MarketCycle has a contact tab at the top of our website and I frequently receive questions from readers. Below are a few of my responses (paraphrased). A couple of people that pre-read this particular posting stated that this month’s article is actually both good and educational, which was good to hear. Please note that if you right click on your computer mouse, you will be offered a PRINT function in the pop-up. The old print function broke. I will eventually put a new print function in the body of the blog, when I get “around to it.”

_______________

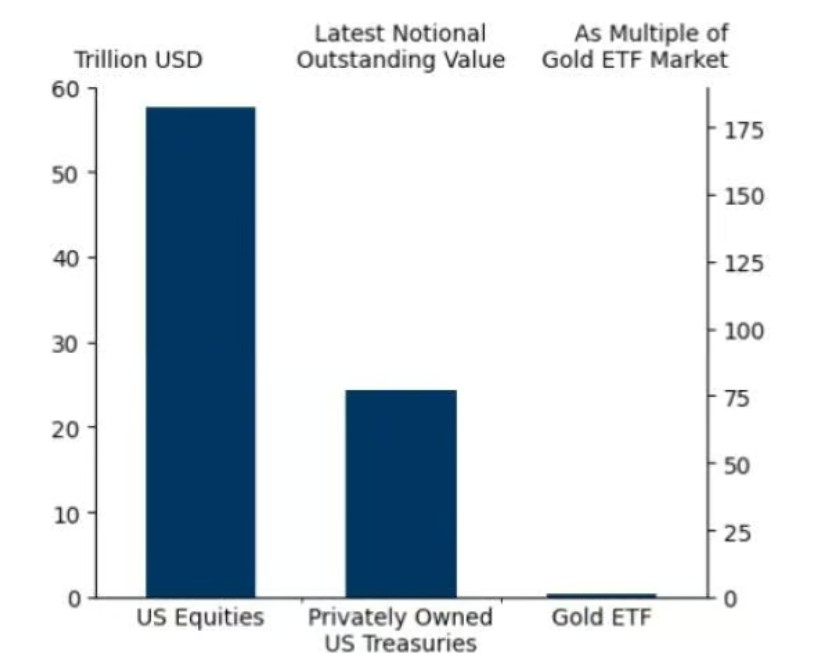

“You say that because of the non-stop (flood-the-zone) turmoil of the past 14 months, caused by tariffs and threats and pulling back from united global involvement while seeking one-sided global conflict, foreigners and foreign governments are no longer offering to loan the U.S. money via the buying of Treasuries and they are rapidly dumping the Treasury-bonds that they already own. Why is this a problem?”

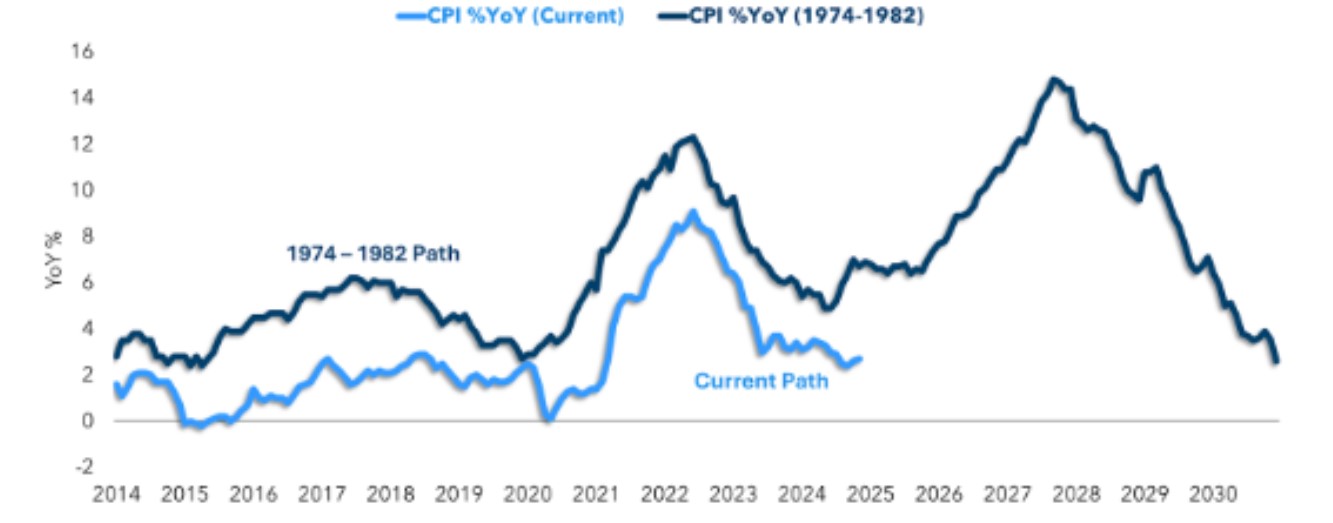

Our current U.S. Government debt level is $39-Trillion ($39,000,000,000,000). This is DEBT; we’re deep in the red. If this were a corporation, it would have declared bankruptcy long ago. Debt has increased by almost $4-Trillion in just the past 14 months all while eliminating or cutting costs in social programs, environmental programs, watchdog groups, etc. Massive military and ICE expansion and grift-styled gifts to wealthy corporations and billionaires adds up quickly.

Old debt comes due and then has to be paid back; over the coming 12 months, the government will have to pay back debt at the pace of $830,000,000,000 per MONTH. Brand spankin’ new U.S. Government debt will increase by more than $292,000,000,000 per MONTH going forward and that will eventually have to be repaid too. Imagine that; what a mess.

This cannot continue. And if it can not continue, then it will not continue. As I so often repeat, I foresee the most profitable global bull market in history lasting for another (roughly) three years… and then global financial ruin. (My personality is to be “optimistic, but not blind.”) We do not have the guts or the will or the smarts to intervene. We probably don’t even have the ability to intervene at this late stage. A politician’s only goal in life is to get re-elected, so nobody in a position of power will voluntarily help. To survive any coming debt crash, investors better delay gratification now and invest every penny that they have into something LIQUID that expands their personal wealth. Every imaginable economic condition, both good and bad, can be fully survivable and thrivable… and this is why I created MarketCycle Wealth Management, so that I could help others.

.

DEBT (the flat areas are government shutdowns):

_______________

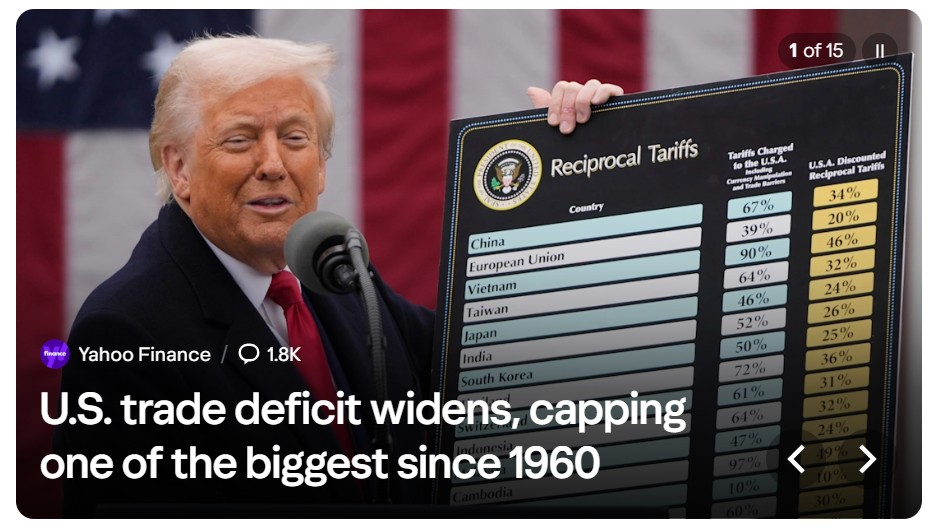

“But tariffs are bringing in additional money and reducing the trade deficit, aren’t they?”

