb so clients must contact me directly and I will x-out the dates at Airbnb so that nobody else can book them. Some Airbnb guests just use it as a place to sleep in order to attend events in the university town of Charlottesville, but my hope always is that guests will use it as a chance to go into peaceful retreat.

WEBSITE: https://FoxMountainRetreat.com/

Airbnb listing: https://airbnb.com/h/FoxMountainRetreat

Thanks for reading! If you like what we do, then please help to spread the word. We do not advertise; we depend on referrals from people like you.

MarketCycle Wealth Management is in the business of safely navigating your investment account through rough waters. We have clients all across the globe; our fees are low; the first 3 months are at no charge. We earn our keep!

SUBSCRIBE to this free, no spam monthly blog via the signup on the website.

SUBSCRIBE to our paid members daily REPORT via the link on the website.

MARKET CYCLE — HEDGE FUND — DUAL MOMENTUM — TREND FOLLOWING — LOW VOLATILITY