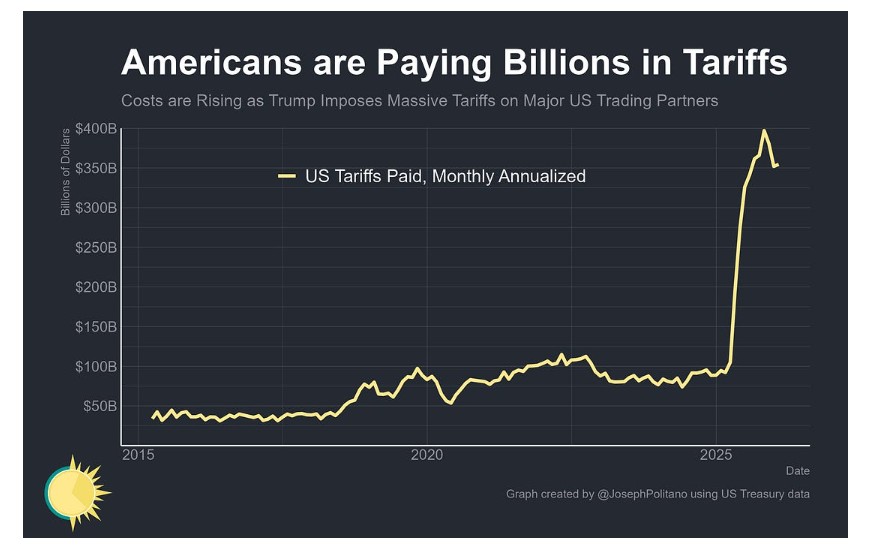

First, tariffs are bringing in 90% less total money than we are being told… AND they are were almost entirely paid for by U.S. corporations… but corporations started pushing the price increases off onto customers starting in the summer of 2025.

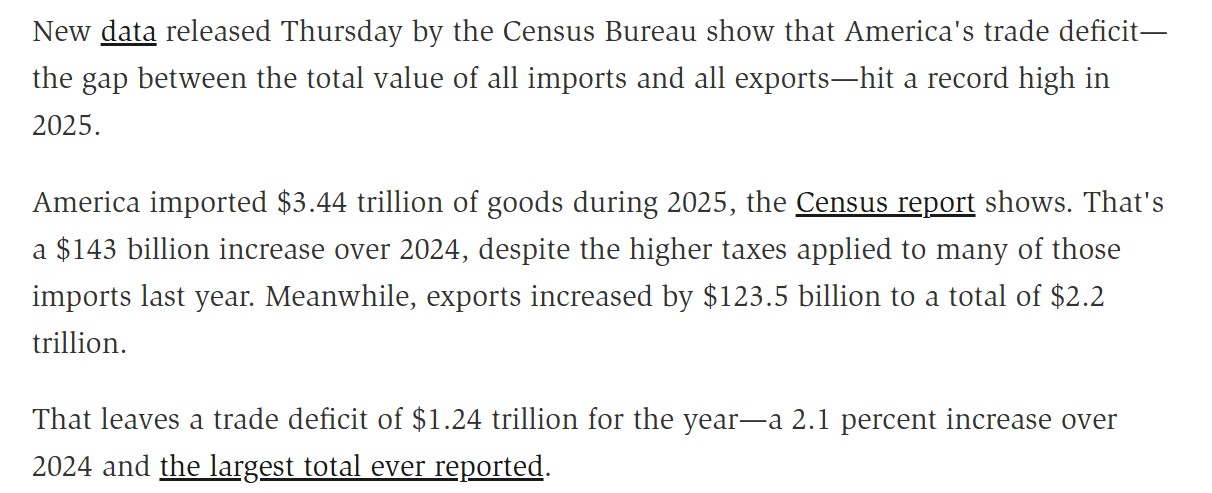

And despite what Washington tells us, the trade deficit has gone UP in 2025, not down.

A snippet that I created via AI about recent and important Federal Reserve research:

.

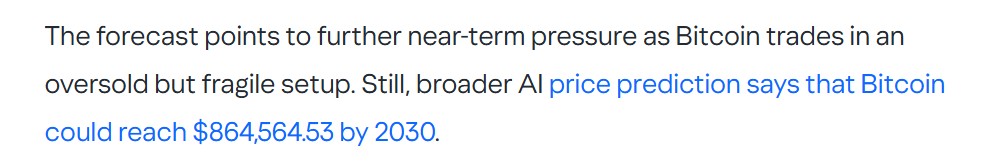

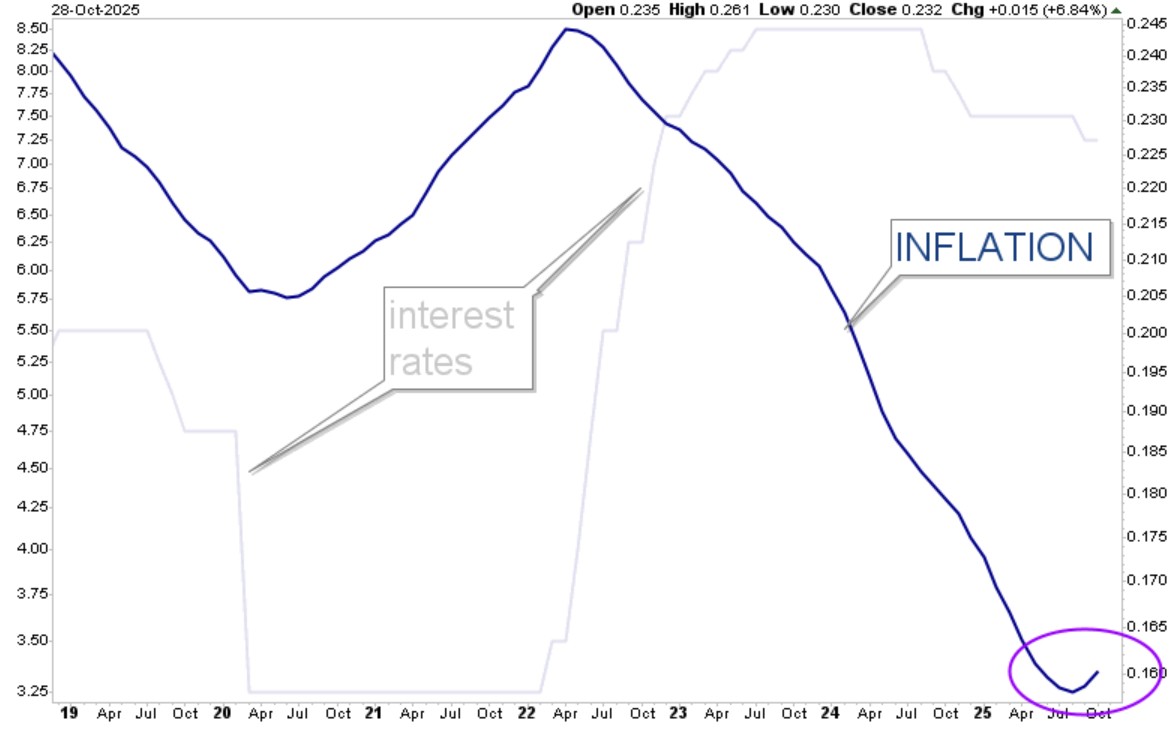

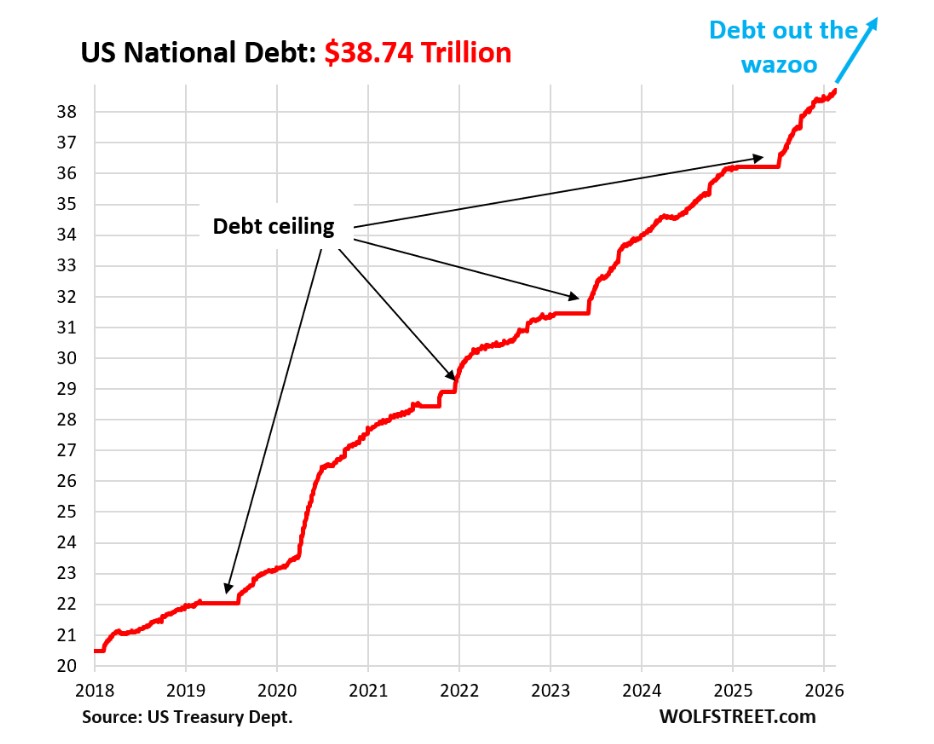

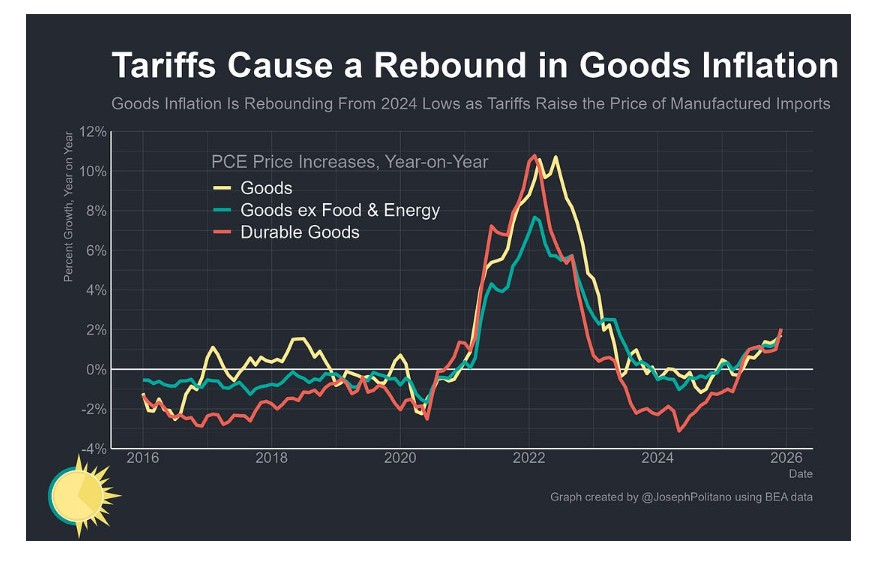

As MarketCycle has been stating, tariffs cause inflation. In a recent private client update I stated that Friday’s PPI would show rising inflation, and it most certainly did.

.

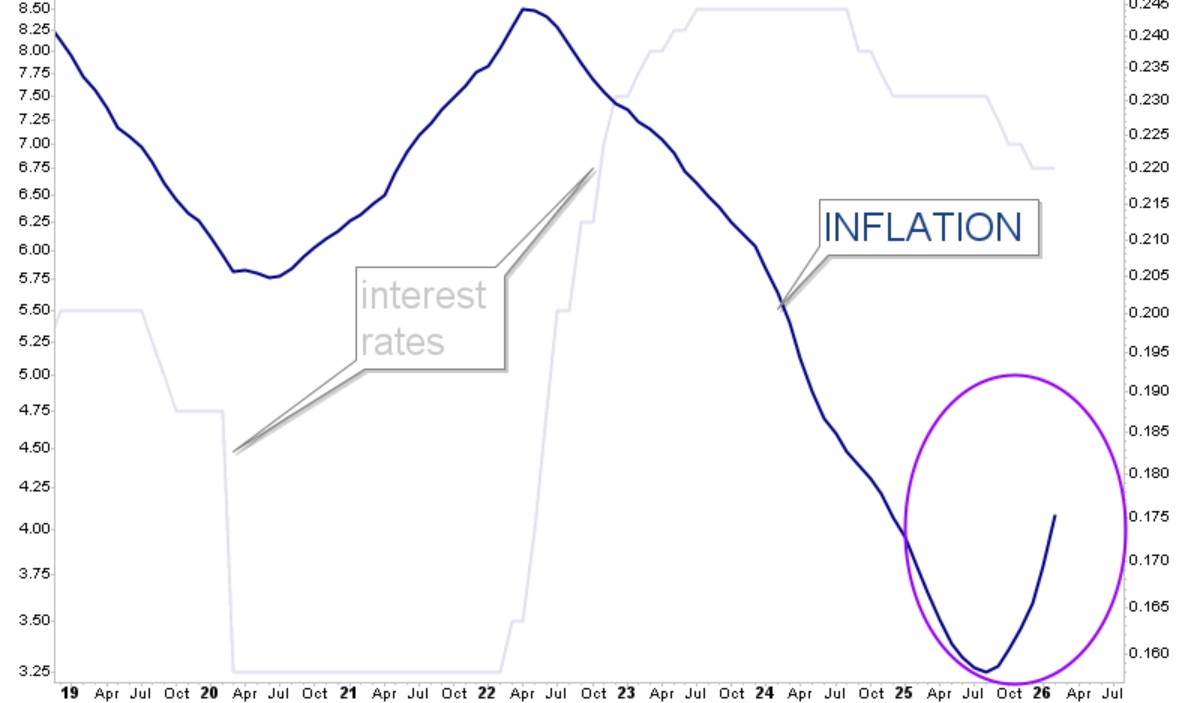

Below is MarketCycle’s proprietary in-house inflation indicator that shows the trend of inflation 3 months in advance of actual inflation… we figured out how to accelerate economic data (easier said than done). This indicator does not show the strength of inflation, it just shows the trend-direction of inflation (see the purple circle). The Federal Reserve’s interest rate direction is shown in pale-gray. This gray line shows how the Fed started raising rates 2 years too late when inflation started rising and how they then started lowering rates 3 years too late when inflation started falling, and this is partly why inflation got out of control. Inflation is now rising again because tariffs are causing corporations to pass the tax costs onto their customers… on to you and me. With the Supreme Court’s recent decision on tariffs having to immediately stop and be re-paid, this may help reduce the price of consumer goods (barring new permanent tariffs)… but any “payback” will further increase the government’s debt level.

.

As MarketCycle has been stating, tariffs are paid for by you and me:

.

The trade deficit is going UP, not down (below is a snippet taken off of a recent white paper):

.

No, haphazard and volatile tariffs do not fix a trade deficit. Below is a snippet from a January 2026 Yahoo Finance, Reuters article. (It is surprising how good Yahoo Finance articles are, and they are free and they come from a wide variety of very reputable sources.):

_______________

“You say that we are in a bubble. Don’t you want to avoid bubbles?”

Absolutely not. Again, absolutely not. Bubbles can be HIGHLY profitable. Nobody avoids investing in a bubble, everyone eventually invests because you will likely see some of your friends getting rich and the fear-of-missing-out (FOMO) will drive you into the markets… but many investors, including many famous and older professional investors, will only go in at the top and then feel obligated to hang on as the market then drops.

Right now we are in the early stage of an AI and innovative technology bubble formation. You do not run from something like this no matter what your “instinct” tells you; you buy with both hands and then hang on. One should only worry about one thing: Catching the top in a bubble. The top is likely a few years away and tops ALWAYS give advance warning, months in advance, if you know what you are doing and if you have lived through a few bubbles, as I have. This is why I monitor objective risk, of all types, every single day.

_______________

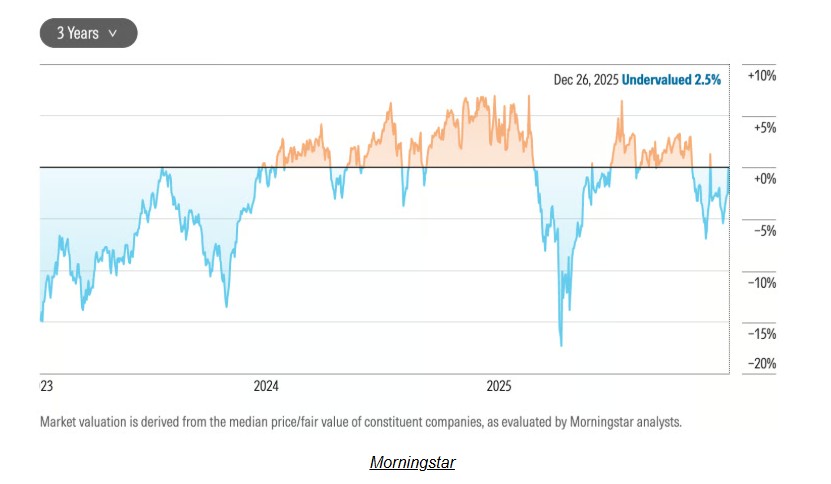

“Aren’t stocks over-valued right now?”

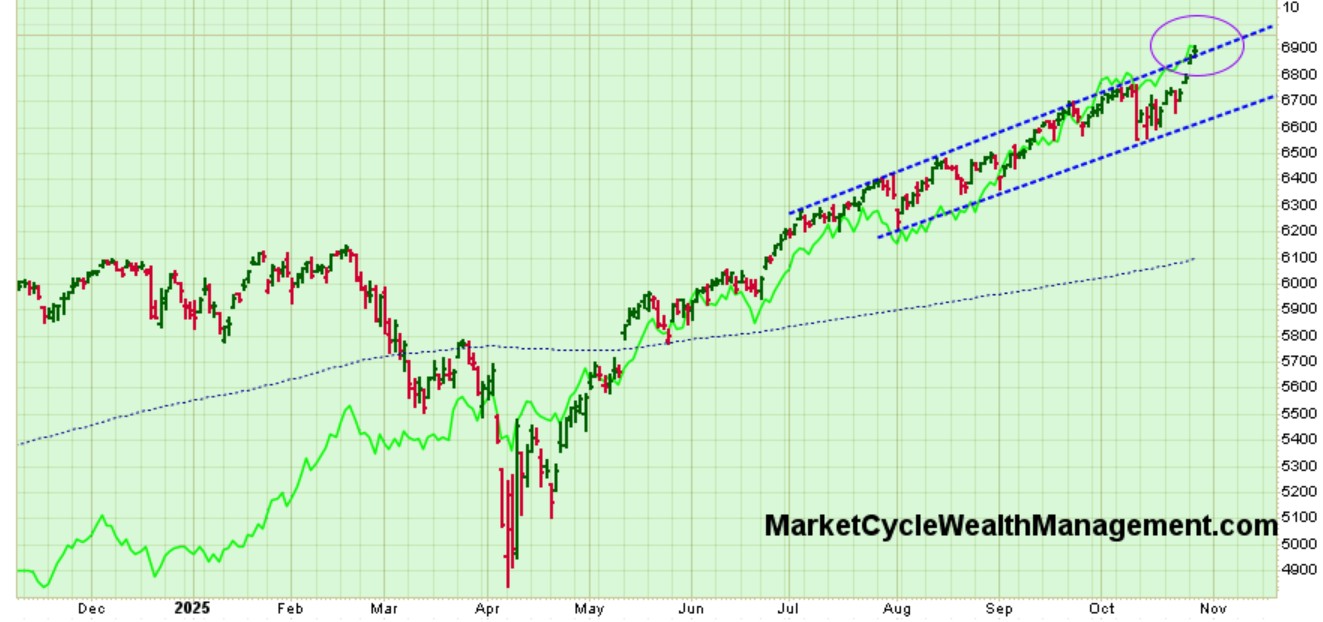

First, overheated stocks always find a way to let off pent up steam by temporarily pulling back or by gyrating sideways for a more prolonged period. A bull market does not move in a straight line from lower left to upper right… it always zig-zags higher and sometimes it just takes a breather.

Second, we are very likely in the early stages of a bubble formation. Bubbles occur at the end of a rare period when an overlapping cyclical bull-market-cycle and secular bull-market-cycle are both coming to a head at the same time. In layman’s terms, the good & bullish times continue until they reach a peak, just like they did in 1929, 1987, 2000, 2008 and in a few periods in between. During periods such as the coming three years(?) one ignores traditional valuation models and invests based on watching other investor’s uncontrolled emotions. We will move beyond “euphoria” and into a mental state where we start saying that “things are different this time” and “we have entered a new and eternal paradigm where markets can ONLY go up!” Investors will start to take out second mortgages on their homes and will use the money to invest in the stock market. Similarly, the use of borrowed “margin” money from brokerage houses will be way, way, way beyond historic highs. And then the doubly bubbly bullish period will disappear.

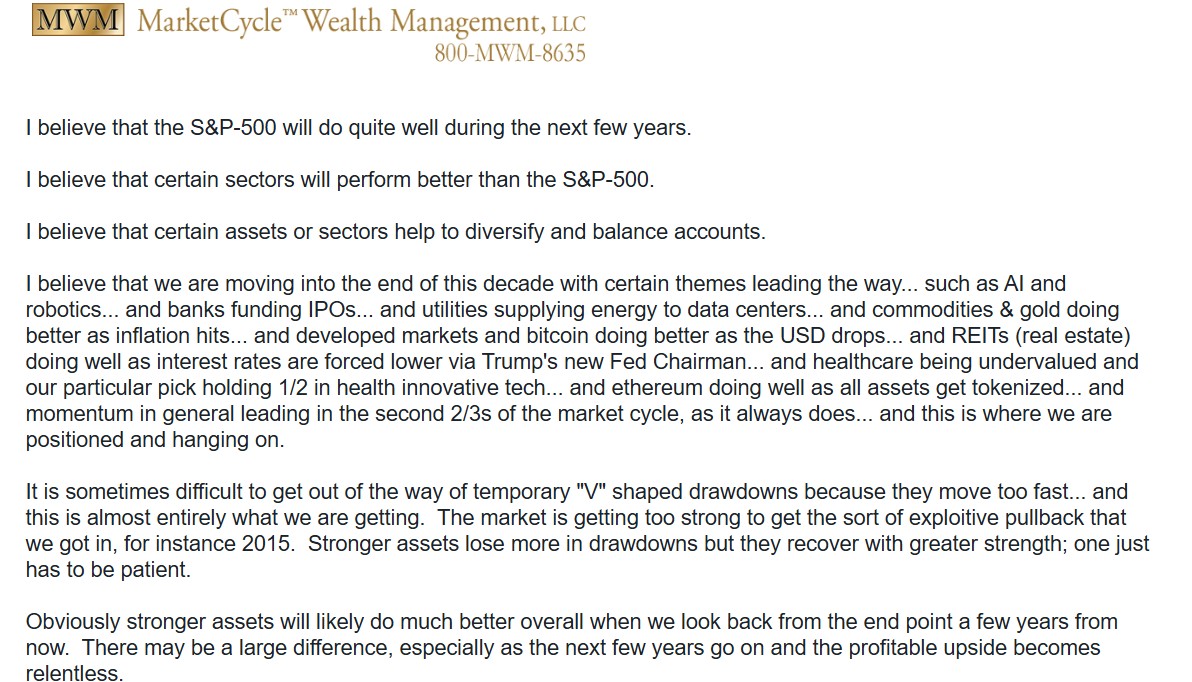

And here I “jawbone” a bit:

So regarding the market, “time’s a-wastin'” as they say locally here in the (actually blue) Blue Ridge Mountains of Virginia. Of course, some of the older folks also tell me that we live in a “holler,” which is a relatively flat valley between high-ish mountains… or that we just had a “frog strangler,” which is a heavy rain downpour… sometimes, just before it rains, they say that “they’re callin’ for it” which means that the pigs are squealing (which they actually do just before it rains) and even my wife has used this expression frequently. Some folks are “fixin’ to eat a mushmellon,” which means that they are, right now, sitting down to eat a cantaloupe. Even my dentist says “might could” when he is actually saying that he “can” do something. Sometimes the local sayings make me feel a bit “cumfluttered” which is the problematic local word for “confused”… so, there’s all of that to deal with… or delight in. My “Ma-maw” (what I called my grandmother who lived on the top of a West Virginia mountain) often used such words. Now, much of this is lost on the younger TV, computer and phone raised generation… and that makes me feel a bit “tore up.”

Below, Blue Ridge Mountains taken from the Blue Ridge Parkway in Shenandoah National Park, just above my property. The Blue Ridge Parkway is 469 miles of mountaintop views and without a single stop sign… it is spectacular. The mountains are actually blue because of the high release of organic “isoprene” from the local trees. These are the oldest mountains on earth; while some mountains like the Himalaya Mountains are still rising, the Blue Ridge is falling, which makes it loaded with wildlife (including a lot of bears, bobcats and even elk that were recently re-introduced), giant tumbled granite boulders, streams, springs, waterfalls and unexplored caves… and some decent folks with regional slang sayings.

The Blue Ridge Mountains:

.

And Appalachian mountain folk don’t actually look like this (because the shotguns are missing in the photo):

.

And now, back to reality.

_______________

“Why do you like corporate bonds more than Treasury-bonds? And what allocation do you give to corporate bonds?”

Corporations are flush with cash and are currently low in debt, making corporate bonds low risk. As implied above, Treasuries are like bombs about to go off, which is making Treasury-bonds high risk for the first time in 25 years.

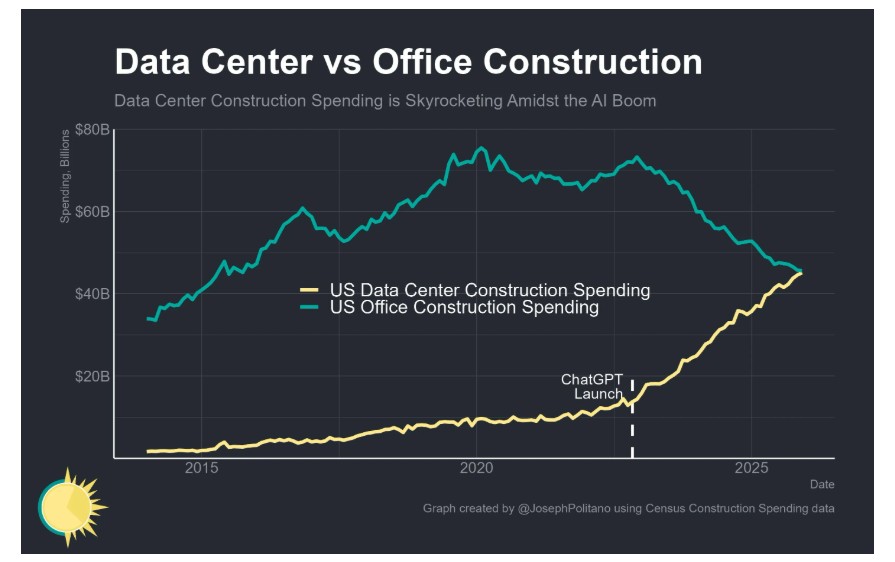

MarketCycle holds a (roughly) 8% position in quality corporate bonds. We also hold some data center REITs. (A REIT is a Real Estate Investment Trust and it is a bundle of rental properties that pay you interest each month but with none of the headaches of owning rental properties directly. The problem with data centers is not their size, it is their energy usage, and this will have to be worked out.)

Data center REITs (yellow line) are strengthening; commercial business building REITs (blue/green line) are weakening:

.

Corporate bonds have bullishly broken out (up) from their consolidation and reached new highs (triangle), while bond volatility has entered the low-risk area and our highly accurate proprietary breadth indicator (green line) has reached (bullish) record highs.

Update: War caused corporate bonds to temporarily pull back on Monday.

_______________

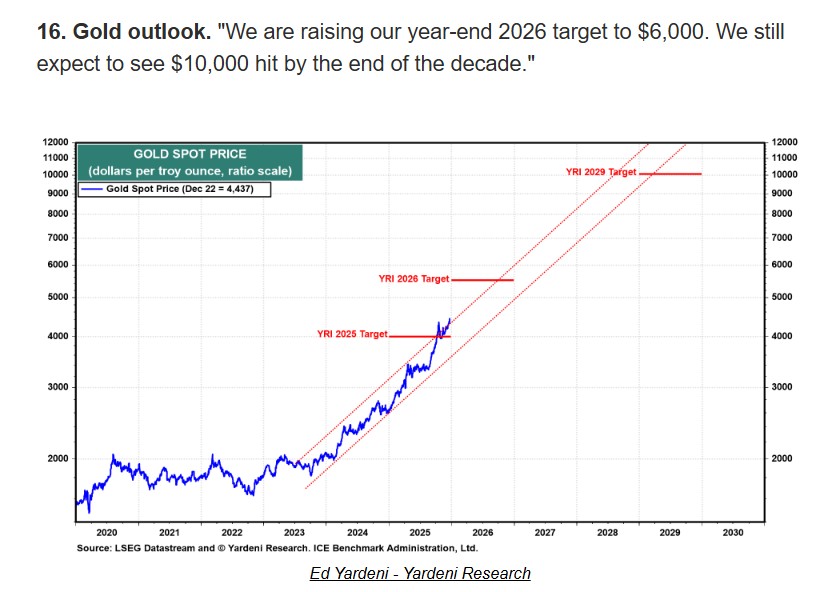

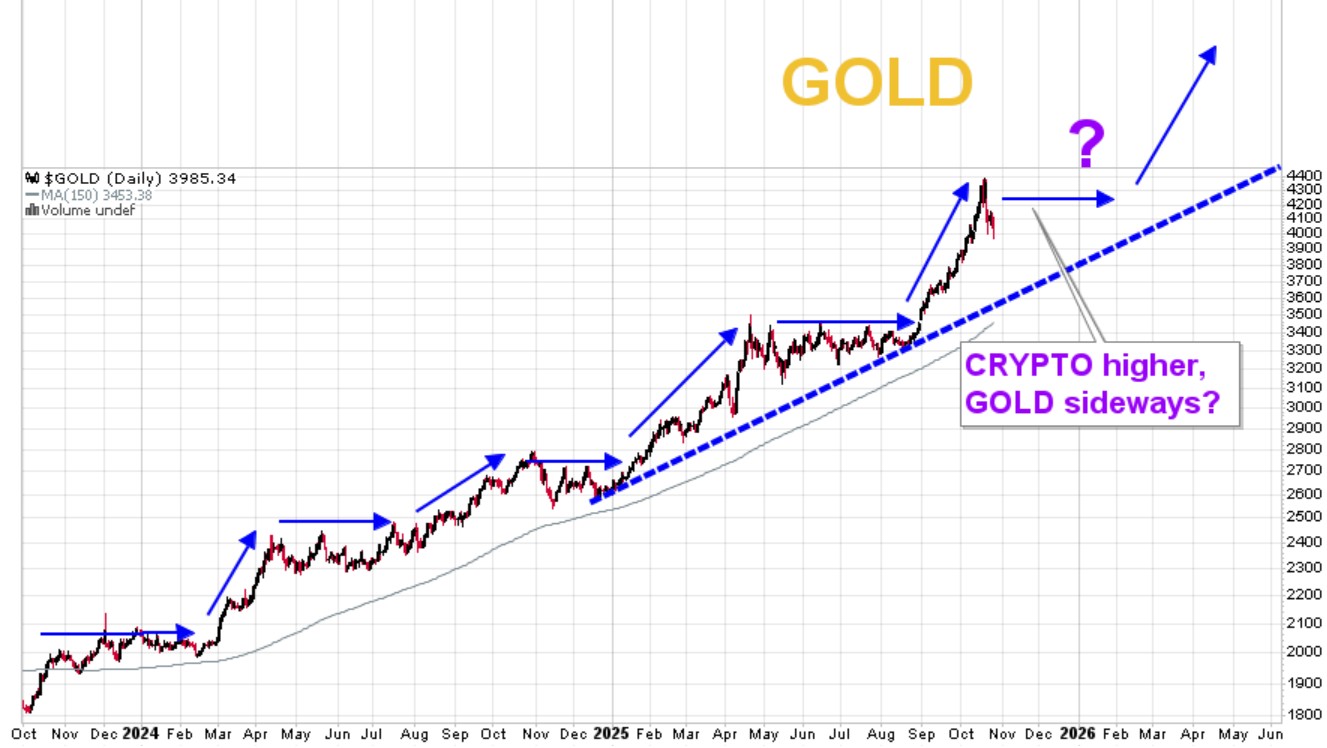

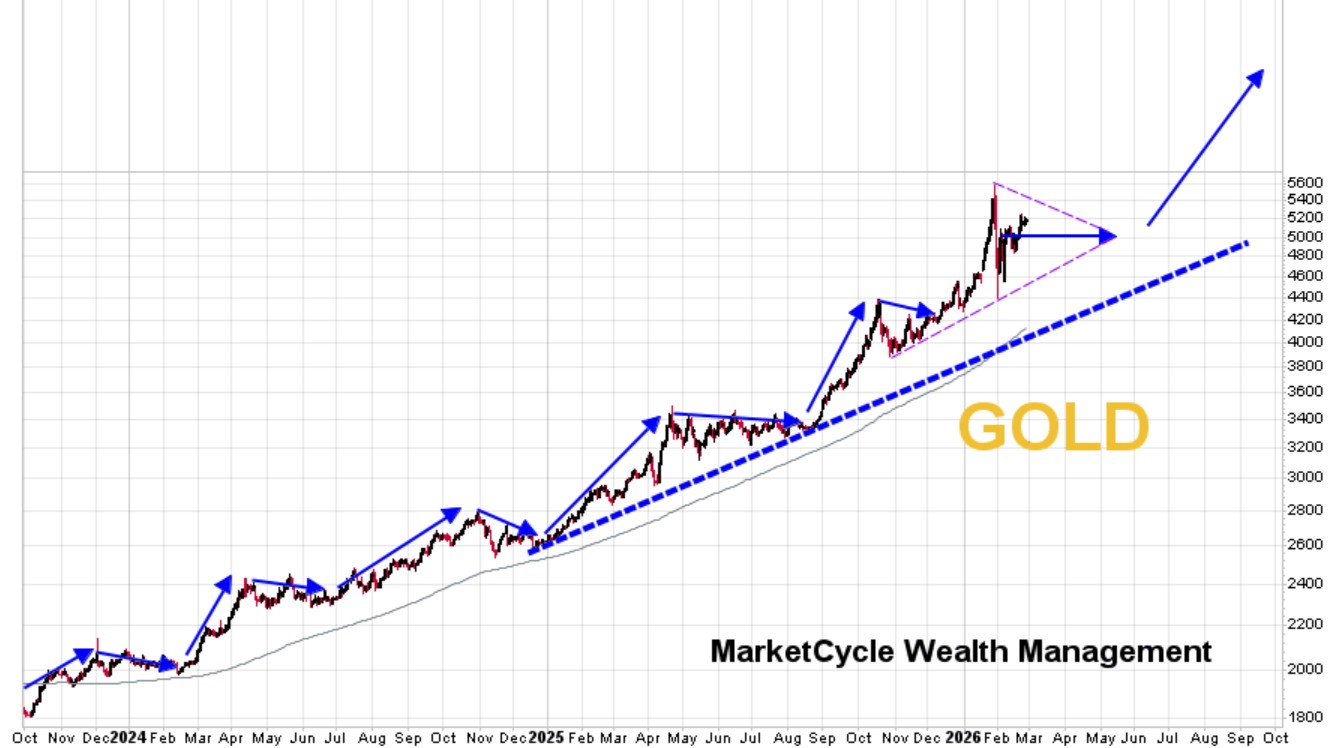

“Gold has gone up too far and too fast; why do you hold a 15-20% position in gold in your portfolios?”

From 2001 to 2011 I held gold bullion 2x leveraged and gained a 1000% profit. I then sold at the top, in 2011, but repurchased again in early 2019 and we still hold today for a 250% gain. I have to keep rebalancing the allocation back down.

The high U.S. debt is reason enough to hold gold, but the coming money printing that will allow the United States to “buy” its own Treasury debt will cause gold to go quite high; we will likely see $10,000 per ounce by 2029, a 100% additional gain. If/when the debt collapses (by the mid-to-late 2030’s?), then gold may suddenly be worth $30,000 per ounce because gold is unprintable money. Call me a fool, but I’m not selling.

Added benefit: Gold goes up when stocks drop and it also goes up during inflationary periods caused by money printing, so it offers genuine account protection.

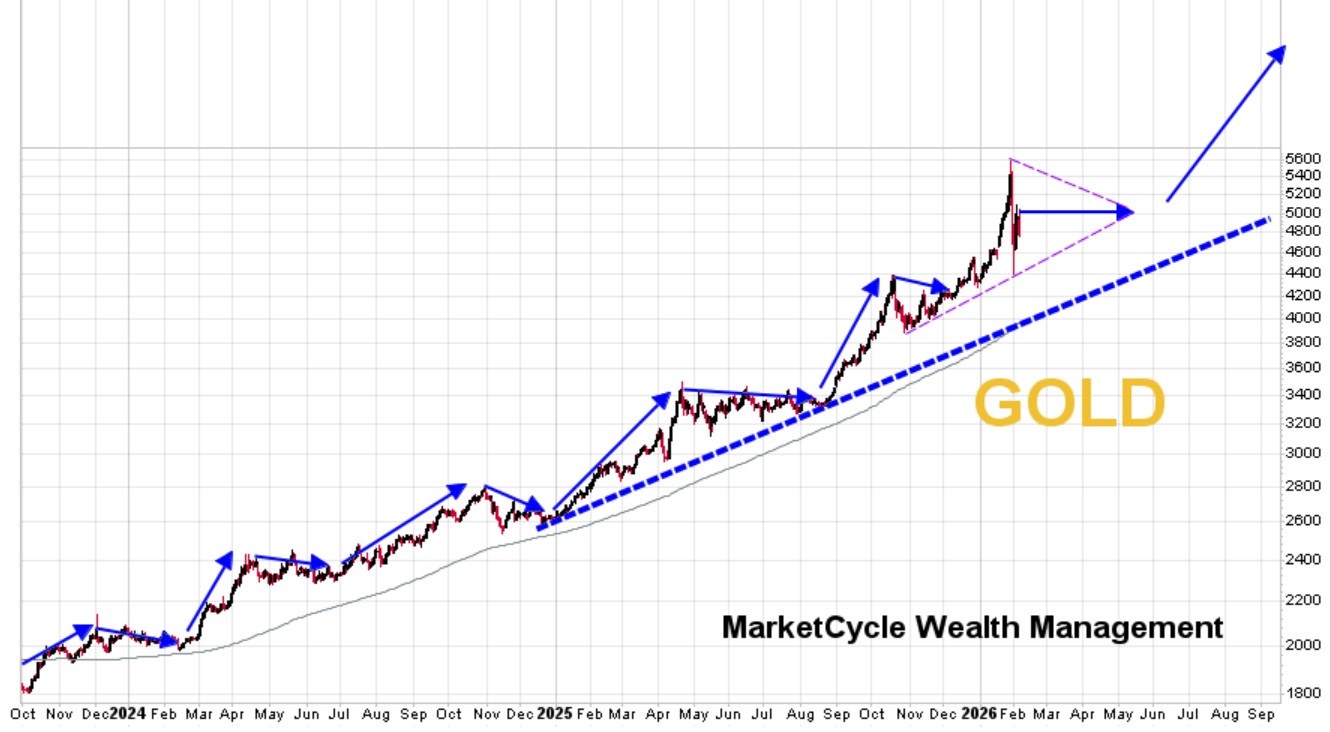

I had expected gold to gyrate sideways for the next 4-ish months (shown below) before heading higher again. HOWEVER, events next week might give fresh impetus to the bullish direction of gold. A charging bull is hard to sideline.

Gold is UNDER-OWNED in the majority of global investing portfolios. Gold profits substantially beat stock profits in 2025. In my opinion, the current big stock bull market may end in 3 years; the gold bull market may not end for another 20 years… perhaps even longer. So, we hold some gold.

Will gold take a multi-month sideways snooze or will it just continue to run higher… we’ll soon know. It needs to take a rest, but it may not want to take a rest.

Update: War caused gold to jump higher on Monday, as a flight to safety trade.

_______________

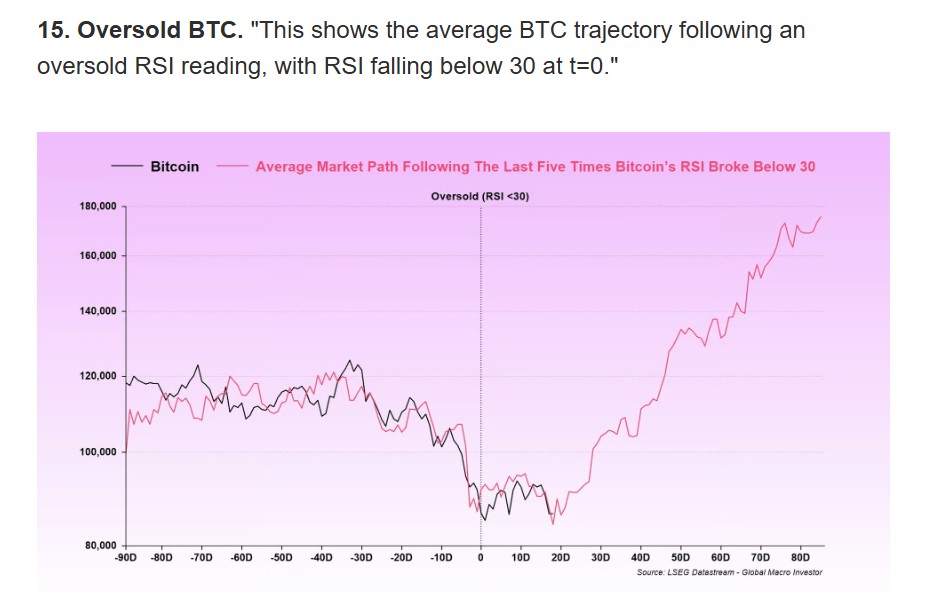

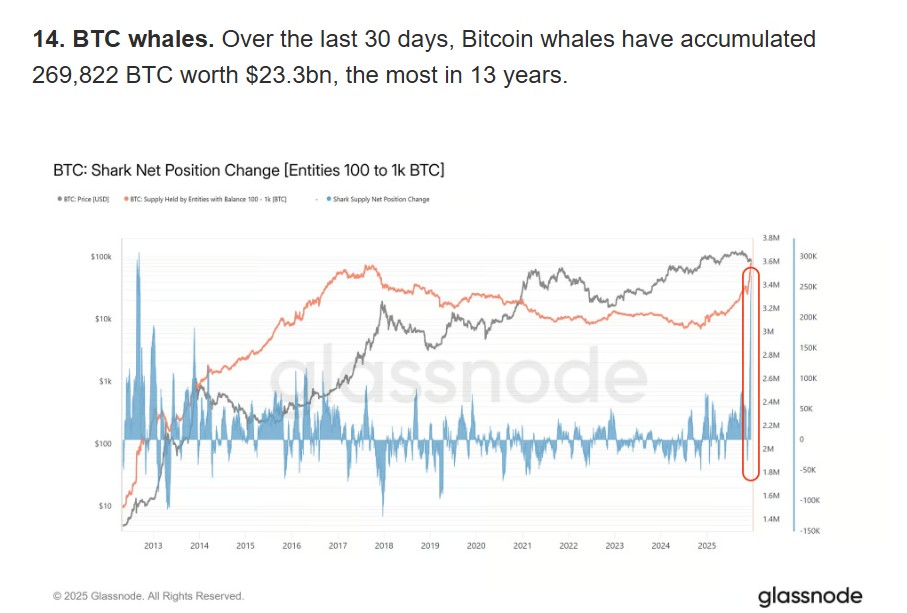

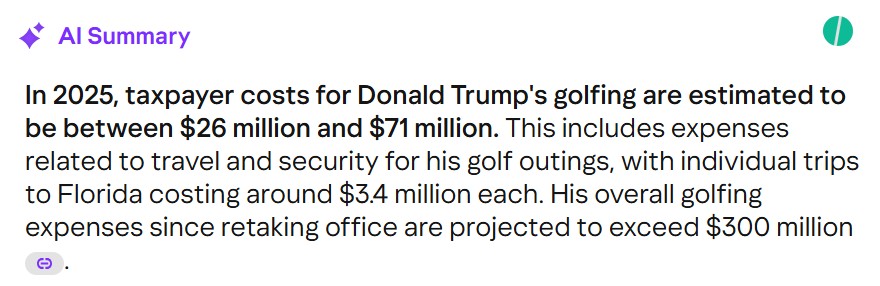

“Bitcoin is dead. It was a Ponzi scheme.”

Any asset generating profits (over time) for all holders of that asset, in no way makes it a Ponzi scheme!

Yes, bitcoin has pulled back, but it was overbought and it has only pulled back toward its long-term trendline and I do not foresee it breaking below that line… so it remains bullish despite the temporary and unpopular pullback.

Bitcoin, just like all other assets, gyrates while moving higher… it is just that the dips and volatility are bigger with crypto and this is why allocations should be very small. Bitcoin is digital-gold and ethereum is the basis for the blockchain. They are not dead; they are just volatile. Like gold, they are both going to go quite high over the next few years. Similar to commodities, crypto drops, bases sideways for months, heads higher rapidly, peaks at a new much higher high, and then suddenly drops again, where it eventually bases sideways for many months (which is what it is doing right now)… and then the cycle repeats. It looks like crypto will be heading higher sooner rather than later. Slow motion higher-highs.

I should note that, after years of testing, I have recently developed an objective method of selling crypto near high points and buying again near low points… and it works.

Importantly, the upside with crypto is so big that the temporary downside is something that becomes tolerable in the grand scheme of things.

And finally, crypto and gold are not Ponzi schemes. Printable, unbacked, fiat currencies are actually the Ponzi scheme… and because of inflation, the only direction for these paper currencies over time is DOWN. Disregarding any market related fluctuations, the actual value of the USDollar has decreased by 86% during the past 50 years! Cash-in-hand is the worst of all possible “investments.” If your parents hid one U.S. Dollar in a closet 50 years ago, that hidden treasure is now worth 14 cents. An ounce of gold has gone up 35X (note, not 35%) during those same 50 years. It is possible that bitcoin might, someday, even surpass gold. But I still prefer gold, so I hold a larger amount of gold and a much lesser amount of bitcoin.

Update: War caused crypto to jump higher on Monday, as a flight to safety trade.

_______________

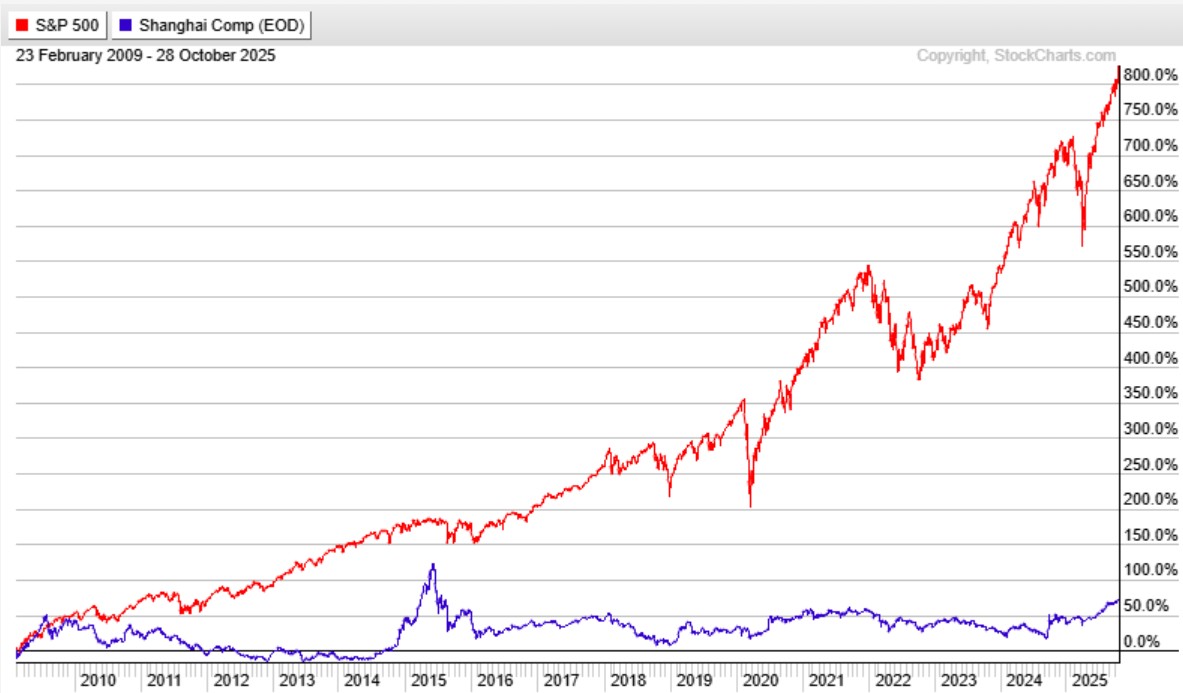

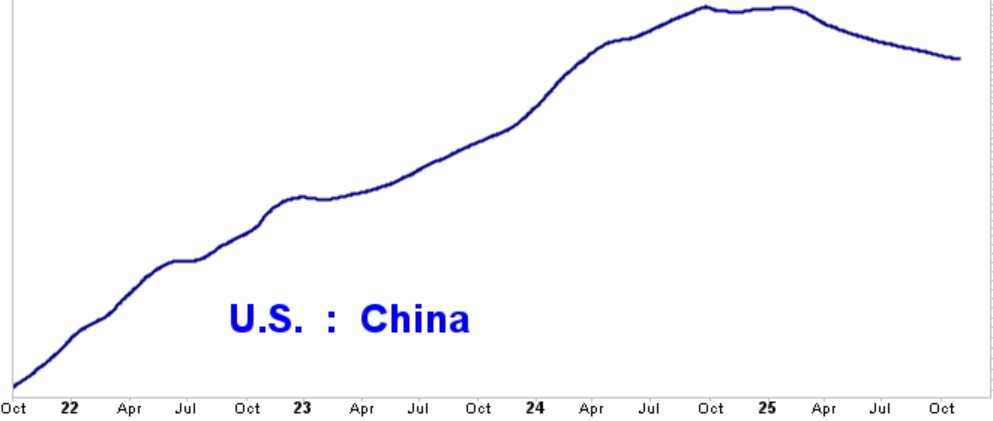

“You say that after having held only U.S. stocks for 13 years, in 2025 you rapidly began to diversify global positioning so that you are roughly 1/2 U.S. and 1/2 global and hard assets. Why?”

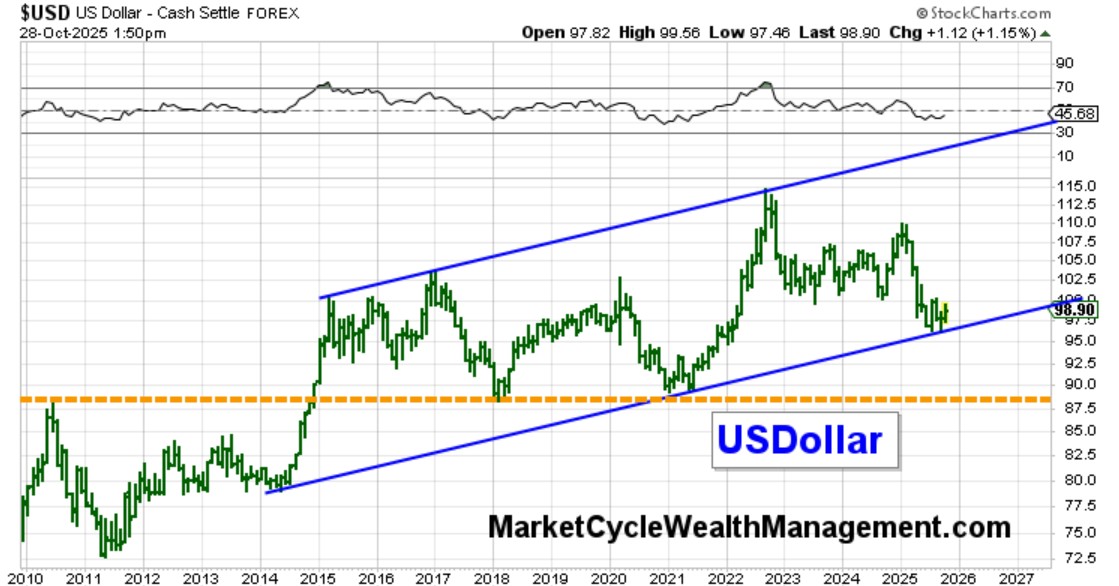

The “Trump-trade” (a popular term on Wall Street) implies that angry foreign investors will pull away from U.S. assets. This causes a (slight) strengthening of foreign currencies against the USDollar. So, the strengthening of foreign currencies further increases the profits in overseas markets, including China. If you hold 1/2 of your portfolio in overseas assets, then you do not have to worry about currency strength or weakness or fluctuations since it all balances out. Ultimately, I expect the USDollar to gyrate sideways for the coming years and I show this below.

So, U.S. corporations trade in USDollars. Foreign corporations normally trade in their local currency. IE, Japanese stocks trade in the Yen and French corporations trade in Euros. In an investing portfolio, the trading currency is almost as important as are the company’s profits.

While the U.S. economy will remain stronger than developed economies for the next few years, I do believe that there will be a lot of near-term strength in developed markets (Europe, Japan, etc.) but that emerging markets will not gain obvious outperformance until the 2030’s, which will likely be a period of “stagflation” (global stagnant economies combined with inflation). In the 2030’s, China and India (and other emerging markets) may become stronger economies than the United States.

Relative Strength shows us that, after 20 years, developed foreign stocks are suddenly beating U.S. stocks (see the two circles showing recent breakouts… the orange line is developed market strength breaking higher and the blue line is U.S. market strength breaking lower):

.

The USDollar should gyrate sideways over the coming years, between the two green dashed lines.

Update: War caused the USDollar to jump higher on Monday, as a flight to safety trade.

_______________

“Will AI lead the market higher for the coming few years?

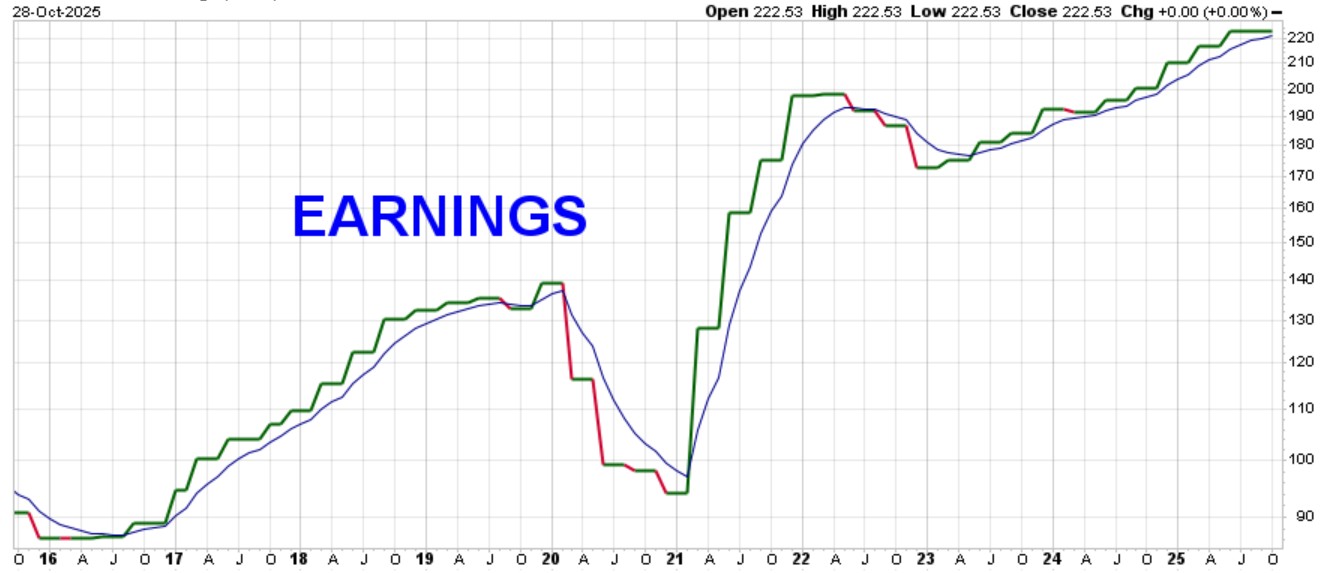

The stock market follows earnings; sectors showing the highest probable corporate earnings over the coming 2-3 years are:

- Technology, particularly innovative & disruptive technology (which includes AI, robotics, gene therapy, quantum computing, space, etc). Technology, and in particular AI and robotics, will have the highest future earnings of all sectors.

- Materials, especially those used in technology.

- Utilities, especially mid-cap and small-cap that supply electricity to technology.

- Banks and private equity companies that fund technology and tech startups.

- Data center REITs

- Global clean energy (despite the efforts of the current U.S. administration, clean energy growth is unstoppable)

- Precious metals & crypto because of continued “money printing”… the miners will show high earnings.

By contrast, the lowest corporate earning sectors are likely to be:

- Traditional energy companies.

- Traditional healthcare.

- Traditional industrials, partly because the “build-back-America” trade is a fantasy.

- Traditional (non-data-center) REITs

- Software (AI will replace this sector)

- Cyber-security (AI will replace this sector)

- Consumer staples will lag more and more as technology bubble conditions manifest.

Beyond a period of a few days, stocks do not trade based on news events, not even today’s new war, but longer-term, stocks do trade based on corporate earnings’ profit levels. Stocks are partial ownership in a corporation and if the corporation generates higher earnings, then patient stock-holders, like you, will benefit. End of story.

.

.

SUMMARY: Bullish… but near-term risk has increased and I sent a private notice to clients last week. Almost everything that MarketCycle uses was created in-house (requiring decades of testing) and it is innovative and proprietary. Half of our “every-day” risk indicators are currently showing increased risk, but the other half are showing continued strength. Our “SEVERE RISK” indicators (I call them “End Times” indicators) are not even close to giving a risk signal. This means that a temporary and tolerable 10%(?) pullback may be on the horizon and we have already taken on a small-ish and unique protective asset that tends to go up when stocks fall and yet it usually moves mostly sideways when stocks go up, so the risk-protective asset is itself low risk.

.

So after all of that, let me repeat: I’m still bullish, but with some near-term caution.

_______________

Thanks for reading!

Consider allowing MarketCycle Wealth Management to manage your investment account. We try hard to earn our keep. There is a “Contact” tab at top of website.

.

.